Physician practices are currently adapting to a “new normal” that is shaped by several key factors, including a stabilizing labor market, steady patient demand, and the growing interest in tech-enabled care, such as remote monitoring. While some pandemic-era shifts are fading, two significant trends are here to stay — the push for operational efficiency and the integration of digital tools into daily workflows. Practice leaders who focus on streamlining operations and make strategic investments in technology will be better positioned to protect profit margins and drive growth.

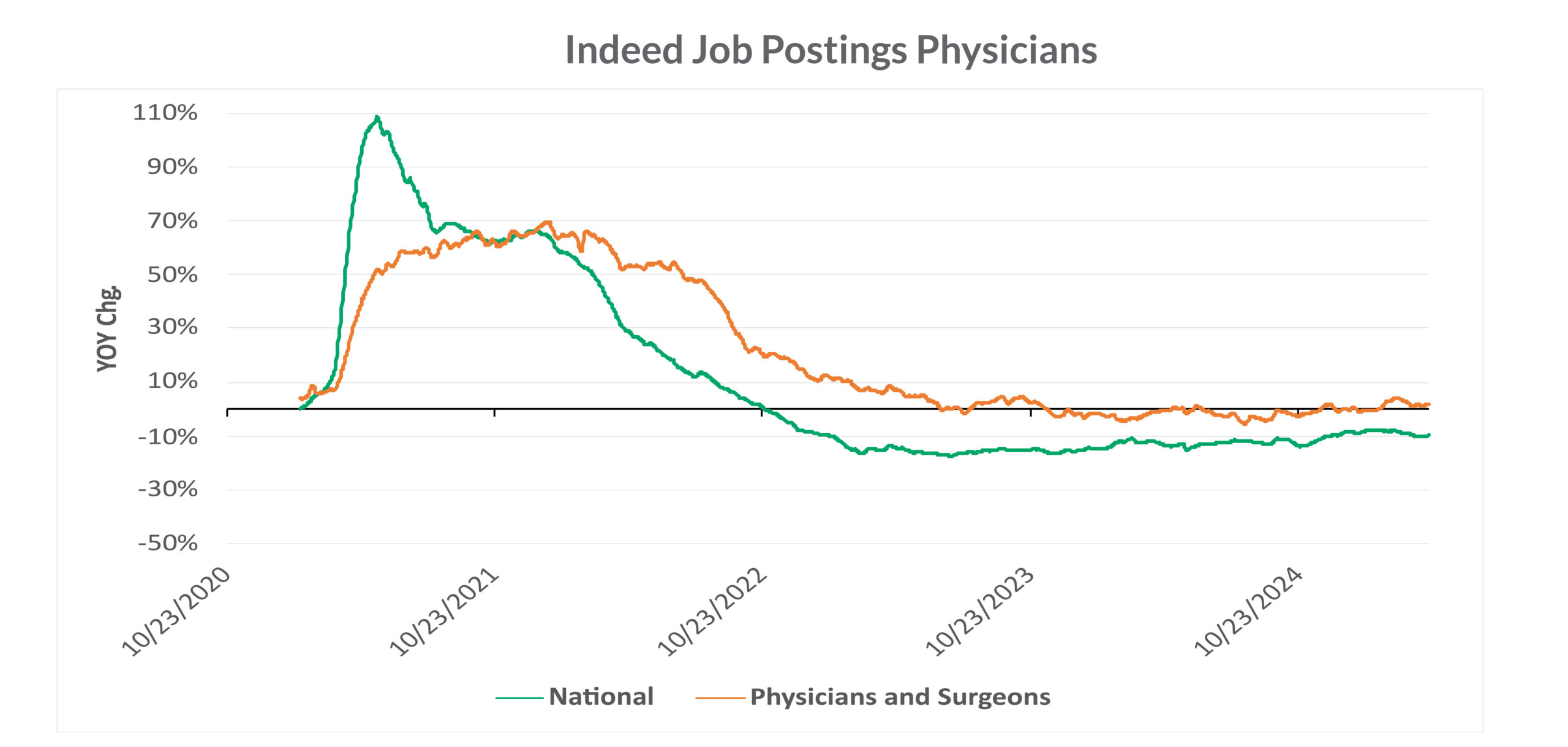

1. Physician Job Postings Remain Resilient—But Flatlined

Job postings for physicians and surgeons have stabilized. Although they remain above national average, they still fall below the hiring surge of 2021 and early 2022. Despite the broader job market declining for the past two years, physician demand is holding steady as job postings show flat to slightly positive growth year-over-year.

Source: Indeed.com

Key takeaway: While there is not a significant boom for physicians, the demand remains steady. This indicates a labor market that’s competitive but not oversaturated. Physician practices should maintain a strong value proposition to attract prospective hires. With the labor market a good mix of competitive but not flooded, hiring timelines may be slightly more manageable going forward.

