6 Real Estate Insights from Q2 2025 and What They Mean for You

Table of Contents

The commercial real estate landscape continues to evolve amid tight capital conditions, rising costs, and shifting investor preferences. Cap rate spreads are narrowing again, making real estate less compelling compared to fixed income alternatives. Demand-side pressures are stabilizing while construction volumes remain depressed, potentially supporting future Net Operating Income (NOI) growth. Below, we break down six charts that tell the story of last quarter and what it means for investors like you.

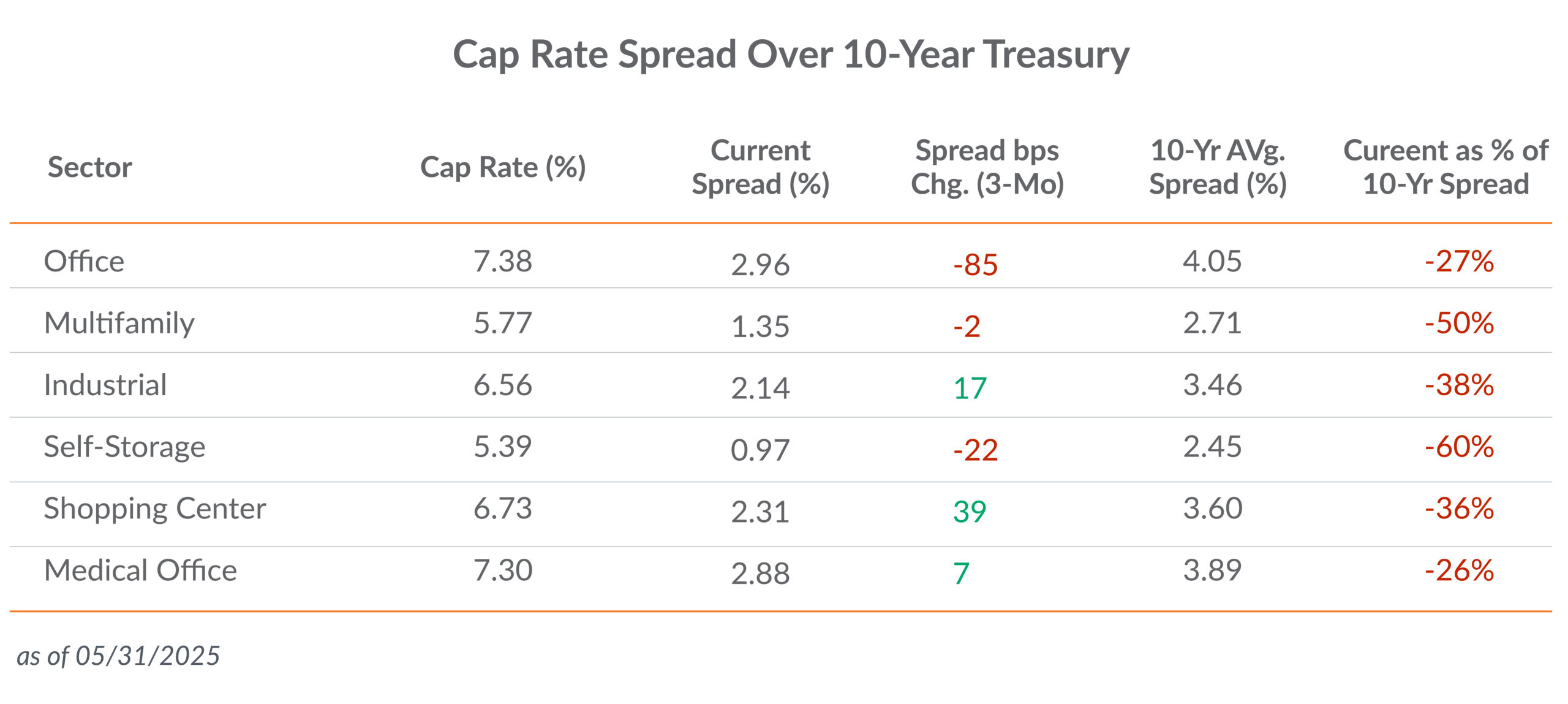

1. Despite higher cap rates, spreads remain compressed

Source: RCA, NAREIT, & ICE Data Indices, LLC

While cap rates inched higher in some sectors, the difference (or spread) between cap rates and the interest rate on the 10-year Treasury remain historically narrow. Medical Office and Office assets are near historical lows in spread terms, with current levels 26% and 27% below their 10-year averages, respectively. The biggest relative compression was in Multifamily (-50%) and Self-Storage (-60%), which remain the least appealing asset classes from a risk-adjusted return standpoint.

Note: The narrower the spread, the less additional return an asset owner will receive for the additional risk of owning that asset compared to a risk-free asset, such as the U.S. 10-year Treasury bond.

What this means for you: Cap rate compression limits real estate’s income advantage over bonds. As a result, investors should be more selective, focusing on real estate assets with growing cash flow, lease rollover protection, and tenant-demand tailwinds.

