6 Dental Insights from Q3 2024 and What They Mean for You

November 15, 2024

The dental industry is stabilizing after dealing with market volatility earlier this year. Declining job postings and low online search activity highlight steadier hiring activity among dentists and the need for new patient acquisition strategies. Consistent consumer spending and strong interest in discretionary procedures signal opportunities for dentists to prioritize preventive and aesthetic care, though rising wages require careful financial planning for practitioners.

Here are the top six takeaways to keep in mind heading into next year.

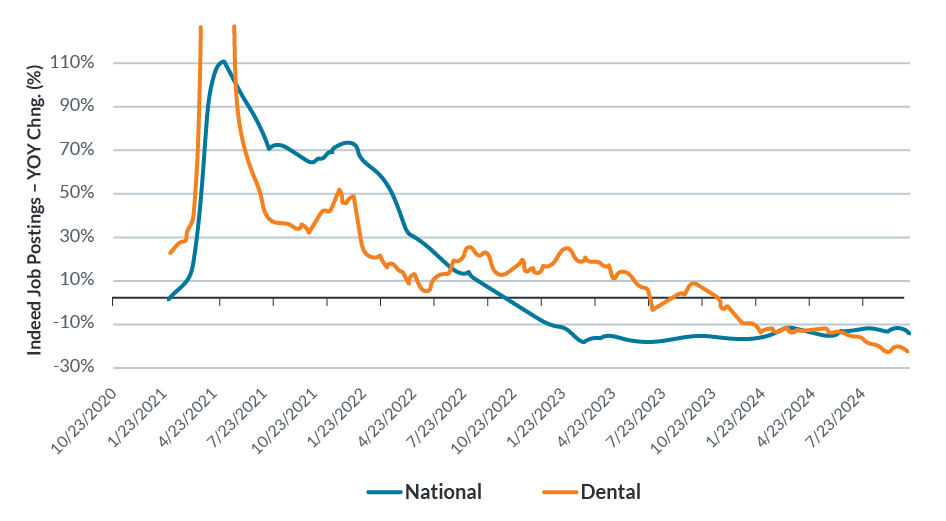

1. Decline in dental job postings signals stabilizing job market

The year-over-year change in job postings for dental roles has declined markedly, aligning with national trends. After a pandemic-era peak, dental job postings have decreased steadily and have recently fallen into negative territory, indicating a reduction in new job openings for dental positions across the industry.

Indeed.com Job Postings for Dental

Key takeaway: For dental practices, the decline in job postings may signal stabilization in the job market, with less competition for recruiting new talent. This presents an opportunity for dentists to strengthen their employee retention strategies and focus on fostering professional growth and a positive work environment. Practices can optimize their teams by fostering skills and camaraderie within existing staff, potentially reducing turnover and enhancing productivity.

2. Search interest for dentists reaches post-pandemic lows

“Dentist near me” Google searches have gradually declined after peaking in early 2021. Fewer patients are actively seeking new dental providers through online searches, with interest now stabilizing at lower levels than during the pandemic peak.

Google Trends: “Dentist Near Me”

Key takeaway: This search interest decline in dental services implies that patient acquisition through online search may become less effective. Dental practices should consider diversifying their marketing efforts and focusing on referrals, word-of-mouth, direct mail, and patient retention strategies. By building long-term patient relationships and enhancing in-office experiences, dentists can help mitigate the impact of reduced online discovery, helping ensure a steady patient base.

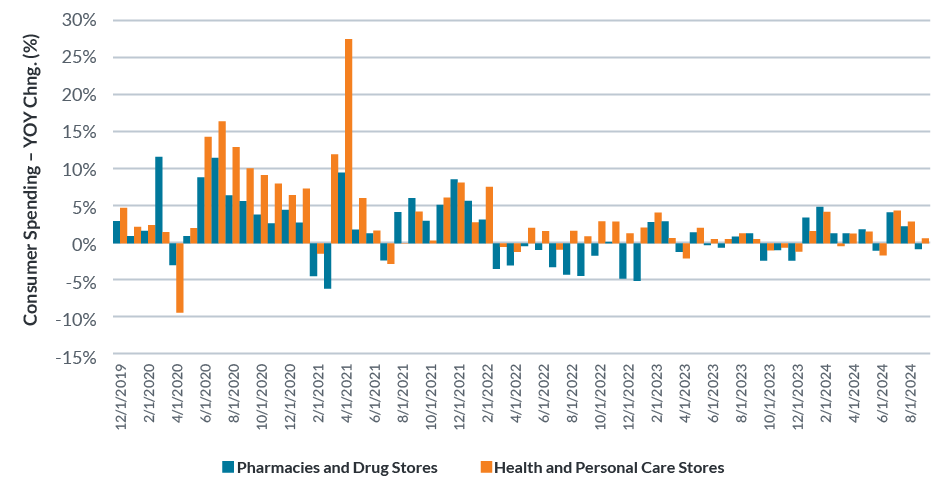

3. Steady consumer spending on health and personal care items

Consumer spending in pharmacies, drug stores, and health and personal care stores has stabilized in recent months, following high volatility during the pandemic years. Both sectors have returned to more consistent year-over-year growth rates, indicating that spending habits have normalized in these areas.

Consumer Spending

Key takeaway: Stable spending on health and personal care suggests that consumers are maintaining their health-related purchases, which may translate into continued demand for dental services. Dental offices could benefit from promoting preventive care and measuring reappointments. By aligning service offerings with patients’ steady health-related spending, practices can reinforce the value of consistent dental care.

