As 2025 unfolds, dental practices are feeling both stability and strain. Hiring challenges remain, with the demand for skilled staff continuing to outpace supply. Although patient spending is steady, the manner in which patients choose providers is rapidly changing. With rising costs and shifting expectations, it’s crucial for dental practices to make thoughtful, strategic adjustments rather than resorting to short-term fixes.

1. Dental Job Postings Have Gone Flat—And That’s Not a Bad Thing

Entering a slightly negative territory year-over-year, dental job postings continue to echo national hiring trends. After peaking during the pandemic recovery, both national and dental-specific job growth have cooled considerably.

Source: Indeed.com

Key takeaway: While the dental job market continues to find its footing, practice owners can take a breather on the recruiting front. Now is the time to shift your focus towards strengthening your existing team through training, culture, and retention, rather than staying stuck in a constant hiring mode.

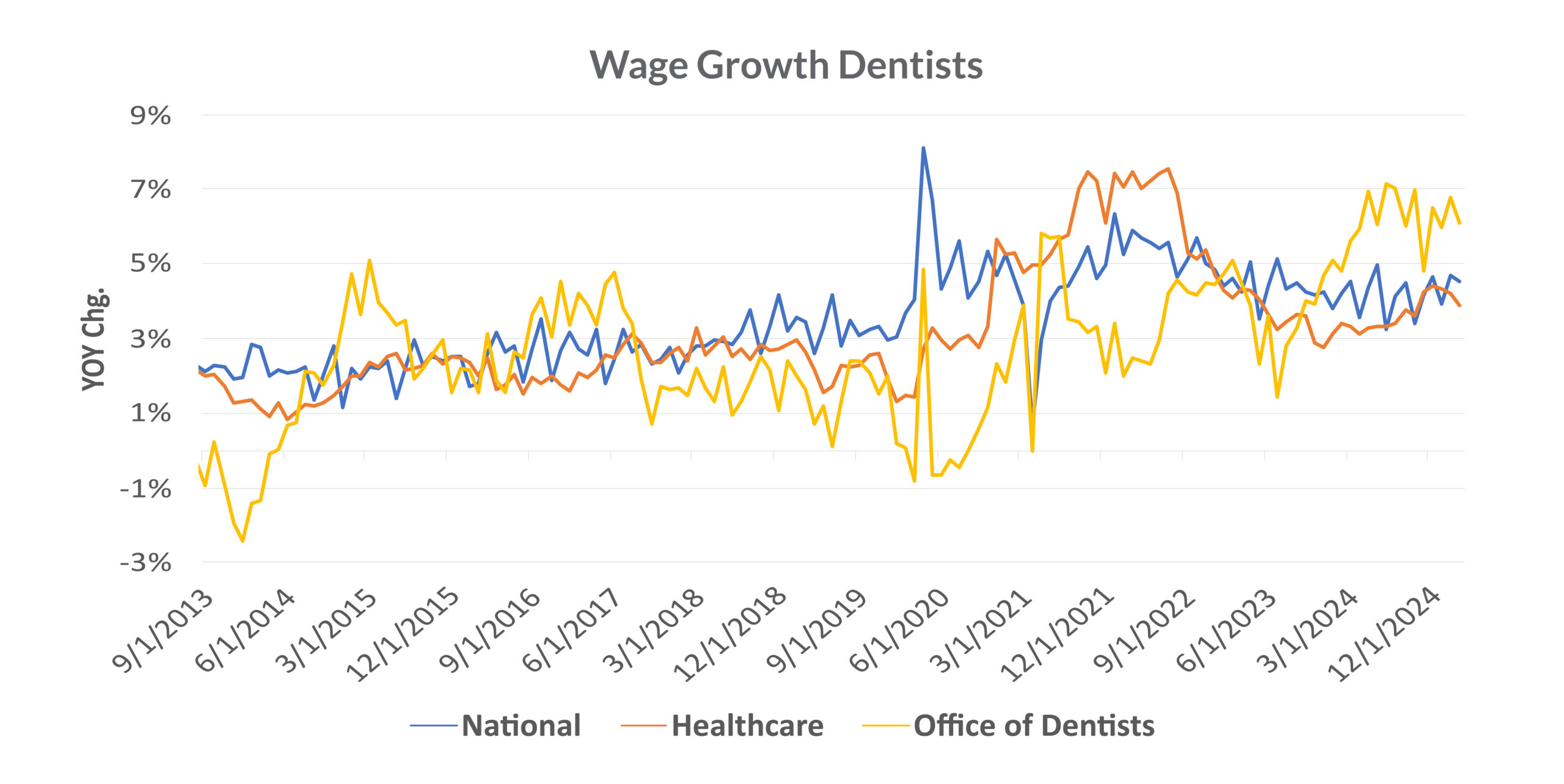

2. Wages in Dental Practices Continue to Outpace the National Trend

Wage growth in dental offices has outpaced both national and healthcare averages. During the pandemic, there was significant volatility in wages, and while growth has leveled off, wages continue to hover near peak levels.