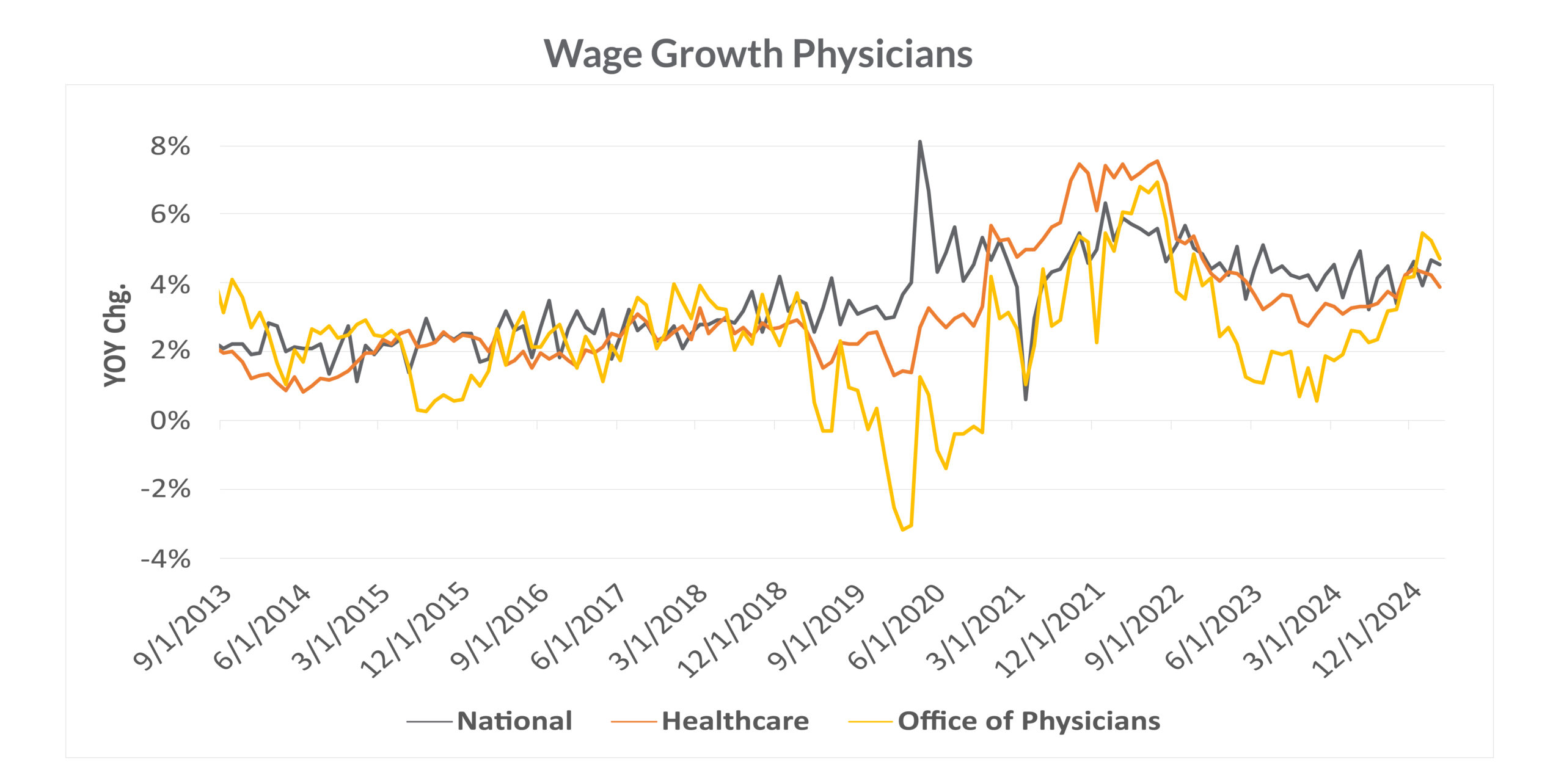

2. Wage Pressures Are on the Rise…Again

After a dip in early 2023, wage growth for physician offices is once again on the rise. As we head into Q3 of 2025, physician wage growth continues to trend higher than the national and broader healthcare averages.

Source: Bloomberg Finance, L.P.

Key takeaway: Despite an upward trend in wage growth, do not expect more affordable staffing. The upward trend in wage growth means that practices will likely need to continue budgeting for higher payroll expenses. Practice owners should consider total compensation strategies, such as flexible schedules or CME reimbursement to add value without ballooning base salaries.

3. Decline in Google Searches for Primary Care Continues

Search interest in “primary care near me” continues its post-pandemic descent. The three-month average search interest has leveled out slightly in 2025 but remains well below 2021 highs.

