4 Private Capital Insights from Q3 2024 and What They Mean to You

September 16, 2024

Private equity firms are shifting their focus as technology and healthcare investments make room for more financial services deals, while exits are increasing via strategic M&A rather than IPOs. Private credit markets are experiencing rising non-accruals and deteriorating coverage ratios, which signals heightened risk, requiring lenders to closely monitor portfolios and potentially adjust underwriting. Conversely, the private real estate outlook appears more promising with income providing stability and capital appreciation potentially rebounding over the next few years as higher interest rates constrain new supply. Private asset investors will want to carefully consider these insights to position portfolios for the changing landscape and capitalize on emerging opportunities.

If you would like to discuss how private investments fit into your portfolio, please reach out to your Aprio advisor, Simeon Wallis, CFA, Partner and Chief Investment Officer, or Adam Niestradt, CFA, Director of Private Capital.

PRIVATE EQUITY

1. Private equity shifts investment focus and exits

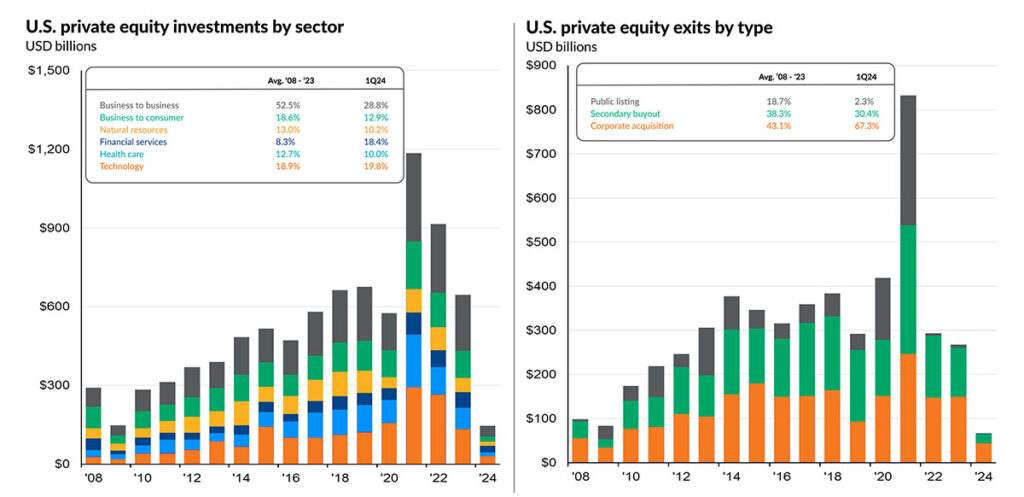

Investments by U.S. private equity firms surged during the period of ever-larger fund sizes and low interest rates, peaking at nearly $1.2 trillion deployed in 2021. Technology and healthcare also experienced significant growth, combining investments nearing $500 billion at their peak. However, the rise in interest rates has slowed investments with financial services claiming a significantly larger portion of the mix. Similarly, investment exits peaked in 2021 with the percentage of exits shifting toward acquisitions by strategic acquirers, and away from initial public offerings and sales to other private equity firms.

What this means for you: For owners of private companies, the trends in private equity investments toward technology, healthcare, and financial services denote how important recurring revenues are for private equity firms. Consider product or service changes that could mitigate volatility in revenue, such as memberships, frequent purchase and loyalty programs, or subscription offerings. Further, the rise in corporate acquisitions and exit strategies highlights the importance of aligning business strategy, operations, and capital allocation decisions with an eye toward maximizing what is valued in your industry. Have a strong sense of the medium to longer-term growth trends within your industry that could attract larger buyers.

PRIVATE CREDIT

2. Non-accruals are rising in mid-market direct loans

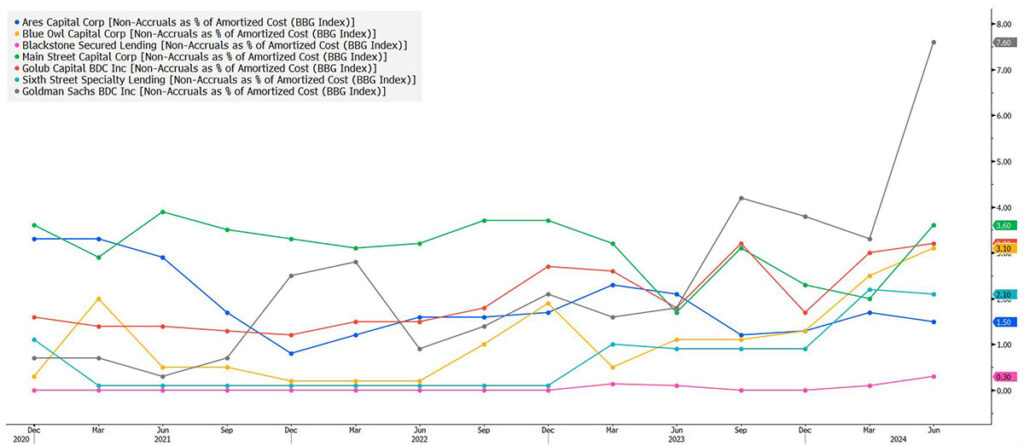

Over the past two quarters, publicly traded business development companies (BDCs) from large institutional players in the private credit space have experienced a notable increase in the percentage of non-accrual loans within their loan portfolios. This increase suggests that more borrowers are struggling to meet their debt obligations, likely due to the sustained high-interest rate environment and slowing economic growth, which has strained cash flows and increased the risk of defaults. In July, Fitch Ratings increased its estimate for U.S. leveraged loan defaults to 5.0% – 5.5% (up 150 basis points) for 2024, still well below the Global Financial Crisis peak of 10.5%.[1] According to Blackstone, non-accrual percentages remain below historical averages.[2]

