6 Manufacturing & Distribution Insights from Q1 2024 and What They Mean for You

January 25, 2024

The manufacturing sector has contracted for 14 consecutive months, but at a slowing rate. Production is up slightly, and factory construction is booming. However, truck tonnage, railroad traffic, and inbound containers are declining as manufacturers re-shore production. Interest in warehouse and factory jobs is rising, suggesting a looser labor market. Manufacturing wages remain high despite quantitative tightening.

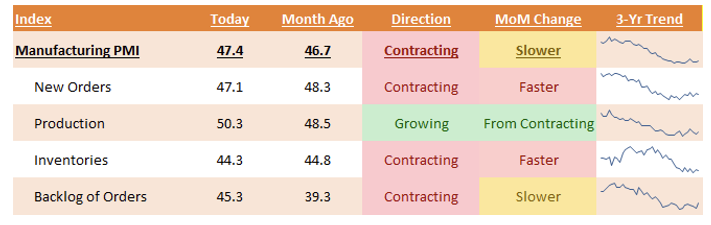

1. Manufacturing Sector Remains in a Slump, but Shows Signs of Improvement

ISM Snapshot

The latest ISM survey marked the 14th consecutive month of contraction, albeit at a slower rate. While ISM indicates that the manufacturing sector is still contracting due to softening orders and diminishing backlogs, the worst seems to be over as production picks up.

What this means for you: Higher interest rates have reduced spending, however anticipation of the Federal Reserve lowering rates in 2024 could ignite greater future demand. As interest rates decline, expect increasing orders and loosening budget constraints associated with higher costs of capital.

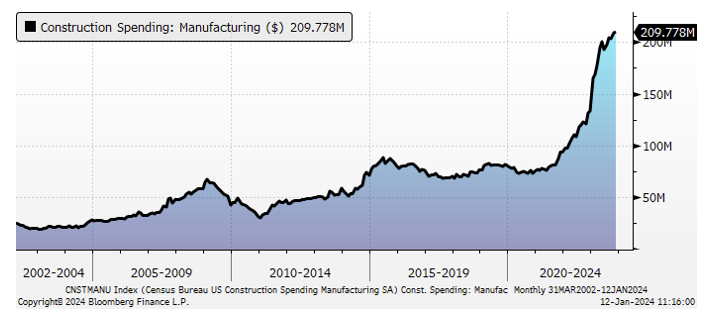

2. Large Amounts of Factories Coming Online Should Support Growth

Construction Spending: Manufacturing

Despite the manufacturing’s sectors 14-month contraction, factory construction is booming due to the support of government subsidies, the encouragement of re-shoring, investments in production capacity for energy transformation, and electric vehicles as well as companies preparing to increase output following the anticipated Federal Reserve rate cuts.

What this means for you: Companies are gearing up for what’s next. New factories and additional capacity are emerging from the industry’s contraction. Start planning and evaluating financing options with the cost of capital expected to decline this year.

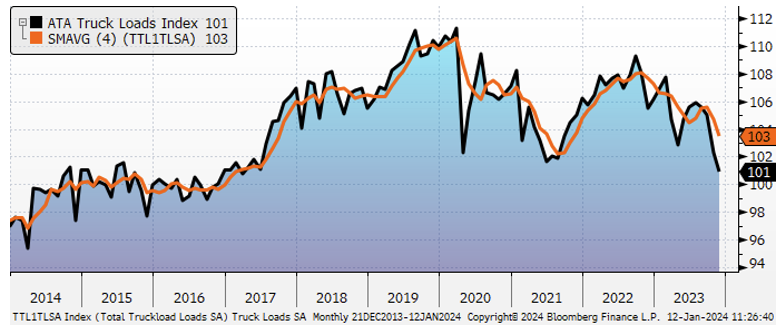

3. Declining Truckloads Indicate Weak Demand Across the Manufacturing Sector

ATA Truck Loads Index

Despite the strong GDP growth, truck tonnage continues to weaken as drivers struggle to find loads due to low demand, including continued destocking by manufacturers.

What this means for you: With the supply of truck drivers currently outweighing the demand for loads, shippers should consider locking in lower contractual truck rates now ahead of demand and production increases.

