The Pulse on the Economy and Capital Markets: June 21–25, 2021

June 28, 2021

Executive Summary

- Market mood swings: After a turbulent stretch, markets were higher last week, bolstered by another Fed announcement and the news of a bipartisan infrastructure bill.

- Hot trends in IPOs, housing: The global IPO market has never been stronger, while we continue to see high demand in residential housing.

- A busy summer awaits: New remarks from executives at Walt Disney World, Universal Studios and other tourism hot spots are providing reassurance that the travel and entertainment sector is back and better than ever. The Boss re-opened Broadway.

The markets can be manic and depressive in short periods of time — investing icon Ben Graham noted this in his classic book, The Intelligent Investor. Over the last two weeks, we’ve seen this in real life.

After a terrible week two weeks prior, the markets that we actively follow were higher across the board:

Why were markets higher?

There are two primary reasons:

- The Federal Reserve said, “Well, on the other hand…” and appeared to temper its comments about how quickly it would increase interest rates, implying that it would let the economy run hotter for longer and, as a result, corporate earnings could grow for longer and higher.

- President Biden and a group of senators said, “We have a deal” — Thursday’s announcement of a bipartisan infrastructure bill sent economically sensitive stocks higher. The Russell 2000 (comprised of smaller publicly traded companies whose fortunes are likely tied to the health of the U.S. economy) and the Dow Jones were top performers.

That’s good — what else?

U.S. banks received a clean bill of health, as all 23 lenders in the Fed’s annual stress test passed easily. This encourages banks to lend more money (facilitating economic growth), and we’re likely to have increased dividends and buybacks for shareholders. Here are a few other points to note:

- According to CNBC, the stress-test scenario includes a “severe global recession” that hits commercial real estate and corporate debt holders, with 10.8% unemployment and a 55% drop in the stock market.

- In this scenario, the industry would post $474 billion in losses, yet the banks would still have more than double the minimum required capital levels.

- On this and the infrastructure news, the financial sector was the second-highest performer in the S&P 500.

“Tonight, we’re going to party like it’s 1999…”

The global IPO market has never been hotter: almost $350 billion has been raised in the first half of 2021. This number is 25% higher than the prior-record six months.

These IPOs include some familiar names:

- What’s old (and tasty) is new again (and still tasty): Krispy Kreme is slated to go public, just as it was in the 1990s.

- I can see clearly now: Warby Parker confidentially filed for its IPO. The founders of the company were the students of famed Wharton professor Adam Grant, and they once approached him about the fledgling business as a venture-capital opportunity. Check out this interesting Business Insider piece on the story.

“You keep using that word. I do not think it means what you think it means.”

About two years ago, you could buy a 10-year U.S. government bond (which is considered credit-risk free) and receive 2.5% interest. Today, that’s the yield for junk — as in, lots of credit risk, according to the bond rating agencies.

Last week, healthcare company Centene issued high-yield (a.k.a. junk) bonds at a 2.45% interest rate, an all-time low for junk bonds. The yield on the Bloomberg Barclays High Yield Index is at 3.85%, a near 30-year low.

The active IPO market and low yields for high yield are a result of central banks that flooded the world with liquidity to address COVID-19 shutdowns. As a result, asset prices are moving higher and the yields from them, which move in the opposite direction from prices, are moving lower.

What’s happening in residential housing?

Economic data released this week showed that the median U.S. home price reached a record $350,000 in May — the largest annual increase at 23.6% in at least 20 years, according to the National Association of Realtors.

This jump reflects several factors:

- Housing affordability for first-time home buyers is high.

- There is record-low housing inventory, while demand is increasing. In parts of the U.S., over-bidding is all but expected. Translation: we need to build more homes.

- The lumber price spike may have home purchasers preferring existing homes to new construction.

- These are easy comparisons — last year, we were in the depths of the shutdown.

Where there’s opportunity, there’s always private equity

Blackstone is betting on housing — again. For $6 billion, the legendary private equity and real estate firm agreed to acquire a majority stake in Home Partners of America (HPA). HPA owns over 17,000 homes across the U.S., offering rent-to-own programs for residents who eventually want to buy a house.

Blackstone previously launched another home rental company, Invitation Homes, after the 2008 housing crisis. The invitation acquired large amounts of foreclosed single-family homes. After investing $1.5 billion in the 2017 IPO of Invitation Homes, Blackstone sold its remaining ownership for more than $1.7 billion two years later.

“I want to get away, I want to fly away” — Domestic travel demand is starting to soar

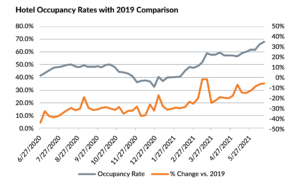

Hotel activity is approaching pre-COVID levels, as U.S. consumers look to enjoy life again.

Occupancy rates have increased 19% and revenue per available room (RevPAR) increased to 41% in less than eight weeks.

Occupancy rates for the week ended June 19, 2021, approached 70% and were less than 10% below 2019 levels. This was the highest level since November 2019.

Florida markets, such as Miami and Tampa, are above 2019 levels, while business-oriented destinations, such as San Francisco and Boston, continue to struggle, with RevPAR down more than 60% from 2019.

It’s not just hotels. It’s the “Travel & Entertainment Complex.”

Hot tourist spots across the country are reporting recovery, including:

Disney World: “Our forward-looking reservations are really strong at our domestic parks, and we’re also seeing strong underlying demand at our Disney Cruise Line in terms of what we’re seeing from consumers.” — Bob Chapek, CEO of Walt Disney (DIS)

Universal Studios: “[On] the demand side of Orlando, we have virtually no international visitation yet, which normally, depending on the time of year, is between 20% and 30% of our attendance. And yet, without any of that attendance, we’re already hitting our capacity and doing better, in some cases, than in 2019, which is remarkable given how soon coming out of this we are. One of the things you’d expect actually is with less international and more domestic visitation, you’d expect forecasts to be lower, and we’re actually not seeing that.” — Jeff Shell, CEO of Comcast (CMCSA) NBCUniversal

The U.S. is not the world…

“Volumes are looking good overall. There are some puts and takes, right. The U.S. looks stronger than not just we, but I suspect most of your guests have expected. Outside the U.S., the recovery probably is a little slower than we might have hoped on spending, but more or less balances out.” — Jeff Campbell, CFO of American Express (AXP)

A Few Stories That Caught My Eye

- The mother of all crypto VC funds — more on Andreesen Horowitz’s $2.2 billion blockchain bet. (link)

- This little hedge fund is taking down big oil. (link)

- Check out The Washington Post’s review of the infrastructure bill. (link)

- “I Have Seen the Return of Broadway, and its Name is Bruce Springsteen.” (link, link)

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (June 28, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.