What this means for you: A deterioration in underwriting performance relative to the decade after the financial crisis has been expected due to the previously low interest rates and floating rate nature of these mid-market loans. Many lenders had expected challenges and have worked with borrowers and financial sponsors on contingency plans. Lenders should maintain rigorous monitoring processes and be quick to work with management teams to implement operational and capital allocation changes while preparing restructuring resources. Additionally, a 50-100 basis point decline in interest rates by the Federal Reserve (Fed) would provide further relief for companies to meet their financial obligations.

3. Weakening coverage ratios in private credit

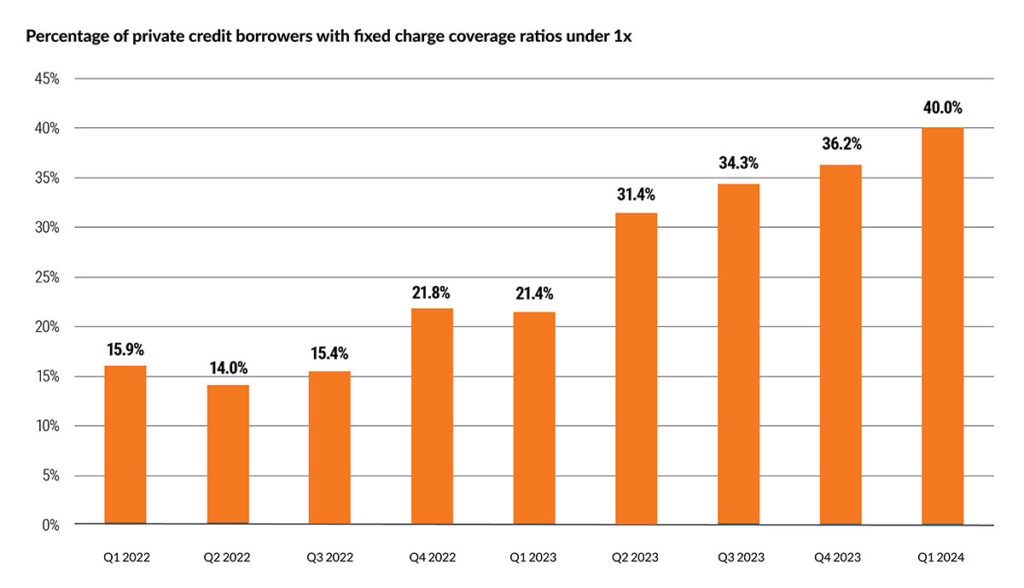

Over the past several quarters, the percentage of private credit borrowers with fixed charge coverage ratios below 1x has steadily increased, reaching a high of 40% in Q1 2024, indicating a deterioration in creditworthiness. Higher leverage levels and higher interest rates, often from private equity transactions, combined with slower growth and increased margin pressures have stressed the fixed charge coverage ratio.

What this means for you: For investors, the rising proportion of stressed borrowers signals higher potential default risk within private credit portfolios, yet there may be opportunities to restructure loans and benefit from additional fees. Further, pre-pandemic loan portfolio vintages’ performance reflected a benign credit environment, so some loan performance reversion is to be expected. Lenders, on the other hand, may face mounting pressure on their income generation and profitability, potentially requiring them to revisit underwriting standards and adjust pricing strategies.

If the Fed lowers rates 50-100 basis points, as the market is expecting over the near term, this could provide relief to borrowers yet compress yields for investors.

PRIVATE REAL ESTATE

4. Future returns in real estate appear promising

The rolling four-quarter returns for global private real estate, segmented into income and capital appreciation components, highlight the different roles played in driving returns. Notably, income has consistently contributed positive returns, though the level trended down from 2010 until late 2022. This underscores income’s importance as a stabilizing factor in private real estate portfolios. In contrast, capital appreciation has been extremely volatile, generally following the direction of the spread between the 10-year and 2-year interest rates.

What this means for you: During the increase in interest rates starting in 2022, capital appreciation peaked; yet with expectations that the Fed would cut rates starting in late 2024, the percentage value declines in assets appears to have troughed. Higher interest rates have dramatically curtailed new supply across real estate asset classes, which combined with the Fed lowering interest rates in the near future, should create tailwinds for capital appreciation with a multi-year time horizon.

[1] “U.S. Leveraged Loan Default Rate for 2024 Revised Up Amid Deterioration,” Fitch Ratings, July 24, 2024.

[2] “Joe Zidle: Optimism and Uncertainty on the Menu,” Blackstone, August 20, 2024.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Aprio Wealth Management, LLC are not affiliated companies. Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Adam Niestradt

Adam Niestradt, CFA is the Director of Private Capital at Aprio Wealth Management. Adam has over a decade of investment experience with high and ultra-high net worth families with a focus on private capital investments. To discuss these ideas and how they may affect your current investment strategy, email Adam directly at adam.niestradt@aprio.com

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.