Source: Bloomberg Finance L.P.

Key takeaway: Wage growth in the dental sector is not a fading trend. It’s important for dental practice owners to stay competitive by offering more than increased pay. Consider evaluating your benefit packages, vacation policies, training opportunities, and company culture, so rising labor costs don’t catch you off guard.

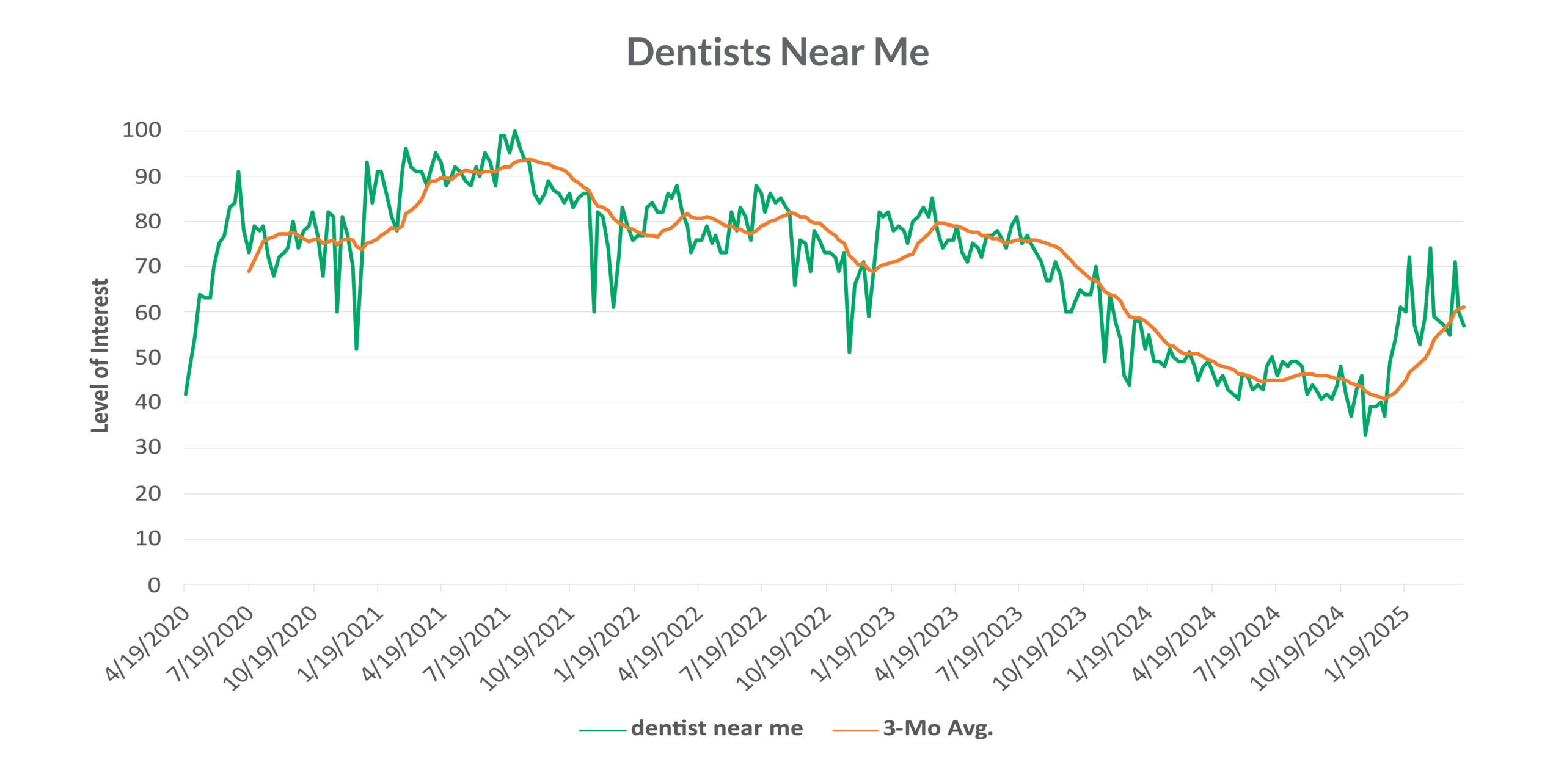

3. Online Searches for Dentists Show Improvement

After a long, steady decline, online searches for “dentist near me” are showing signs of new life in 2025. But they haven’t returned to pre-2022 levels.

