6 Key Tech Industry Insights and What They Mean for Your Business

August 15, 2024

2024 Third Quarter Report

What we are seeing in technology

The venture capital landscape of Q2 2024 is a study in contrasts with $65.7 billion in funding, yet deal volume is down for the ninth straight quarter. Artificial intelligence (AI) companies snagged 28% of the venture rounds globally, with Elon Musk’s xAI raising nearly a third of the rounds with its $6 billion raise. Public valuations are strong except in the fintech sector, and tech layoffs are easing. Two critical trends are continuing this quarter with global data traffic set to explode and interest in cybersecurity surges.

1. Venture funding continues to grow despite declining deal volume

The venture environment is a tale of haves and have nots. While funding increased for the second consecutive quarter to $65.7 billion, 47% was invested in mega-rounds ($100M+ deals). Elon Musk’s xAI’s $6 billion round accounted for nearly 10% of total venture funding, which prevented a quarter-over-quarter decline. Despite this, deal volume fell 7% for the ninth straight quarter, reflecting normalization after the zero-interest rate policy (ZIRP) bubble years.

What this means for you: Building relationships earlier and staying flexible on deal terms will be crucial for navigating this environment. Anticipate having to show more product development, product-market-fit progress, and financial metrics at more modest valuations.

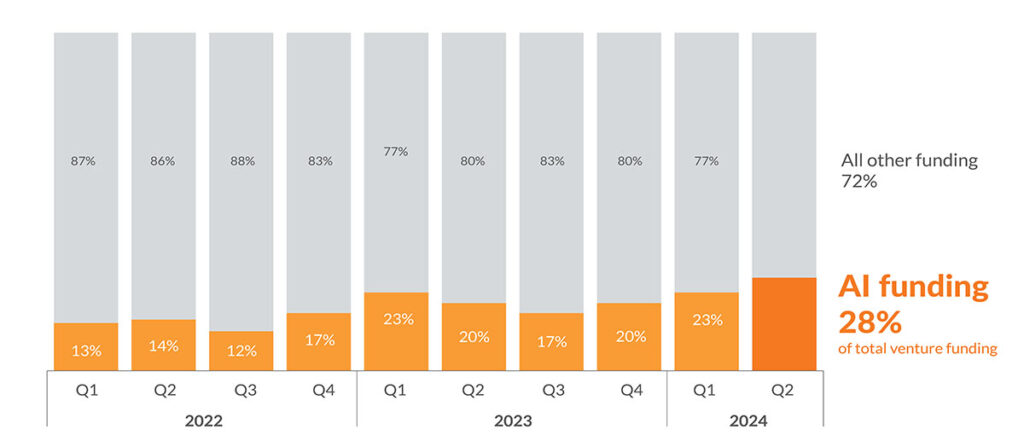

2. AI leads venture market growth with record $18.3B raised in Q2 2024

AI is the primary driver of growth in the venture market, with startups in this sector raising $18.3 billion in Q2 2024, accounting for 28% of the global total — the highest share on record. This trend has been increasing, particularly since the launch of OpenAI’s ChatGPT in late 2022.

What this means for you: This trend highlights that funding remains available for tech startups, particularly native AI companies and those developing AI solutions. To navigate this landscape, look to focus on integrating AI technologies, showcasing unique value, forming strategic partnerships, and investing in top AI talent to stay competitive and attract investment.

3. Publicly traded tech companies are trading at large premiums

Driven by strong anticipated growth, small-cap tech, software, and cybersecurity companies are trading at premium valuations relative to their 10-year historical multiples. In contrast, the fintech sector’s significant discount suggests potential challenges or decreased market confidence, possibly due to low barriers to entry, higher delinquencies on loans, greater customer churn, and regulatory concerns.

What this means for you: Consider leveraging high market valuations to attract investment for an exit or fuel growth by continuing to innovate and address market needs. Fintech startups need to address market concerns through transparency and demonstrating strong business fundamentals to regain investor confidence and improve valuations.

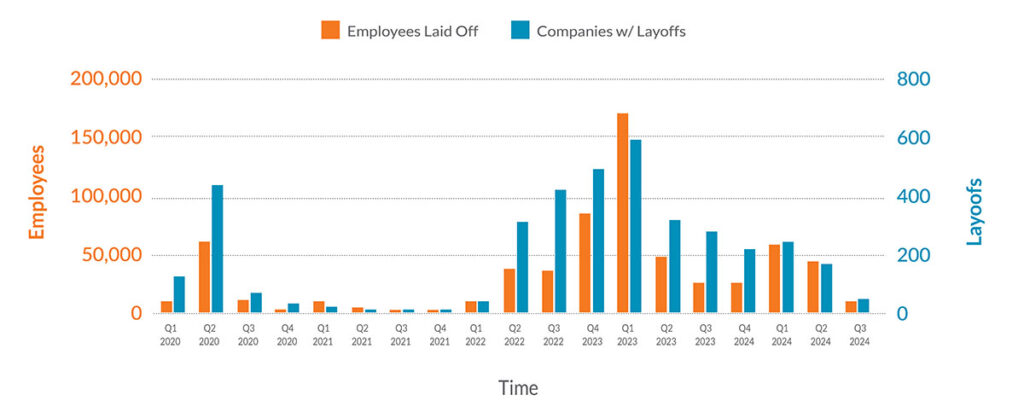

4. Tech layoffs continue to decline indicating industry stabilization

A decrease in tech layoffs since Q1 2023 indicates a potential stabilization in the industry. Layoffs surged during Q1 2022 to Q1 2023 due to economic uncertainties and post-pandemic over hiring. This decline in layoffs suggests adjustments have been made to the market environment, providing a more optimistic outlook for tech companies moving forward.

