This quarter, in private equity, we are seeing deals shift further toward equity-heavy structures as lenders pull back and pricing risk rises. In private credit, we are seeing more weight put on covenant strength — especially now, with economic uncertainty making downside protection more important. Data centers remain one of the most resilient corners of real estate, powered by the demand for AI infrastructure and sticky, long-term leases. But even here, net cash flow trends are cooling, a sign that no market is without challenges.

This newsletter is designed to be accessible to investors new to private capital, with a focus on clear, practical insights. If you would like to further discuss how private investments fit into your portfolio, please reach out to your Aprio advisor, Simeon Wallis, CFA, Partner and Chief Investment Officer, or Adam Niestradt, CFA, Director of Private Capital.

1. Private Equity: LBO Purchase Price Multiples

Leveraged buyout (LBO) purchase multiples have increased from 8.6x EBITDA in 2006 to 11.0x in 2024. This rise was driven by higher equity contributions as the use of debt in financing deals has declined. In the past, sponsors relied more on debt to finance their deals; however, in the current environment, they have increased their equity contributions. While this change may lower private equity returns going forward, due to the decreased reliance on debt, it fosters a more balanced approach to financing a deal that aligns with private equity sponsors and their investor base.

What this means for you: Private equity deals are being increasingly funded with more equity and less debt, potentially reflecting tighter lending conditions requiring larger equity contributions. Higher equity contributions may reduce financial risk and increase the focus on operational improvements. Therefore, investors should prioritize managers with proven value creation strategies, not just financial engineering. In this type of environment, discipline and sector proficiency is rewarded, especially at high valuations. Investors should be selective, concentrating on funds with strong underwriting and operational track records.

2. Private Credit: Covenant Protections

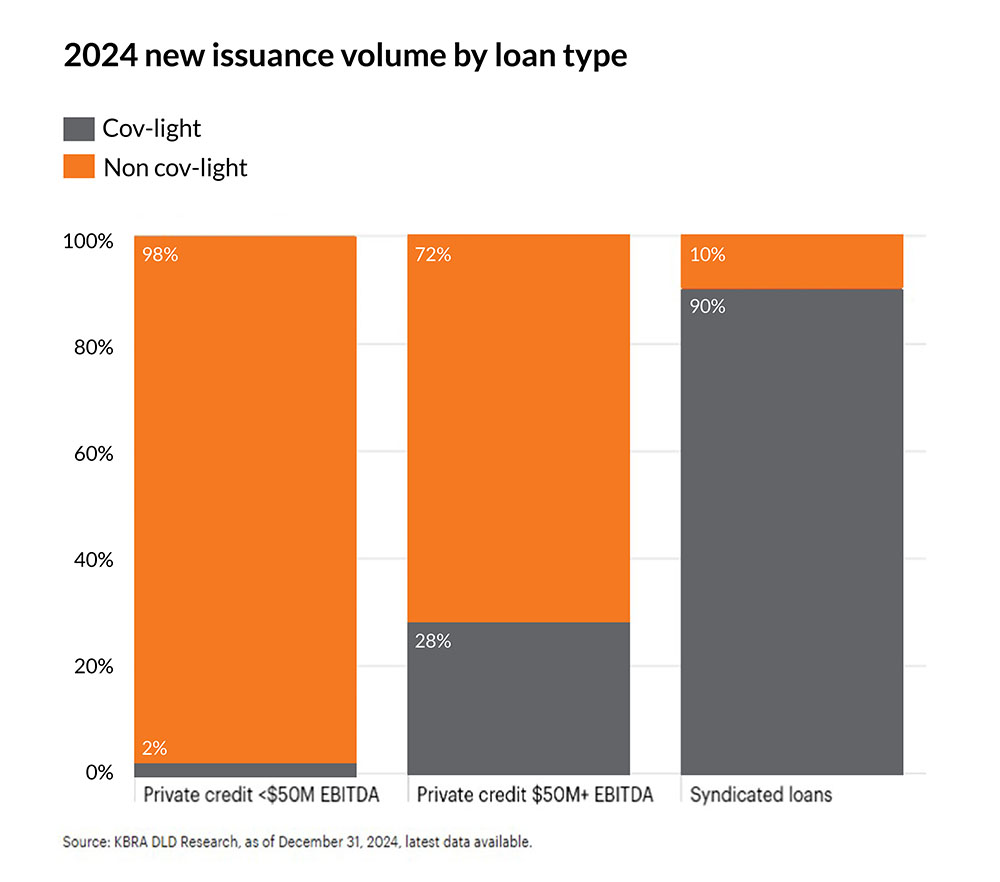

Covenant clauses in loan agreements are designed to protect lenders by helping to ensure that borrowers focus on financial performance and their ability to repay their debts. However, in 2024 only 10% of syndicated (public) loans included covenants, compared to 72% in upper middle market private credit and 98% in lower middle market private loans. [1]

What this means for you: Private credit loans offer stronger protections for lenders compared to publicly syndicated loans. Covenants provide lenders with tools to intervene earlier if a borrower’s financial condition begins to deteriorate. For investors, the structural difference in loans reduces risk and improves recovery prospects in the event of default. During economic downturns, covenants act as safeguards, enhancing private credit’s resilience as a reliable income source. Therefore, investors should consider covenant strength as a key feature when evaluating credit opportunities.

3. Real Estate: U.S. Data Center Market

Over the past decade, the U.S. data center market has experienced significant growth in both absorption and new supply. From 2015 to third quarter of 2024, vacancy rates in the U.S. have steadily declined. Despite record levels of new supply in 2022 and 2023, vacancy rates fell from 11% in 2017 to below 2% in Q3 2024. This drop indicates that the demand for data center space is outpacing new supply being added to the market.

What this means for you: Data centers continue to benefit from strong demand, driven by AI, cloud computing, and digital transformation trends. Low vacancy rates suggest pricing power and rising rents for operators. The data center real estate market can offer investors stable, long-term leases with high credit tenants, and the potential for income growth and inflation protection. Private real estate funds targeting data centers may capture secular growth while also providing portfolio diversification.

4. Infrastructure: Private vs Public Infrastructure

Private infrastructure investments have historically delivered an average annual return of 9.8% with lower volatility. Meanwhile, public infrastructure investments have averaged an annual return of 8.8% but tend to experience more frequent negative years.

What this means for you: Private infrastructure investments offer investors lower volatility, smoother returns, and lower correlation to equities than public infrastructure investments. While less liquid, private infrastructure investments enhance diversification and resilience in multi-asset portfolios and provide inflation-linked cash flows backed by essential services. Offering greater control over operations and governance, investors seeking downside protection and portfolio stability may benefit from allocating to private infrastructure.

5. Venture Capital: Net Cash Flow Trends

After a positive net cash flow in 2020 and 2021, venture capital has been cash flow negative since 2021 as contributions have outpaced distributions. The chart above tracks venture capital cash flow trends from 1997 through the first quarter of 2025, indicating that in recent years deal count has also declined, reflecting a slowdown in new investments.

What this means for you: Venture capital is currently in a phase where investors are contributing more money than they are receiving, reflecting a slower exit environment, with fewer IPOs and acquisitions returning capital to investors. Paradoxically, the current environment may create better buying opportunities and lead to stronger future returns. Therefore, venture capital investors should plan for longer capital commitments and slower distributions, yet staying committed through downturns has historically rewarded patient investors with exposure to lower entry valuations.

[1] Syndicated loans are loans that banks underwrite and then sell to investors. In private credit, typically specific funds are created to make loans, with interest and principal payments flowing to the fund’s investors.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.