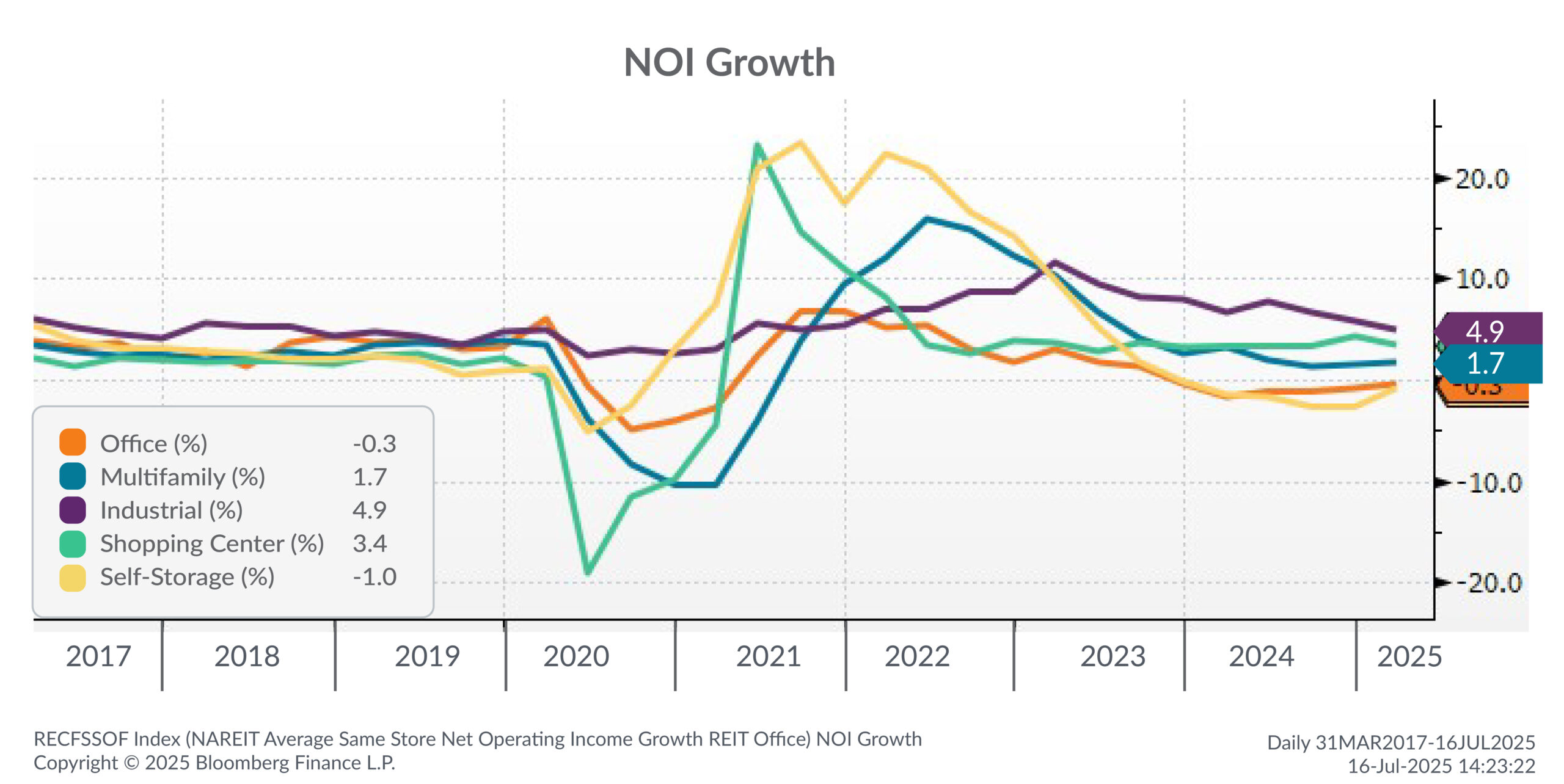

2. NOI growth diverges by sector

Source: Bloomberg Finance L.P.

NOI growth shows continued resilience in Industrial and Shopping Centers, with 4.9% and 3.4% growth, respectively. Multifamily is holding up modestly at 1.7% as the sector works through supply overhang in some markets, while Office and Self-Storage are both negative. The data suggest that pricing power is uneven, and past pandemic-era highs are normalizing quickly.

What this means for you: Focus on sectors where NOI is still expected to grow. Owners in Office or Self-Storage should focus on cost controls, lease restructuring, or disposition strategies. NOI growth is your margin of safety when cap rates aren’t doing you favors.

