6 Manufacturing Insights from Q3 2023 and What They Mean for You

July 25, 2023

The manufacturing sector continues to experience a contraction with the Institute of Supply Management (ISM) surveys falling for the eighth consecutive month, and concerns for sales pipelines as new order surveys weaken. But not all is lost. The silver lining is that the slowdown has reduced input prices, thus alleviating inflationary pressures.

While the industry navigates a slowdown, loosening labor market conditions have lowered wage growth pressures and shipping costs are declining as change in supply and demand dynamics pressure container and truck rates. M&A activity has also slowed due to higher borrowing costs, economic uncertainty and sellers anchoring on prior valuations. Despite the slowdown, we’re seeing rising interest in supply chain sustainability.

1. The manufacturing sector contracts further in Q3

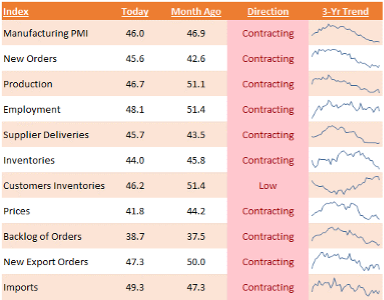

ISM Snapshot

A manufacturing PMI reading above 50 indicates industry expansion and below 50, a contraction. In June, the ISM marked the eighth consecutive month of contraction as backlogs decline and factories work down weakening new orders. However, lower input prices are alleviating inflationary pressures.

What this means for you: Expect subdued demand and potential delays for new orders until the manufacturing economy improves. Consider flexible staffing and production levels, and taking advantage of lower input costs if balance sheets permit.

2. Growth in manufacturing wages is beginning to decelerate

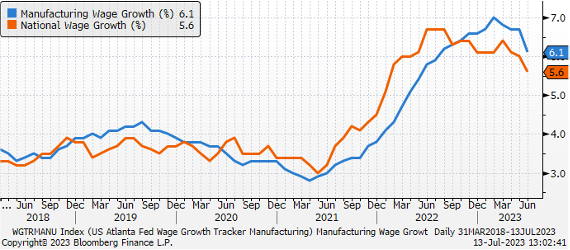

Manufacturing Wage Growth

Looser labor market conditions have appeared to start curbing sticky wage inflation as the growth rate in manufacturing wages decelerates.

What this means for you: Manufacturing wage growth is still historically high, however, signs point towards the worst being over. Expect inflationary wage pressures to decline as the economy slows and labor markets soften further.

3. Interest in manufacturing-related jobs persists in 2023

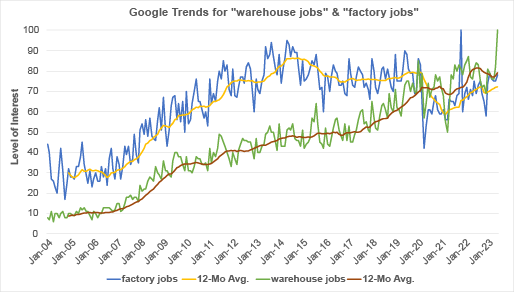

Google Trends for “warehouse jobs” & “factory jobs”

According to Google Trends data, interest in “warehouse jobs” and “factory jobs” remain high. However, with the demand in manufacturing contracting, manufacturers may look to slow hiring, and even consider targeted layoffs.

What this means for you: Manufacturers may slow hiring but interest in manufacturing jobs remains elevated, with funding for re-shoring, infrastructure and decarbonization attracting attention. This could lead to a looser manufacturing and distribution labor market, thus helping employers. As demand weakens, look to flex production and hiring, and seize the opportunity to renegotiate compensation where that may be out of market.

4. Container and trucking rates collapsed after Q1 2022 peak

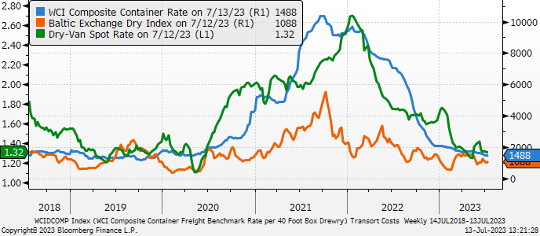

Container and Trucking Rates

While some inflationary pressures remain elevated, shipping costs have plummeted to pre-pandemic levels as supply and demand dynamics normalize.

What this means for you: Container rates may further decline in the second half of 2023 as more ships and trucks are in service while global economic growth weakens. Given this change in supply and demand dynamics, carriers will be pressured to be more competitive on rates. Look to use these competitive dynamics to renegotiate lower contractual rates and reduce your shipping costs.

5. Industrial M&A deals continue to decline over economic uncertainty

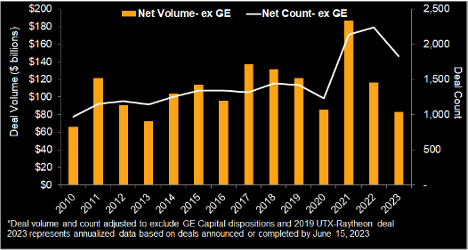

Industrial M&A Deals and Volume

Extended economic uncertainty, higher borrowing costs and sellers anchoring on prior valuations have reduced industrial M&A activity. Despite lower and more attractive asset prices, corporate deal makers have been more cautious.

What this means for you: Dealmaking could remain subdued over the next one-to-two quarters as higher bowering costs impact financing structures and projected returns until sellers accept the new reality on valuation multiples. With the market expecting the Federal Reserve to start reducing interest rates in mid-2024, we believe M&A activity will pick up as the market becomes more confident in that time frame, likely one-to-two quarters ahead of the actual rate reductions.

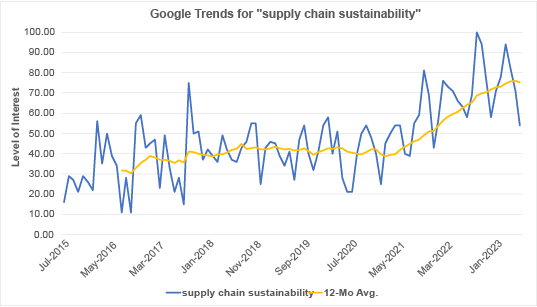

6. Google Trend Data suggests greater interest in supply chain sustainability

Google Trends: Supply Chain Sustainability

Supply chain sustainability is trending worldwide as companies increasingly recognize the revenue opportunities and threats related to customer and supplier interests in sustainability across their supply chains.

What this means for you: With increased interest in supply chain sustainability, consider ways to incorporate it into your supply chain. For example, adopt renewable energy sources, optimize transportation logistics, reduce waste, increase use of sustainable packing materials and extend the life of your products. Remember, showing progress matters.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (July 25, 2023) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Adam Beckerman, CPA, CGMA

For more than 20 years, Adam has been enabling the success of manufacturers in all stages of the business lifecycle whether they are starting up, growing, or getting ready for an equity event. As the Partner-in-Charge of Aprio’s Manufacturing & Distribution Group and Lean Six Sigma Green Belt, Adam is passionate about helping established and high-growth manufacturers in the flooring, chemicals, plastics, and food industries drive efficiencies into their manufacturing processes.

(404) 898-7542

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.