Marketplace Minute

Table of Contents

Thinking of buying or selling a business? Important decisions are clarified with relevant data. In this brief report, we provide data on transaction volume and multiples for select industries to help inform your decision-making process.

Have more questions? Connect with a member of Aprio’s Transaction Advisory Services Team today.

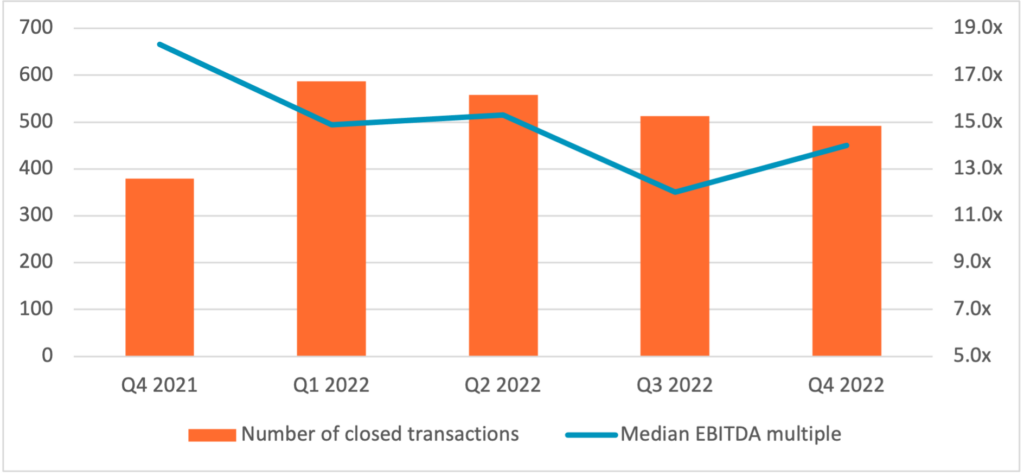

Retail and consumer products

Transaction volume and multiples held steady in all quarters of 2022. A handful of smaller transactions in niche corners of the consumer space traded at greatly lower multiples, but this is not seen as an over-all industry trend.

As of 2023, the US consumer remains cautious and conservative in their spending habits due to lingering economic uncertainty from the pandemic and ongoing financial strain. Despite this, there are signs of a slow but steady recovery, with an increase in consumer confidence and a potential stabilization of spending on discretionary items.

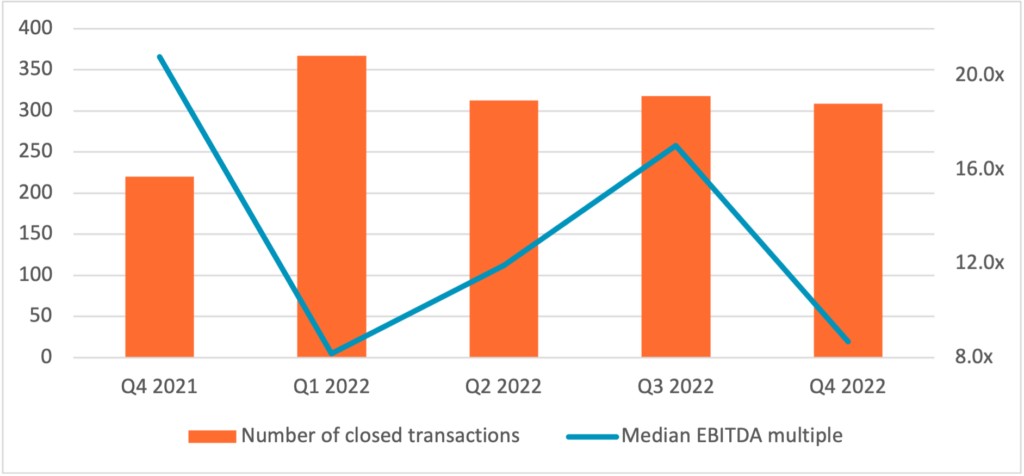

Healthcare

Consummated transaction count was in the 300 to 350 range for each quarter of 2022; however, multiples were very dependent on sub sector as health tech and pharmaceutical transactions led the fourth quarter of 2022 deal count.

COVID highlighted the fragility of infrastructure — whether healthcare or physical infrastructure. Governments seized on the opportunity to raise funds at low interest rates and passed legislation creating programs to disburse funds and prioritize investments.