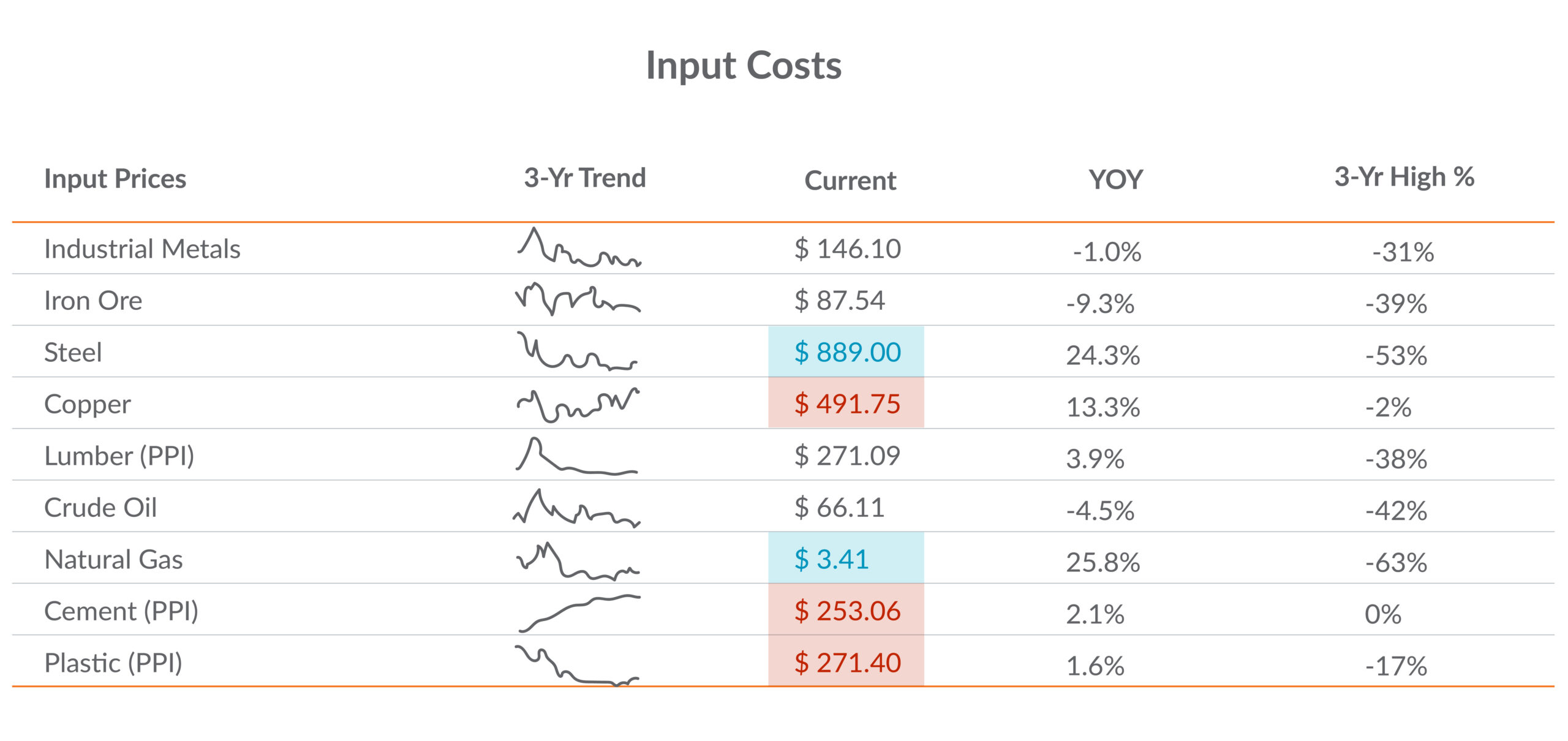

3. Construction input costs show mixed signals

Source: Bloomberg Finance L.P.

Prices for key construction materials are climbing again: steel is up 24.3% year-over-year, copper is up 13.3%, and natural gas is up 25.8%. Cement prices are near 3-year highs. While lumber and iron ore remain depressed, overall cost inflation is firming after a lull.

What this means for you: Budgeting for new builds or renovations will require greater scrutiny and adaptability. Rising input costs can stall speculative development and tilt favor toward existing assets. If you’re underwriting new projects, bake in a wider buffer for cost overruns and timing delays.

