R&D Demystified: A Recap of the Rules You Should Know

June 9, 2021

At a glance:

- Get credit where credit Is due: For both U.S.- and U.K.-based companies, the R&D tax credit is one of the most lucrative benefits available, especially for firms that are involved in innovative projects.

- Break through the complexity: Like many areas of the tax law, the rules around the R&D tax credit can be difficult to understand, especially if you do business in other countries.

- Take action today: Scroll down for answers to basic questions about the R&D tax credit, and how you can leverage it to increase your bottom line and fund future innovation.

Want professional R&D tax expertise? Contact Aprio’s R&D Tax team today.

The full story:

If you operate a business in the United States or the United Kingdom (or both, if you have offices in both countries), then you may already be aware of the tax breaks available on both sides of the pond — including the research & development (R&D) tax credit.

But like many areas of tax law, the rules surrounding the R&D credit are filled with jargon and it can be hard to understand whether your business qualifies to benefit from it. Here, we demystify the credit and break it down for businesses with operations in both the U.S. and overseas in the U.K.

What does the R&D tax credit do, anyway?

At its most basic level, the R&D tax credit rewards businesses that undertake innovative projects. The credit also reduces some of the risks that businesses encounter when undertaking innovative development projects as part of their regular business activities.

What exactly qualifies as an innovative project? The definition differs in both the U.K. and the U.S. In the U.K., a business qualifies for the relief if:

- It is a limited company in the U.K. that is subject to Corporation Tax.

- It has carried out qualifying research and development activities that include creating new products, processes or services that advance its field, whether in terms of science or technology, or changing or modifying an existing product, process or service that advances its field.

- The company’s advance in a field of science or technology results from the resolution of scientific or technological uncertainties that were not readily deduced by a competent professional in the field.

- It has spent money on these projects.

In the U.S., qualifying criteria is slightly different. The R&D credit is equivalent to the sum of amounts calculated using qualified research expenses (QREs). QREs include wages, contractor costs, computer rental expenses and supplies, among other items, that are necessary to research and development. QREs can be used for specific objectives outside of scientific development, such as product or process improvements or software development. Typically, between 6%–8% of R&D dollars can be recaptured as a credit. This can give businesses access to instant cash liquidity by reducing their current-year tax liability.

Each country provides a way to receive benefits even if a company is loss-making, such as the option to take a repayable credit in the U.K., and the federal withholding benefits available in the U.S. It’s important to work with a qualified tax expert with deep experience in R&D tax credits to fully understand those provisions and determine if they work for you.

Can any business apply for the R&D tax credit?

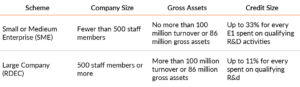

Though any business across any industry can apply for the R&D tax credit in the U.K., the incentive is split up into two different categories, or “schemes”: the SME scheme and the large company scheme. The rules around what classifies an activity as R&D is the same, but how that expenditure gets treated differs by scheme:

The U.S. has slightly similar guidelines around its version of the R&D tax credit, in that any company, at any size and in any industry, can take advantage of the incentive so long as it invests in R&D activities. From a taxpayer standpoint, the business also must:

- Pay a similar state tax in one of the U.S. states that provides incentives (of which there are a little more than 40) for R&D and investments in R&D.

- Pay similar taxes in one of the more than 35 non-U.S. countries (including the U.K.) that also provides R&D incentives.

- Pay regular federal income tax.

- Pay federal payroll tax.

What are some common misconceptions about the R&D tax credit?

The first is that not everything that seems like R&D qualifies for the credit; your company’s R&D efforts must generate some sort of asset to qualify. For example, your company may conduct market research on competitors in the space to help support a new project. While research is undoubtedly important to the success of your project, if your company is based in the U.K. and filing for an R&D credit there, that activity would not qualify. The same goes for the U.S.

On the other side of the spectrum, many businesses believe that subcontracted work doesn’t qualify for the R&D credit. This isn’t necessarily the case. In the U.K., for instance, an SME that is conducting R&D can typically claim up to 65% of the costs paid to a subcontractor for those qualifying activities. What’s more, the subcontractor does not need to be a U.K. resident, and the subcontracted R&D work does not necessarily have to be performed in the U.K. In the U.S., a percentage of contractor spend can be included as a QRE when claiming the R&D credit, so long as the contracting company has at least substantial use rights to the intellectual property being developed and they bear the financial risk of the development.

There are additional complexities around cost categories that also can trigger misconceptions, which is why it’s essential to have a qualified R&D expert helping you through the claim process.

Related Resources:

- R&D Tax Credits: A Valuable Cash Infusion for Businesses

- HMRC Clamps Down on Fraudulent R&D Claims

- Aprio: R&D Tax Credits and Incentives

- Moore Kingston Smith: Research & Development

The bottom line

Not all R&D tax professionals are created equal; in many cases, individuals market themselves or their firms as “R&D tax experts” when, in reality, they do not have the credentials, nor the subject matter expertise to advise on claims appropriately.

At Aprio, we conduct hundreds of R&D tax credit studies each year, for companies performing R&D all over the U.S., Canada and the U.K. Together with Moore Kingston Smith, we can help U.S.- and U.K.-based companies make the most of the credit to boost their bottom line. Contact us today to learn more.

Recent Articles

About the Author

Carli Huband

Carli leads the Specialty Tax and the national R&D Tax Credit practice at Aprio. She has worked with companies across a variety of industries and ranging in size from startups to Fortune 500 businesses, performing technical interviews with subject matter professionals, calculating complex credits and preparing technical reports.

(678) 431-9619

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.