The Pulse – What’s happening in the Economy and the Capital Markets: June 14-18, 2021

June 21, 2021

Executive Summary

The markets dropped last week as the Federal Reserve announced it plans to increase interest rates earlier than expected. Below, we answer investors’ most pressing questions — from implications of the rate hike to the winners and losers of the situation.

Last week: a whole ‘lotta red going on

It was a brutal week in the markets as just about everything sold off:

What was behind the drop? The Fed, the Fed, the Fed.

Last week the Fed essentially said that inflation and the economy are rebounding faster than they expected just three months ago, so they’re likely to increase interest rates earlier than they planned. This raises several questions:

How much earlier?

The Fed now believes it’s likely to raise rates in 2023, when it previously expected to raise them in 2024. What’s more, the Fed is now anticipating two rate increases in 2023.

2023 feels like an eternity — why wait so long?

The Fed’s mandate is to balance two key aspects of the economy:

1. Mitigate the impact of inflation

2. Manage the economy so that unemployment is at “normal” levels

This balancing act shows that inflation and unemployment don’t move in lock step.

The unemployment rate is 5.8% versus 3.5% pre-COVID; this means the Fed still sees 3.6 million jobs that need to be filled from economic growth before the economy approaches normal. Many jobs may return as the service economy rebounds, but the Fed is unlikely to move until it has strong conviction that those jobs will be fully recovered.

2023 still feels like an eternity — why did the market sell off?

Well, the market thought the Fed would have to raise rates earlier than what it initially intimated. Wednesday’s announcement signaled that perhaps the market is right about inflation and the Fed is too cautious.

As the U.S. economy moves through 2021, the Fed may have to move closer to taking more aggressive (i.e., restrictive) actions to reduce how fast the economy will grow. This may hurt companies’ future earnings.

One way we can see this is in the difference between the interest rate for 10-year government bonds and 2-year government bonds. The narrowing between the difference, or “spread,” of the two bonds is a sign that the market expects lower future growth rates for the economy compared to near-term expectations. The spread plummeted after the Fed’s announcement:

Who wins and who loses in this situation?

- Who fared worse? Sectors that have benefited the most from cyclical-rebound investments are the ones whose stocks performed best in recent quarters: energy, materials and financials. Not surprisingly, last week these were the three worst-performing sectors of the 11 sectors in the S&P 500, declining 5.2%, 6.3% and 6.2% respectively.

- Who fared best? Sectors with steadier business models, more recurring revenue and higher levels of profitability performed best — specifically, technology (+0.1%), consumer discretionary (-0.1%, with e-commerce winners like Amazon) and healthcare (-0.8%). In these sectors, long-term growth trends likely will not be impaired if the economic cycle slows, and companies’ profitability is less reliant on financing costs.

- Who fared somewhere in between? Sectors that have some inflation resistance (because companies can raise prices over time) yet are reliant upon financing costs — such as real estate and utilities — performed somewhere between “best” and “worse.”

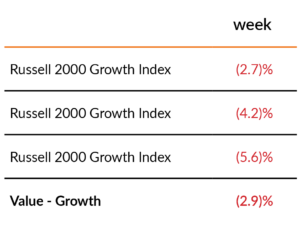

Last week, we saw these effects in the performance of the Russell 2000, which is the smaller-company index. Growth companies in the Russell 2000 outperformed the more cyclical (“value”) companies by 2.9 percentage points:

We’ve been hearing about inflation for a while — what’s new?

The Fed has traditionally focused on data that lags the real-time news (though, in all fairness, the Fed has acted swiftly in times of crisis), so its comments last week reflect deliberations that may not reflect what’s currently occurring in the market.

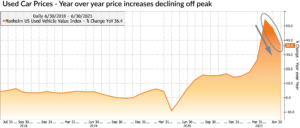

In prior editions of The Pulse, we’ve seen price spikes in sectors where there have been supply-chain shortages (e.g., used cars, lumber and copper). We’re already seeing a retreat in some of those sectors in the most dramatic instances of inflation:

So, while prices have increased across the economy, we may start to see the rate of increase temper.

A Few Stories That Caught My Eye

- As we discussed above, the Fed sees two rate hikes by the end of 2023. Take a deeper dive into their comments. (link)

- Airbnb is spending millions to make nightmare rental situations go away. (link)

- The world relies on one chip maker in Taiwan to keep electronics running — leaving everyone vulnerable. (link)

- The tight labor market is returning the upper hand to American workers. (link)

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (June 21, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.