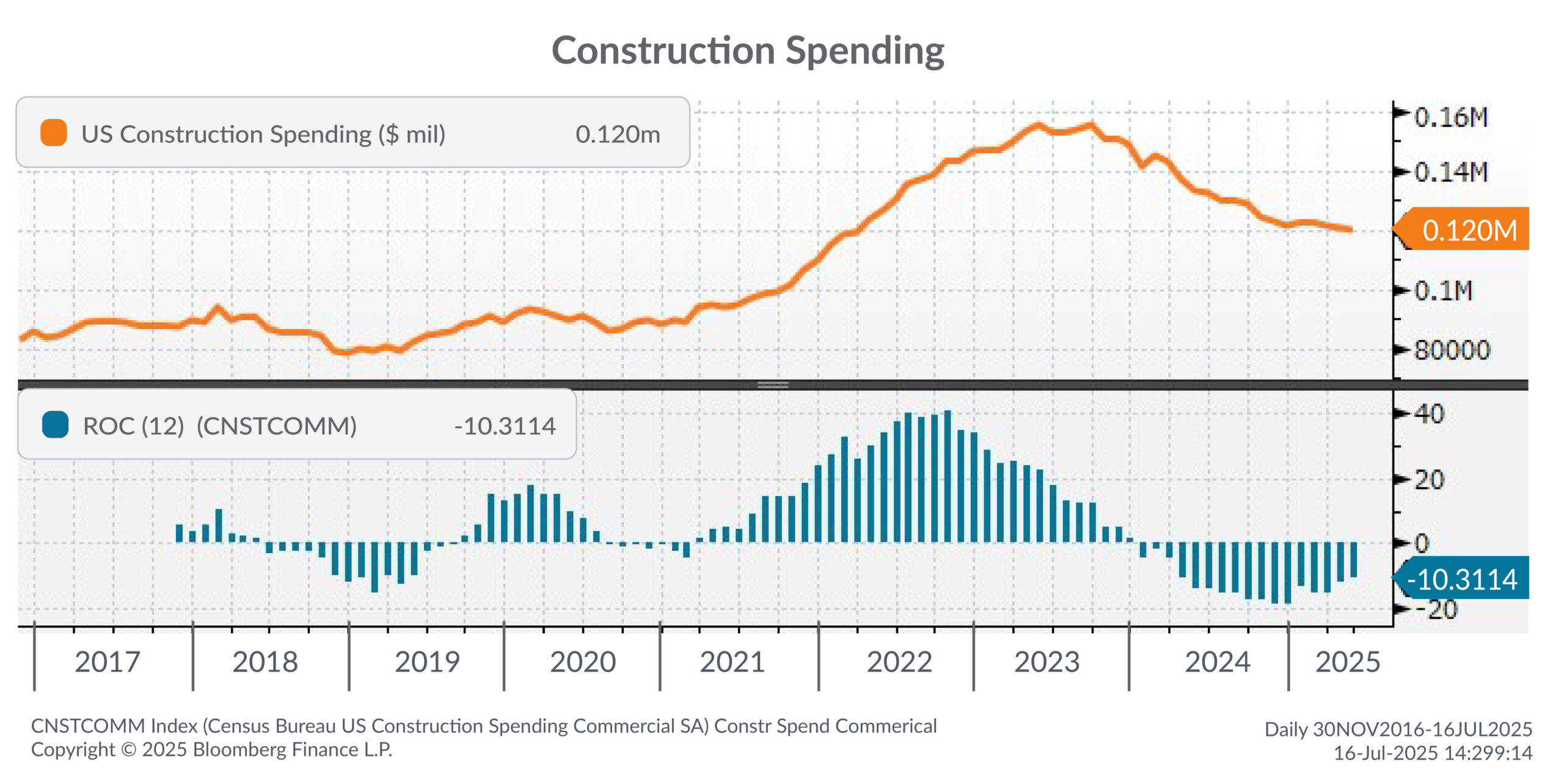

4. Commercial construction spending remains depressed

Source: Bloomberg Finance L.P.

Commercial construction spending continues to shrink, down over 10% from a year ago. While the pace of the decline is slowing, the current trajectory suggests that developers should remain cautious. Higher financing costs and tepid demand are curbing developers’ appetite for new groundbreakings.

What this means for you: Low construction volume sets the stage for future scarcity. Existing well-located assets will benefit from limited new supply, especially in the retail, healthcare, and industrial segments. Look for stabilized assets that can ride this supply-demand imbalance into the next cycle.