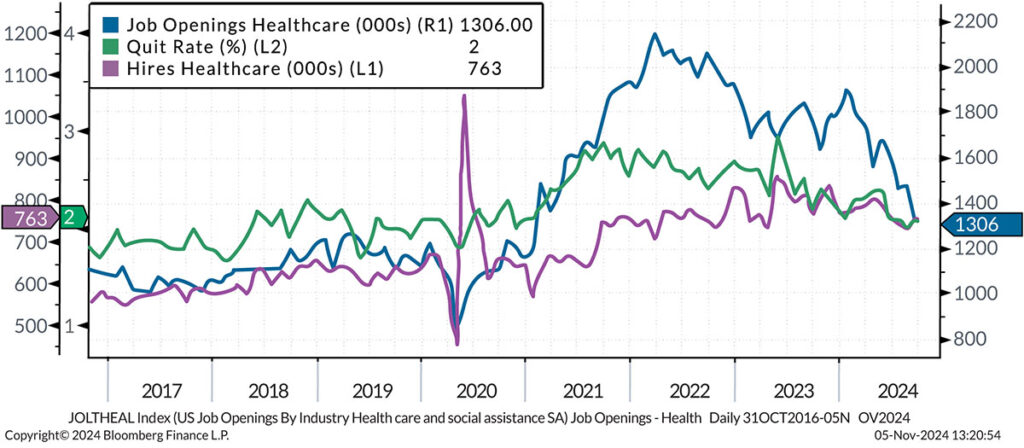

4. Elevated healthcare job openings with lower turnover

The healthcare job market continues to exhibit elevated job openings alongside declining quit rates, while hires have remained relatively steady. This trend indicates a high demand for healthcare workers with a gradual easing in turnover, as employees are more likely to stay in their positions.

Healthcare Jobs Market

Key takeaway: This trend points to a competitive hiring environment for dental practices. Going forward, practices should focus on building desirable workplaces to attract and retain staff, including promoting career growth opportunities, offering flexible schedules, and investing in staff well-being initiatives. These activities can improve retention and help practices create a stable, committed team in a challenging labor market.

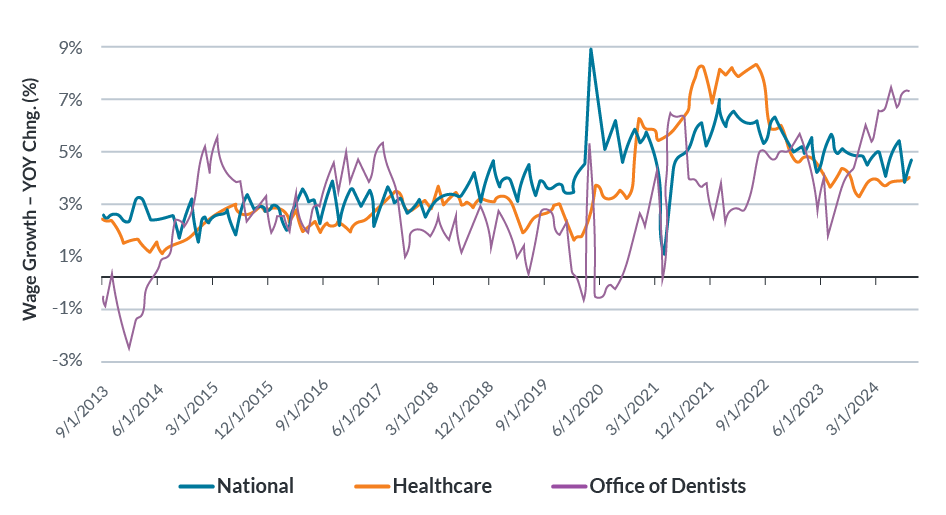

5. Rising wage growth pressures for dental offices

Recent data shows that wage growth for dental offices has outpaced both the national and broader healthcare sectors, reflecting increased wage pressures within the dental industry. After a period of volatility, wage growth for dental practices has stabilized at elevated levels.

Wage Growth

Key takeaway: Rising wages emphasize the need for dental offices to plan for higher labor costs. Practices should assess their financial strategies, balancing competitive wages with benefits that appeal to current and prospective employees. With wage growth showing resilience, dental practices should consider offering a well-rounded employment package, including benefits and career development, which can help them enhance staff retention while managing labor expenses effectively.

6. Stable demand for Invisalign services maintains patient interest

The trend for online interest in “Invisalign” has remained steady after fluctuating in previous years. The 3-month average suggests a stable level of interest for discretionary cosmetic and corrective dental services.

Google Trends: “Invisalign”

Key takeaway: For dental practices, the consistent interest in Invisalign represents a valuable opportunity to attract patients seeking aesthetic and corrective treatments. Practices should consider actively promoting Invisalign services and educating patients on the benefits of orthodontic care. Additionally, practices could benefit from highlighting financing options and patient success stories to help capture the interest of potential patients and grow this segment within the practice.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Trenton D. Watrous

Trent serves as a strategic business advisor to dentists and dental practice owners, leveraging his extensive experience as a tax advisor, auditor*, forensic accountant, and expert witness to provide sophisticated advice and solutions. He educates and coaches his clients to navigate the complex financial challenges that come with being a practice owner in today’s rapidly changing and competitive business environment.

(615) 312-9050

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.