In addition to traditional infrastructure investments, we expect increases to intellectual property-related infrastructure, such as health tech, artificial intelligence/machine learning and life sciences.

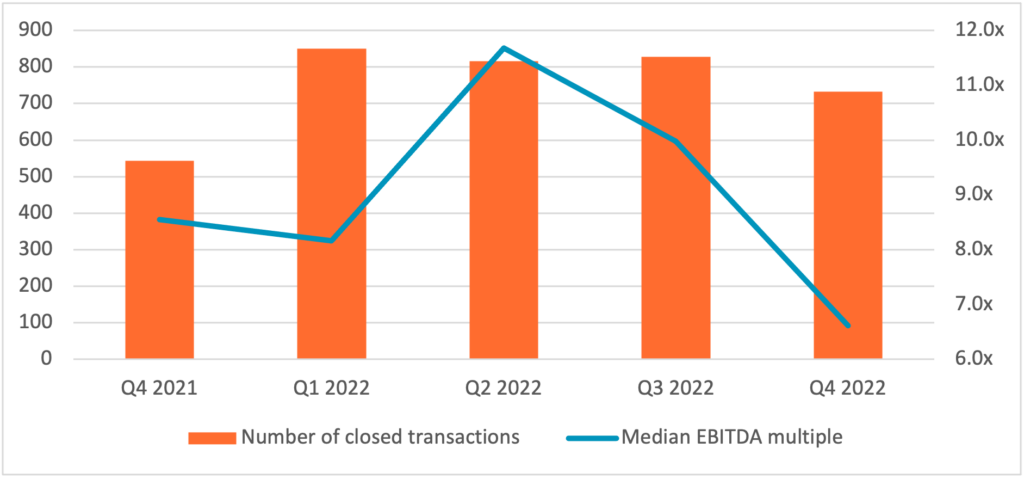

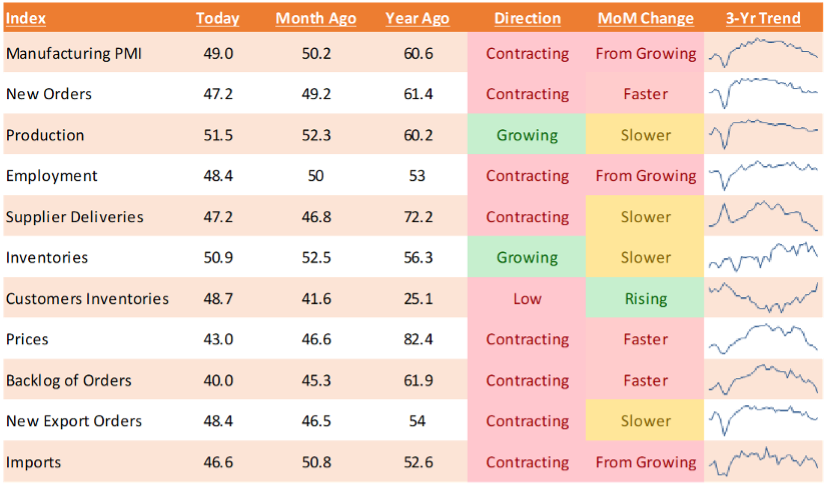

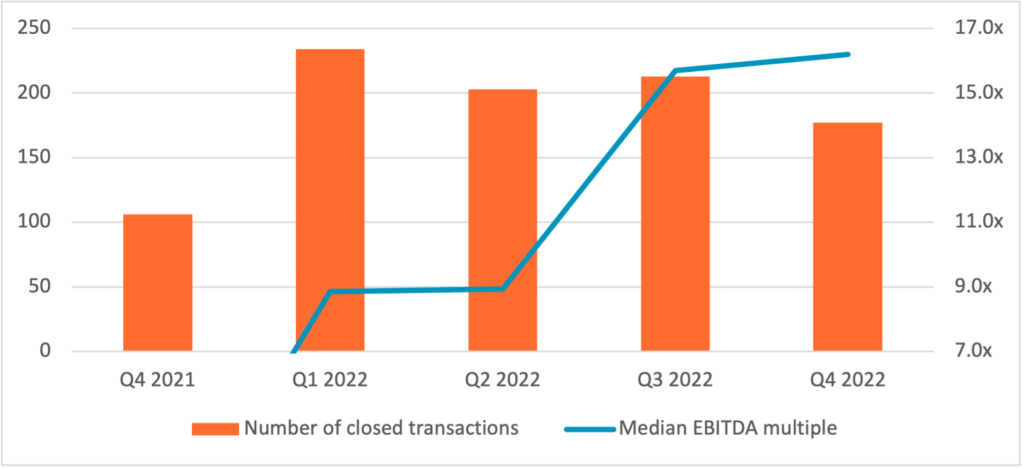

Manufacturing and distribution

Manufacturing and distribution multiples were hurt in the fourth quarter by a handful of strategic acquirers executing transactions at less than 5.0x EBITDA. A slower growing economy and excess inventories resulted in the manufacturing sector surveys signaling contraction for consecutive months. Coupled with rising interest rates, corporate deal makers are now uncertain what lies ahead.

ISM Snapshot

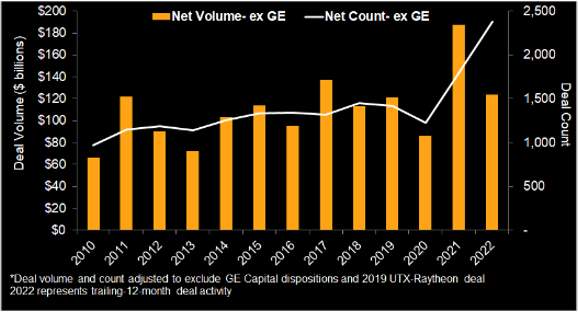

Industrial M&A Deals and Volumes

Rising interest rates and fears of a recession have pressured M&A activity as corporate dealmakers remain cautious. The trend of higher interest rates and weaker demand is expected to continue in the near term. If considering a transaction, aggressively managing costs to protect margins, and maintaining a healthy balance sheet by paying down debt, should enhance exit opportunities when the economy turns around.