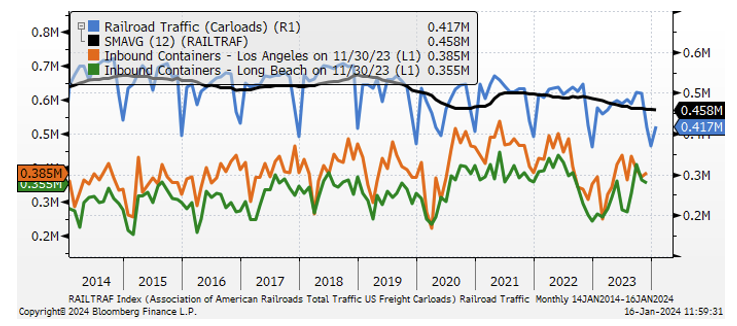

4. Declining Railroad Traffic and Inbound Containers Indicates More Manufacturers Reshoring Their Production

Monthly Railroad Traffic

Railroad traffic and inbound containers have seen a steady decline in recent years as manufacturers shift their production to domestic soil. Vulnerable supply chains and volatile shipping costs have more manufacturers reshoring their production, despite the difference in labor wage rates.

What this means for you: Reshoring can improve supply chain resiliency and reduce lead time to adapt to quick changes in demand. With the increased use of robotics and advanced manufacturing technologies, reshoring may be more cost-effective and efficient than the already low cost of labor overseas.

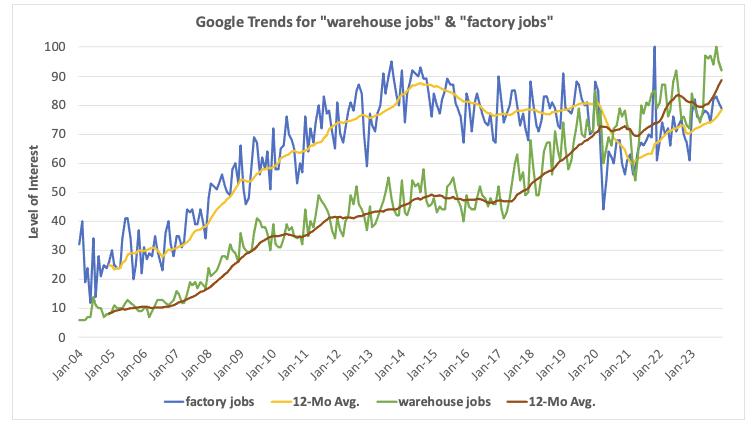

5. Interest in Manufacturing-Related Jobs Remains Strong

Google Trends for “warehouse jobs” & “factory jobs”

Google Trends data highlights that interest in “warehouse jobs” and “factory jobs” is climbing to peak levels. Rising interest in manufacturing-related jobs implies that the sector’s labor market is loosening, to the benefit of employers.

What this means for you: Looser labor markets coupled with reshoring incentives offer an opportunity to manage compensation more effectively and could provide a more cost-effective transition of higher U.S. labor costs.

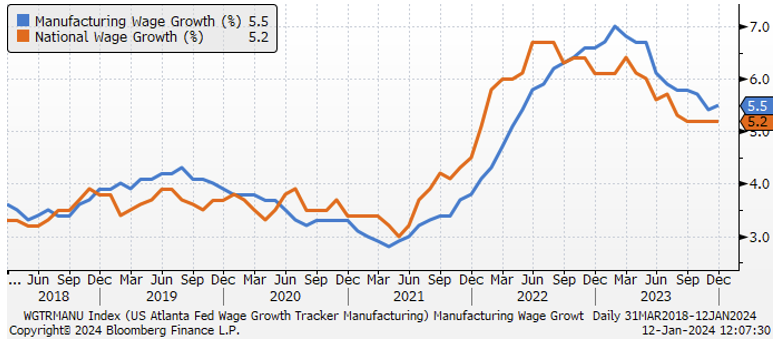

6. Growth in Wages Are Trending Lower Yet Remain Historically High

Wage Inflation

Growth rates in manufacturing wages have been declining yet remain historically high despite aggressive quantitative tightening. Wages tend to be stickier than the price of other expenditures, such as food and energy, thus it may take longer to revert to more normal growth rates.

What this means for you: The rate of wage growth will likely continue declining moving forward, albeit not as quickly as in 2023. With manufacturing and distribution job interest seemingly high according to the Google Trends chart above, use that data as leverage to negotiate fairer wages and retain workers that are most efficient.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (January 25, 2024) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Adam Beckerman, CPA, CGMA

For more than 20 years, Adam has been enabling the success of manufacturers in all stages of the business lifecycle whether they are starting up, growing, or getting ready for an equity event. As the Partner-in-Charge of Aprio’s Manufacturing & Distribution Group and Lean Six Sigma Green Belt, Adam is passionate about helping established and high-growth manufacturers in the flooring, chemicals, plastics, and food industries drive efficiencies into their manufacturing processes.

(404) 898-7542

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.