Source: Google Trends

Key takeaway: Patients are no longer searching for dentists like they used to, making retention and referrals more important than ever. Don’t wait around for online traffic to pick up. Instead, focus on patient experience, follow-up, and word-of-mouth to grow your client base.

4. Demand for Invisalign is on the Rise

Interest in Invisalign has rebounded, hitting new highs in early 2025. This bounce in activity suggests a strong patient appetite for elective and cosmetic dental services, despite economic uncertainty.

Source: Google Trends

Key takeaway: Elective procedures, such as Invisalign drive high profit revenue, especially when hygiene and routine care volumes are flat. Dental practice owners should highlight elective and cosmetic services in patient communications and train your team to confidently speak with patients about treatment planning and financing.

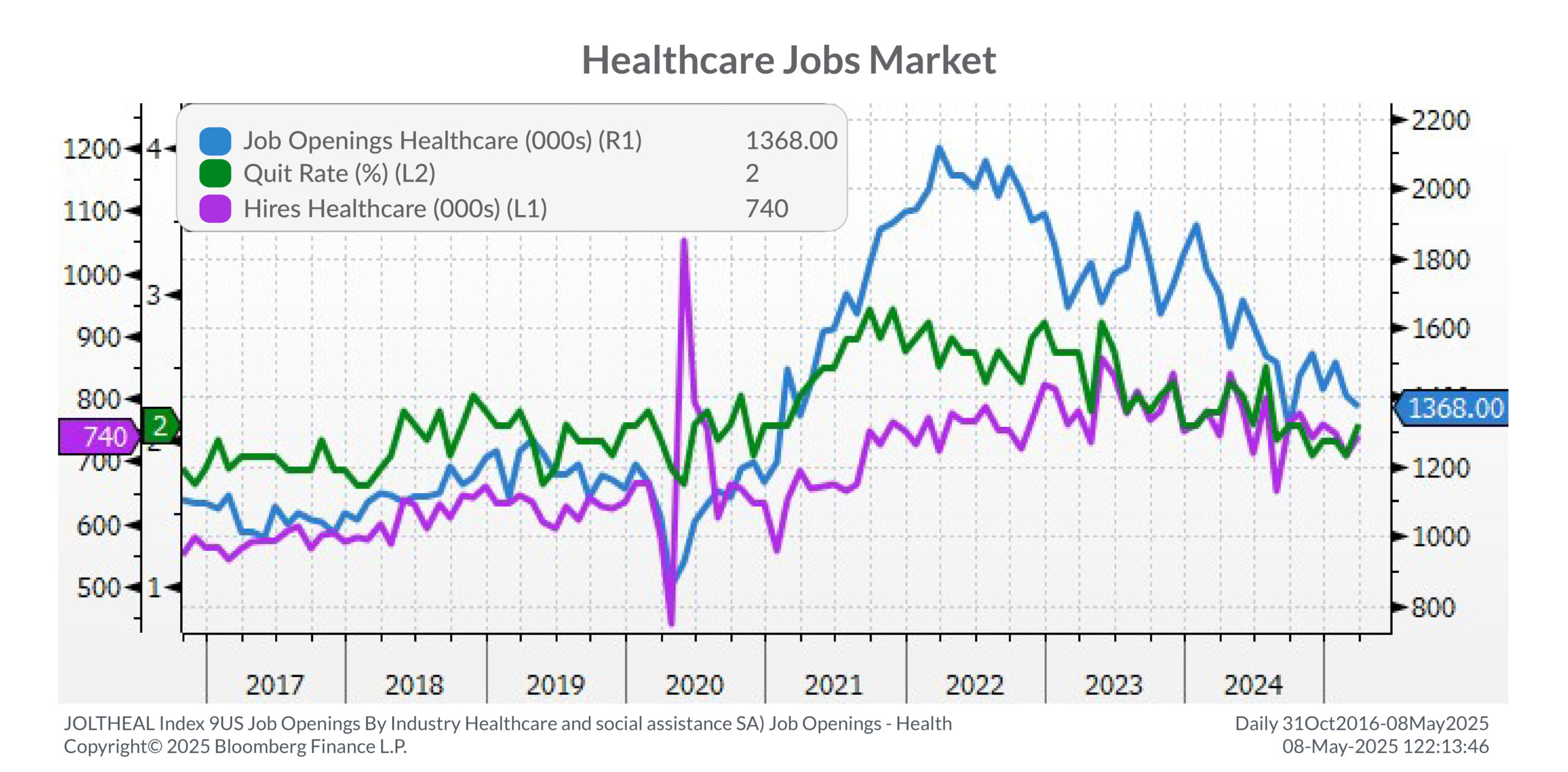

5. Healthcare Hiring Remains Competitive Despite Decline in Turnover

Job openings across the healthcare sector remain high yet quit rates have decreased. This indicates that practices are still actively hiring, but employees are not leaving jobs as frequently as they did in 2022.