Technology

Technology multiples held firm in the fourth quarter, though deal volume was off as compared to other quarters of 2022. There is a bifurcation between IT service and equipment multiples with premiums being paid for service-centric companies.

Total IT spending is increasing rapidly. While recent venture capital deals indicate that valuations are adjusting for slower growth, other data suggests that demand is still high for things such as cloud solutions and industrial robots. Furthermore, virtual reality (VR) and augmented reality (AR) hardware are expected to emerge out of the early-growth stage, as businesses are finding greater use for the technology outside of gaming and in segments such as e-commerce and real estate.

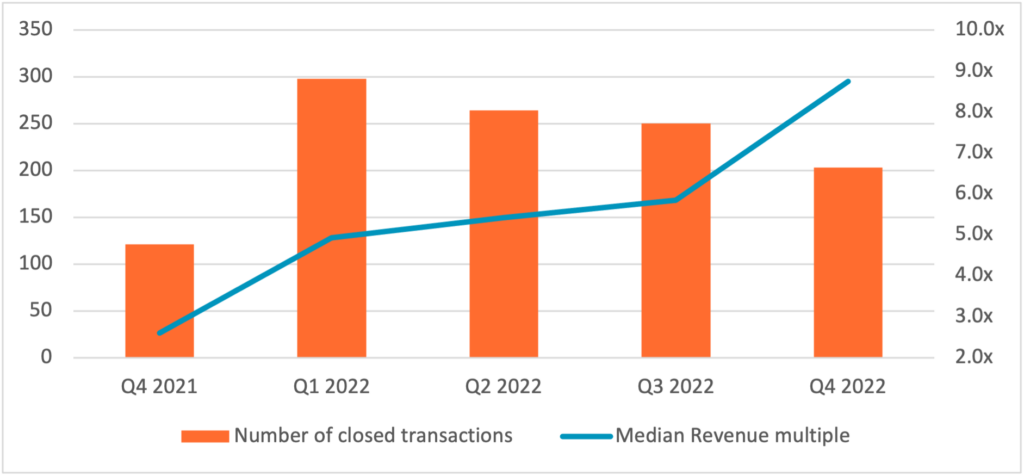

Software

Software revenue multiples continued their climb with the Bill Trust and Avalara exits to private equity sponsors leading the way.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.