Source: Google Trends

Key takeaway: Retention remains more important than ever as patients are no longer searching for new doctors the way they used to. Physician practices should consider investing in service quality, patient experience, and referral programs rather than relying on digital discovery to fill their appointment books.

4. Patient Visits Remain Steady but at Elevated Levels

Patient visits per provider are holding strong at historically high levels, excluding flu cases. The 12-month average and linear trend show steady growth since 2022.

Source: Centers for Disease Control and Prevention

Key takeaway: Despite online searches slowing, demand for care hasn’t softened. Physician practices should view this as a green light to refine operational processes. Whether through staffing models, scheduling systems, or the use of mid-level providers, now is the time to improve operational best practices to meet this stable and elevated patient load efficiently.

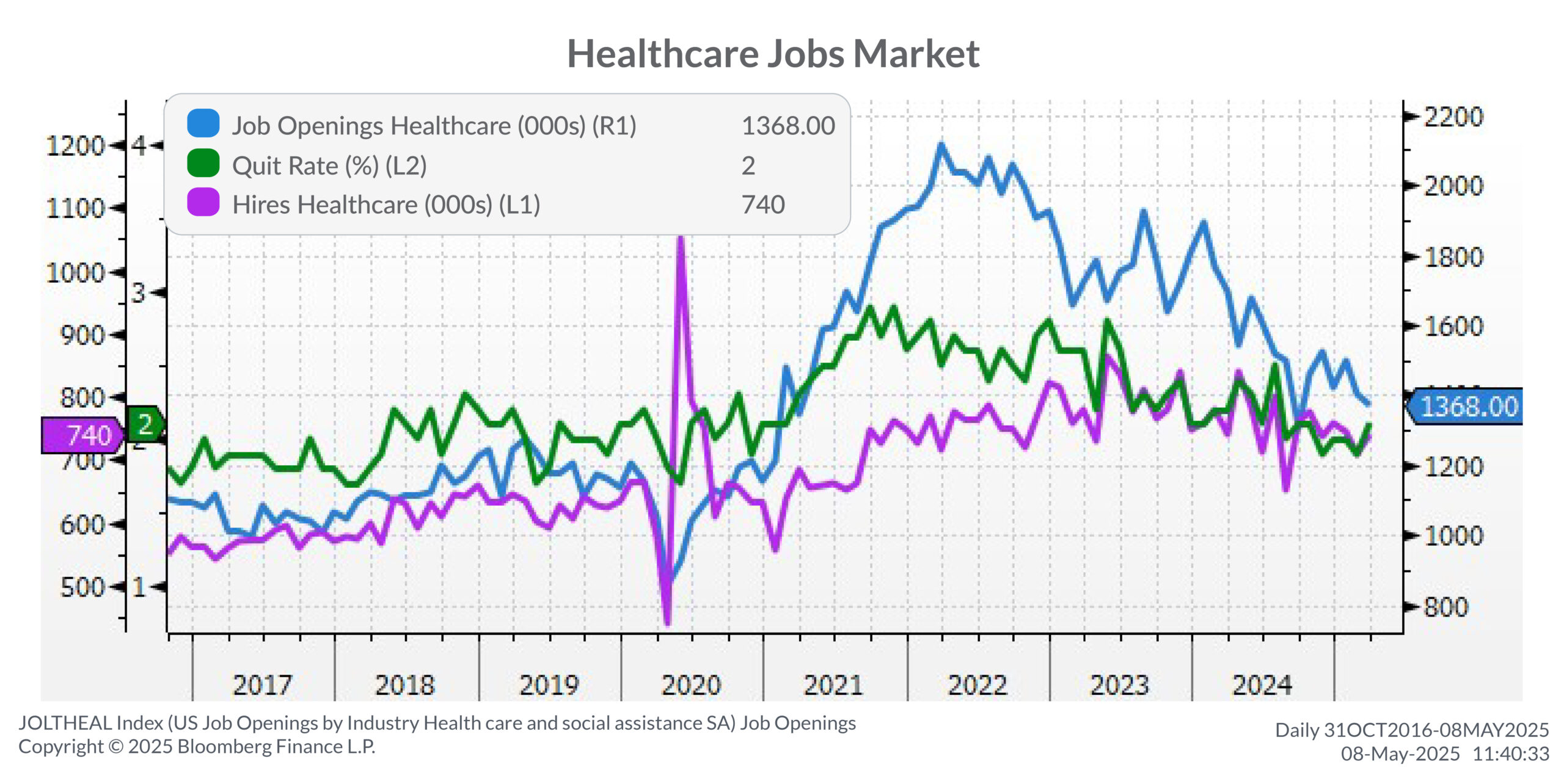

5. High Job Openings Persist Amid Declining Quit Rates

Healthcare job openings remain high, driven by two emerging trends: quit rates are falling and hiring activity is picking up. These positive trends suggest improved employee retention and a modest easing in the difficulty of filling open roles.