What this means for you: The recent decrease in tech layoffs suggests improved economic conditions and market stability, offering a more positive outlook for tech startups. This trend can boost investor confidence, providing better opportunities for growth and funding.

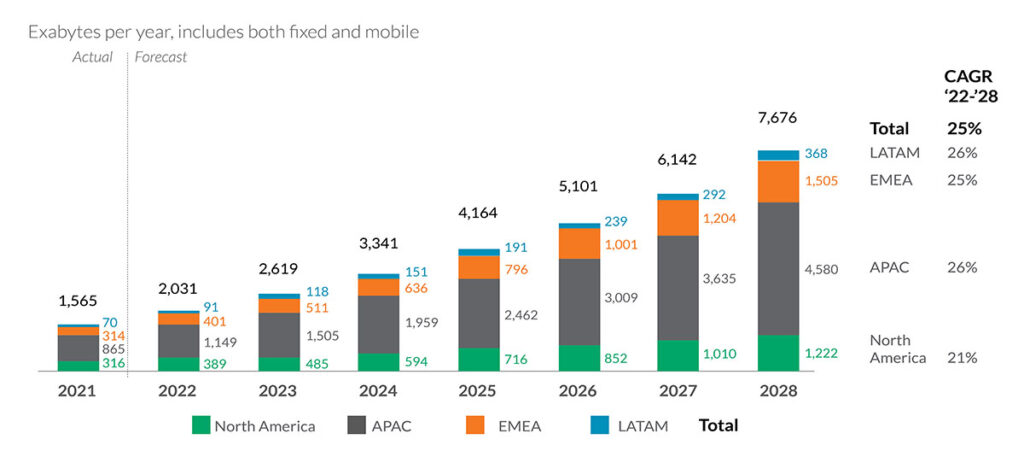

5. Demand for data transmission and storage is expected to grow exponentially

Global data traffic is projected to grow significantly from 1,565 exabytes in 2021 to 7,676 exabytes in 2028. This represents a Compound Annual Growth Rate (CAGR) of 25% from 2022 to 2028.

What this means for you: Anticipate fast growth and budget for investing in robust data infrastructure to scale efficiently. Developing innovative data-driven products and services can enable the growing data traffic.

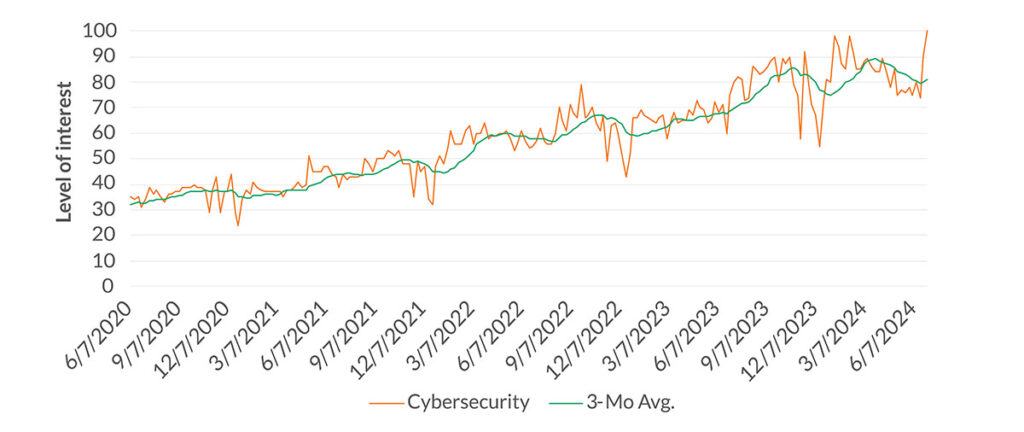

6. AI cyberattacks increases demand for cybersecurity

A steady upward trend in search interest for “Cybersecurity” indicates growing concern of cyberattacks and demand in this area of technology. The recent surge around cybersecurity highlights a renewed or heightened focus on cybersecurity issues.

What this means for you: Innovative cybersecurity solutions are in continued and growing demand. Additionally, we believe they should continue to attract investors, partners, and customers by showcasing their expertise and solutions.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Aprio Wealth Management, LLC are not affiliated companies. Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Mitchell Kopelman

As national leader of the firm’s Technology industry client base, Mitchell coordinates and collaborates with leaders across all service lines supporting the firm’s technology clients providing a range of services. Mitchell has been a partner with Aprio since 1990. He works with domestic and multinational clients in a range of technology industries, including software, blockchain, gaming, prop tech, fintech, healthtech, IT, generative AI, and privacy and security. Mitchell helps business owners, venture and PE investors, and C-level executives achieve their business objectives, from pre-revenue startups to high growth liquidity events.

(404) 898-8231

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.