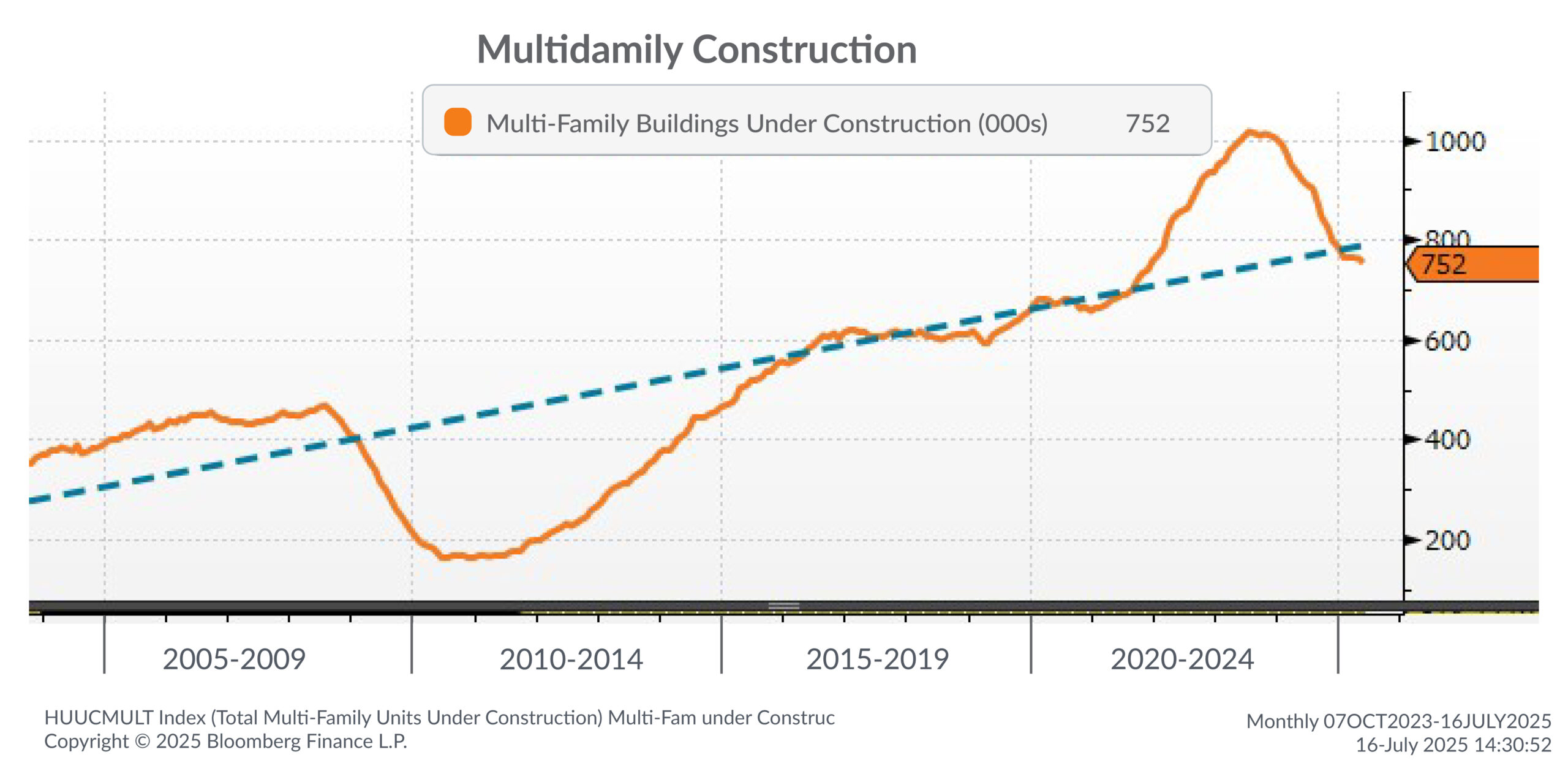

5. Multifamily construction is still elevated despite pullback

Source: Bloomberg Finance L.P.

Multifamily units under construction have dropped from recent peaks but remain historically high, with over 750,000 units underway. The slope is downward, but absorption will take time, especially in high-growth metros.

What this means for you: Expect continued rent concessions and sluggish revenue growth in oversupplied markets. Investors with staying power may find compelling acquisition opportunities as weaker hands exit. Focus on long-term fundamentals and population migration trends.