Healthcare Jobs Market

Source: Bloomberg Finance L.P.

Key takeaway: Attracting experienced, high-quality talent is still tough, even as the healthcare job market pressures ease. Your best defense is building a workplace where employees want to stay in their roles. Consider offering flexible schedules, growth opportunities, and fair pay to attract and retain top talent.

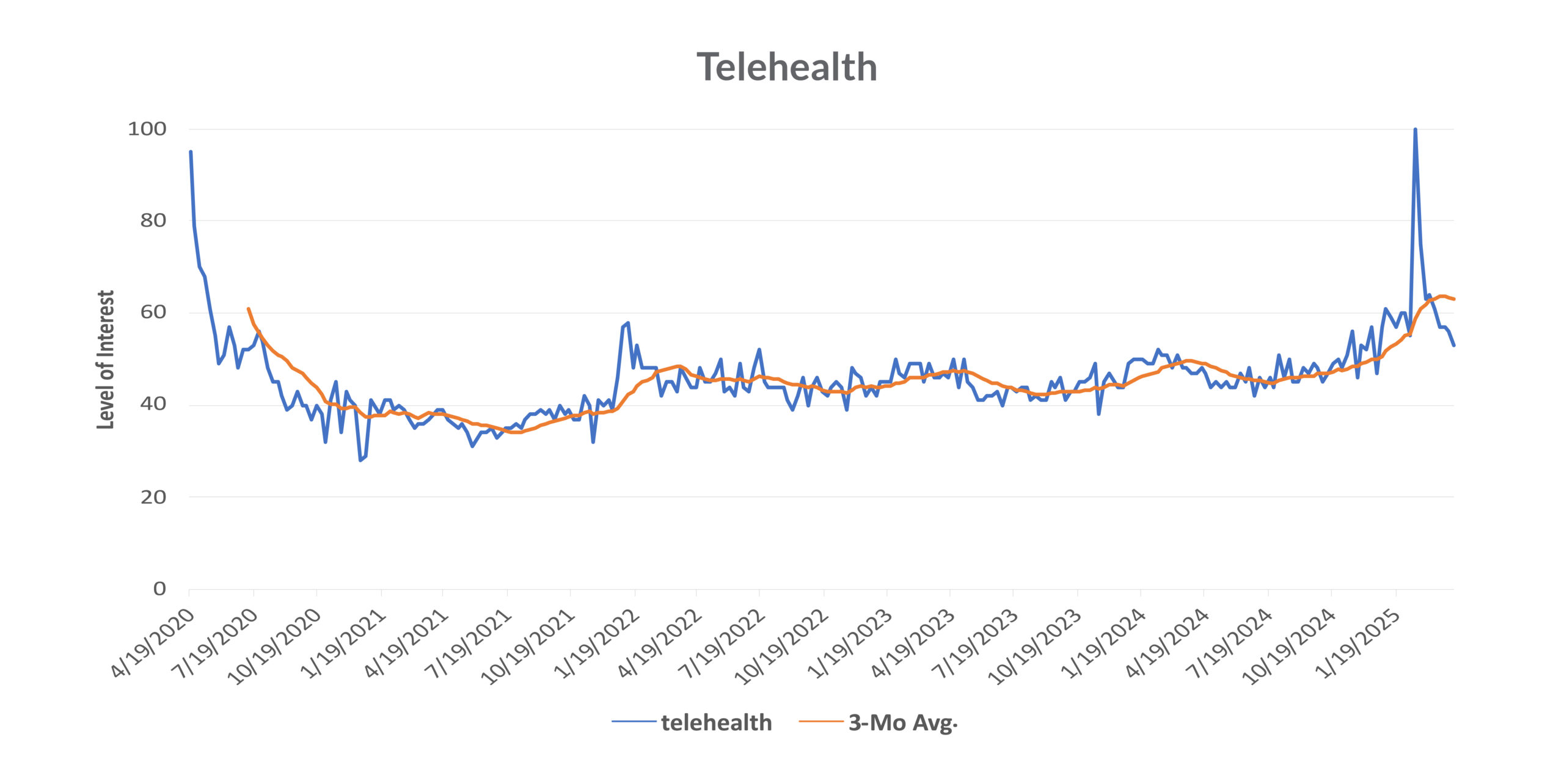

6. Telehealth Spiked, But Don’t Expect a Long-Term Surge

Search interest in telehealth experienced a significant spike earlier in the year. However, the surge in interest has already faded, and overall, interest remains well below pandemic highs.

Google Trends: telehealth

Source: Google Trends

Key takeaway: While telehealth remains a useful tool, as of now it does not serve as a growth engine for the dental sector. Instead, dentists can leverage telehealth strategically for consultations or post-op check-ins to keep existing patients engaged.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q