Source: Bloomberg Finance, L.P.

Key takeaway: Physician offices may begin to feel the pressure of staffing finally easing. With quit rates down and hiring improving, now’s the time for practices to double down on retention and strengthen team structures that have been stretched thin in recent years.

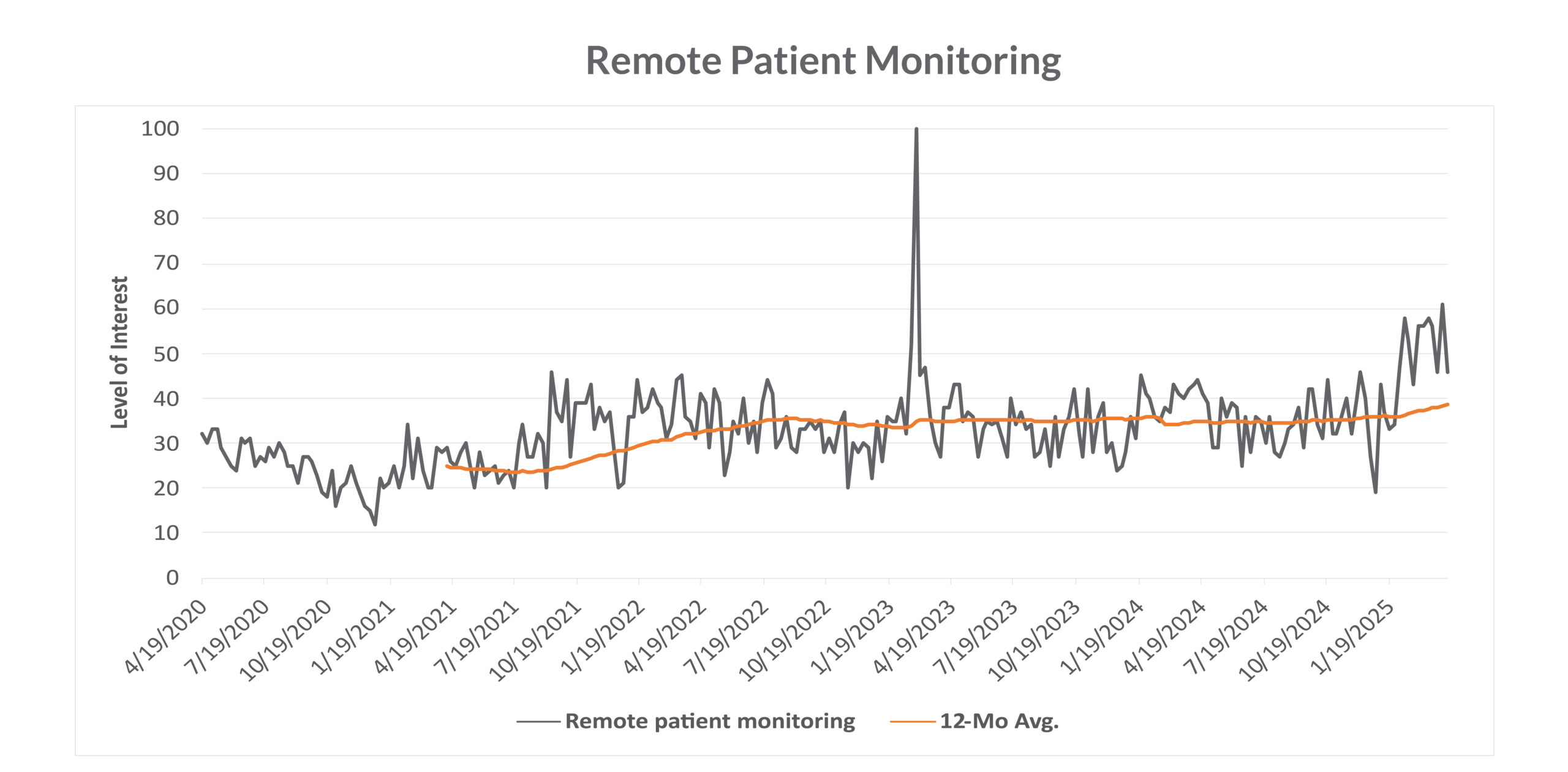

6. Interest in Remote Patient Monitoring Picks Up

After holding steady in 2023 and early 2024, interest in remote patient monitoring is picking up again. The revived interest in remote patient monitoring signals renewed momentum from both patients and providers in integrating technology into routine care.

Source: Google Trends

Key takeaway: Remote monitoring is not a fading pandemic trend and continues to gain real traction within the healthcare sector. Physician practices should take a fresh look at how tools like chronic care management, device integration, and telehealth can improve patient care and create up new billing opportunities.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q