The Pulse – What’s happening in the Economy and the Capital Markets: 6/7/21 – 6/11/21

June 16, 2021

Executive Summary

- A familiar face: Inflation is all anyone can talk about these days — and following the release of May’s Consumer Price Index numbers, the chatter doesn’t seem to be quieting down.

- A SPACtacular trend: The growing popularity (and criticism) of special purpose acquisition companies (SPACs) is reaching a fever pitch, marked by a major deal between Universal Music Group and Vivendi.

- A new kid on the block: Technology is society’s great disruptor, and it’s now making its way to an unexpected sector: lawn care.

Welcome back, welcome back, welcome back

If you remember Sweathogs, Arnold Horshack (RIP Ron Palillo) and the nerdy coolness of Mr. Kotter, talk of inflation is nothing new.

Last week, we received May’s Consumer Price Index (CPI) numbers, which were higher than expected and came with headlines that may scare investors — the numbers increased 5% year over year, and we saw a 3.8% increase for “Core” inflation, which excludes food and energy.

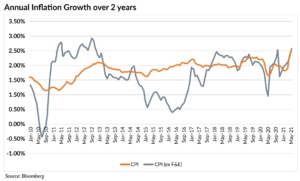

When comparing the impact to numbers from two years prior (i.e., 2019), we see an annual increase of 2.5% for both Core CPI (which is less volatile) and overall CPI.

While we are seeing the highest level for CPI (excluding the impact of food and energy) in over a decade, when factoring in energy and food spikes, the level is in line with recent highs and below what we experienced in the years after the financial crisis.

What’s driving the recent spike? In a word, economic reopening.

Vacation, all I ever wanted…vacation, had to get away

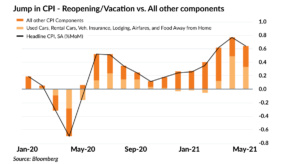

According to Bloomberg, 52% of the month-over-month increase in CPI numbers came from used cars, rental cars, vehicle insurance, lodging, airfares and food away from home.

In other words, these are the activities that characterize travel. The rise in prices tied to vacations is transitory and should decline as more supply enters the market.

As the chart below shows, the “All Other CPI Components” figures in orange have been more consistent, if not on a decline relative to what we saw earlier in 2021.

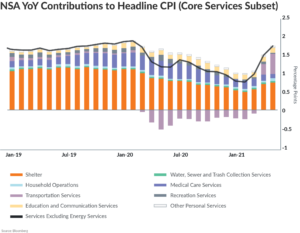

The impact of travel and automobiles (“Transportation Services”) is driving the large, recent spike; these figures were negative for 13 months, so the recent jump reflects the rebound in these categories.

The costs of shelter (home ownership and rent, for instance) and healthcare services remain well below 2019 levels.

Over time, we expect the costs associated with auto and travel to moderate, while home and healthcare increase toward more normal levels.

The markets looked at these components of inflation as transitory, meaning that the Fed is less likely to raise interest rates any time soon. As a result, interest rates on bonds fell.

The difference in yields between 10-year U.S. government bonds and 2-year government bonds narrowed to 1.3%, down from a peak of 1.6% earlier this year.

When the spread narrows, growth and technology stocks perform well compared to the rest of the market. When the spread widens, more cyclical stocks, such as financials and industrials, outperform. And that’s what we saw last week: the tech-heavy Nasdaq increased 1.7%, while the more-cyclical Dow Jones declined 0.8%.

They’re real, and they’re SPACtacular…

Special purpose acquisition companies (SPACs) are blank-check companies where investors give an acquirer money to go find a company to acquire by merging into their shell company. As we’ve noted before, SPACs became an extremely popular financing route because of COVID-19 restrictions.

The catch is that once money is raised by the SPAC, SPAC managers have two years to complete a deal; if they do not, they must return the original cash to investors and lose deal incentives they may be provided for orchestrating the deal. For sponsors of the SPAC, this creates a perverse incentive of any deal being better than no deal.

Controversial investor Bill Ackman had one of the largest initial public offerings (IPOs) for a SPAC. In a highly complex transaction, he announced a deal to acquire 10% of Universal Music Group from Vivendi. Universal has been growing significantly since streaming reversed the fortunes of music labels — so this deal may turn out SPAC-tacular for investors.

And maybe not so SPACtacular…

Many SPAC deals have been for profitless, tech-oriented companies in nascent markets aligned with secular trends. For instance, electric vehicles is one sector that’s had several SPAC deals.

Less than a year after announcing its deal to merge with a SPAC and receiving a $675 million cash injection, electric pickup truck manufacturer Lordstown Motors (RIDE) announced in an SEC filing that it received a “Going Concern” notice from its auditors. In other words, despite the injection of cash, auditors are concerned that the company won’t have enough money to fund operations over the next 12 months. In fact, Lordstown said it may not have enough money to begin production of its trucks. The stock sank 16% after the news emerged.

How dirty is your landscaper?

In a legendary essay published a decade ago, Marc Andreesen declared that “Software is Eating the World.”

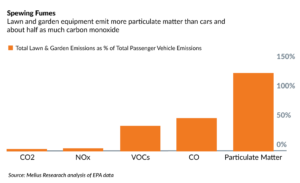

And now, we’re starting to see software disrupt a very nontechnological place: the lawn. According to Melius Research — a Wall Street industrials-sector-focused investment research firm — lawn and garden emissions account for more than 100% of the emissions for U.S. vehicles regarding particulates. The sustainability impact of software and electric tools for lawn care is huge.

First, it was the Roomba for cleaning your house; now enter Graze, the equivalent for your lawn.

Graze is the first fully autonomous commercial lawn mower. One enormous benefit of the product is its sustainability compared to current forms of lawn care. Graze is 100% electric-powered, which eliminates 75% of fuel costs and 50% of labor costs.

Stanley Black & Decker — owner of tool brands like DEWALT® and CRAFTSMAN® — has focused on this market for several years. With 60% of lawn and garden equipment tied to gas-powered tools, this presents a significant revenue opportunity for the industry. Melius Research sees this as a $4 billion revenue opportunity for Stanley, which could boost sales 3% annually over the next decade.[1]

A Few Stories That Caught My Eye

- China’s largest ride-hailing app, Didi Chuxing, filed for an IPO in the U.S., valuing the company at $70 billion. Didi previously purchased Uber’s China operations.

- Apple’s announcements at the Worldwide Developers Conference show that augmented reality (AR) is still its “next big thing.”

- As vaccination rates have increased, national parks are now overcrowded and closing their gates.

- Here’s why Japan’s big bet on hydrogen could revolutionize the energy market.

[1] Brooke Sutherland, Industrial Strength Newsletter, Bloomberg Opinion, May 21, 2021, accessed June 2021.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (June 16, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.