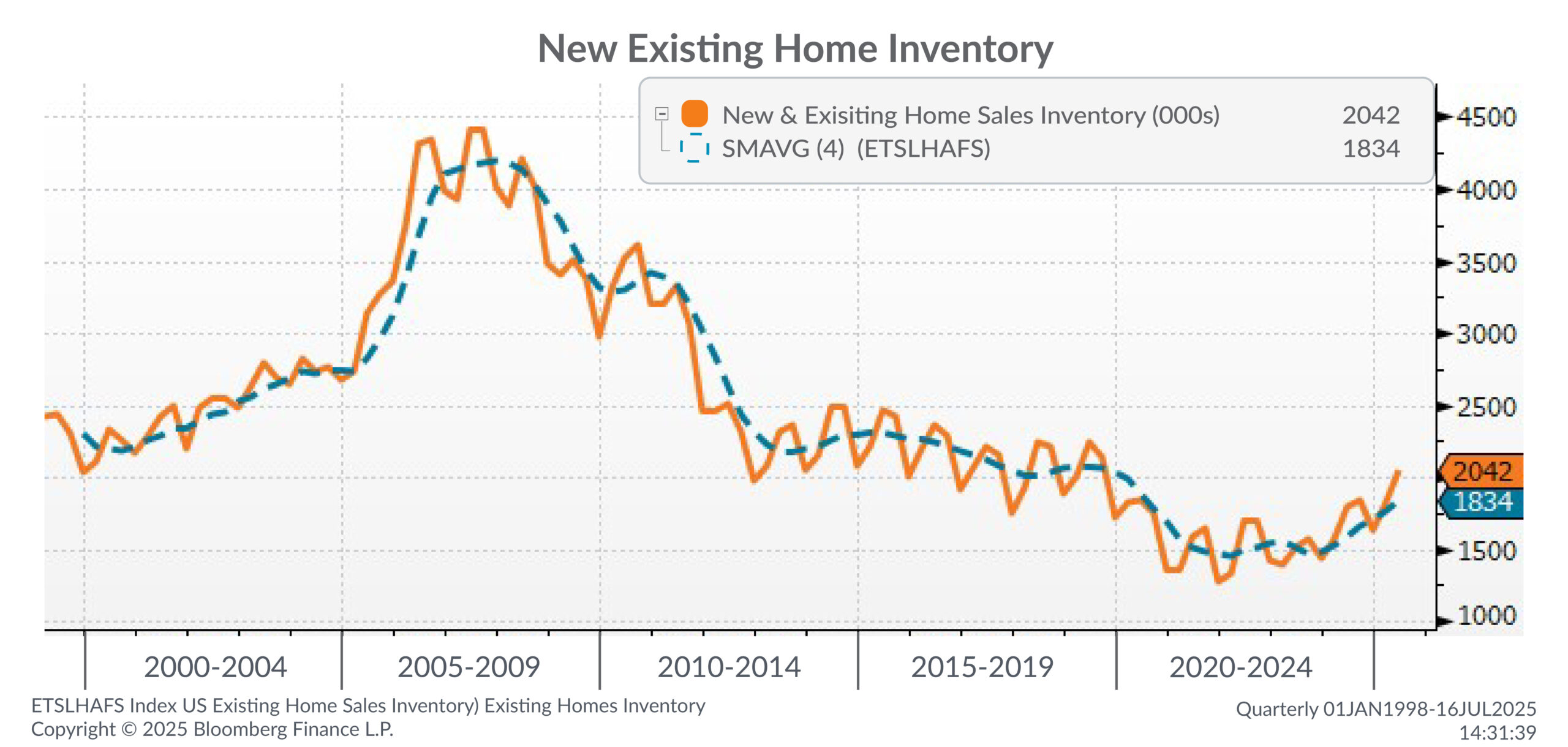

6. Housing inventory begins to rebuild

Source: Bloomberg Finance L.P.

Housing inventory — both new and existing — is finally rising after a multi-year drought. Total units on the market just topped 2 million, the highest they have been since before the pandemic. While this number is still low by historical standards, the shift could impact rent growth and pricing in both single-family and multifamily segments.

What this means for you: A normalization in housing inventory helps relieve pressure on rent inflation but may also dampen multifamily pricing power. For real estate investors, it’s a cue to track home affordability, mortgage rates, and regional household formation more closely.

This commentary is brought to you by our advisors at Aprio.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.