6 Healthcare Insights From Q4 2022 and What They Mean for You

December 14, 2022

With the global economy battling a large inflationary wave, the healthcare industry has faced its own challenges of wage inflation and increased operating costs. Yet more recent data provides silver linings: the healthcare jobs market appears to be improving, which may subdue the inflationary pressures healthcare providers have experienced. Despite rising costs, the demand for healthcare has increased as data around in-person and online visits remains strong. The pandemic also spurred merger and acquisition (M&A) activity to build economies of scale; to remain competitive, healthcare providers are changing their business models by incorporating greater uses of technology and data.

Here are six key trends to watch as we look forward.

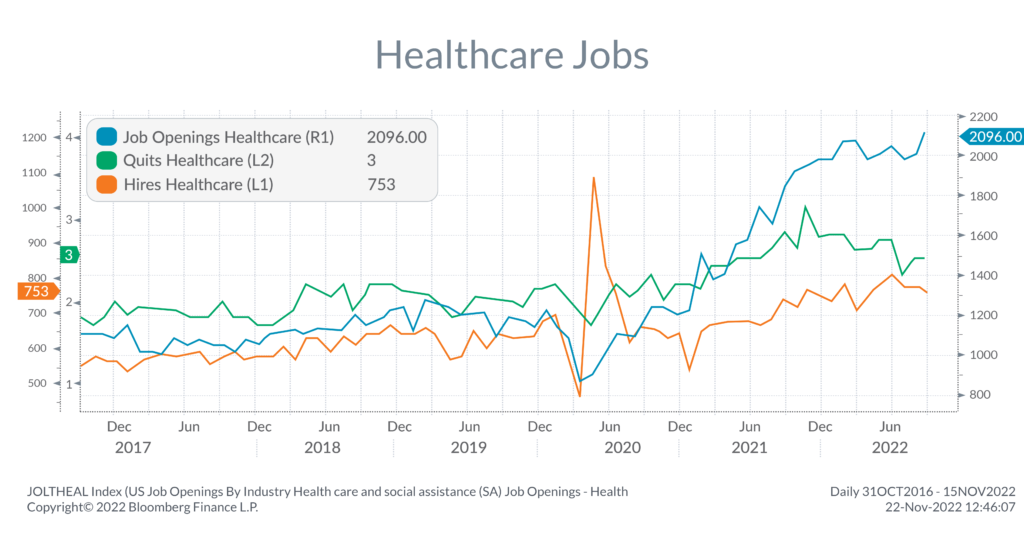

1. The healthcare jobs market is improving with more hiring and fewer employees quitting

Growth rates in job openings are slowing while job quit rates decline. For employers, this creates a better hiring environment.

Key takeaway: The healthcare jobs market remains robust. As labor conditions loosen, employers should start to be able to negotiate more balanced compensation packages. Since the economy may slow down, employers should look to lower overhead costs by negotiating fairer wages with new and existing employees.

2. Healthcare wage growth continues to climb despite the loosening labor market

Wage growth in the healthcare field has accelerated quickly to its highest rate in over a decade. However, with decreasing quit rates, competition for employees is diminishing and may ultimately restrain wage growth from rising further.

Key takeaway: A looser labor market typically puts downward pressure on wages, causing wage inflation to subside. With the appearance of a potential inflection point in labor and wages, look to optimize your overhead costs with the optimal number of employees and fair remuneration.

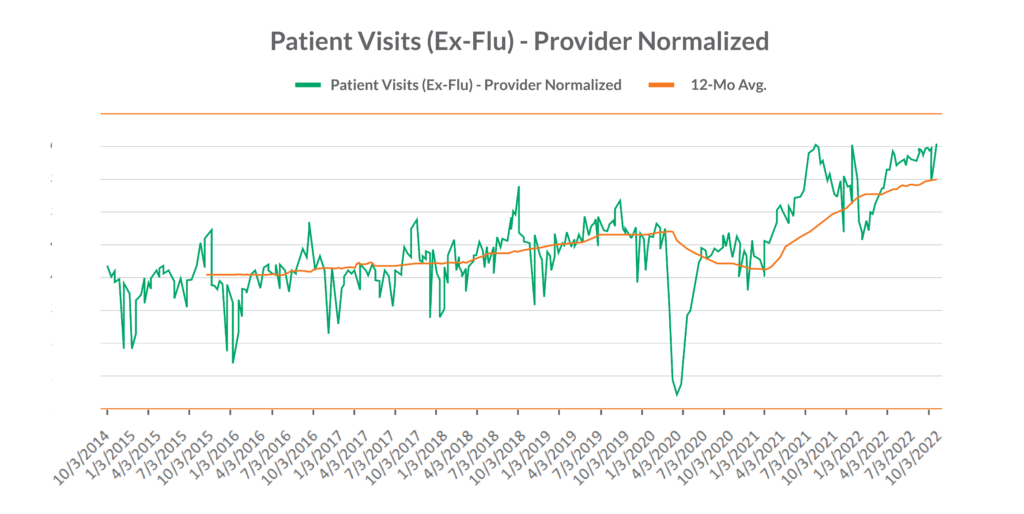

3. The number of patient visits continues to climb steadily

After in-person visits declined during COVID-19 quarantines and patients moved to telehealth, interest around in-person visits is growing again, as patients’ mindsets around preventative and integrative health change.

Key takeaway: In a post-pandemic world, people have become more attuned to preventative health. Consequently, we have seen a large and steady rise in patient visits after COVID-19 first began. Given this increase in demand for physicians, look to adapt with more integrative healthcare practices.

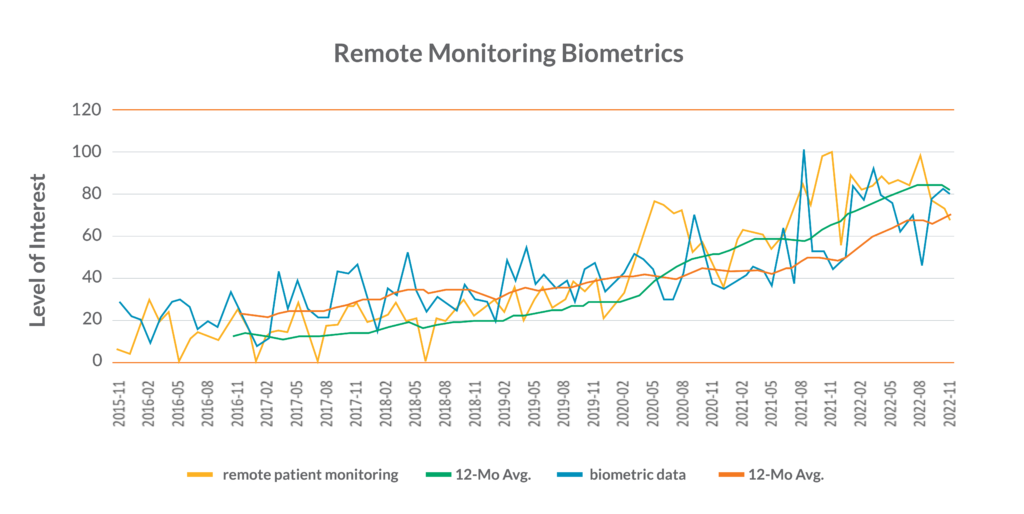

4. Rising interest in biometrics

As consumers have become more data-oriented and health-conscious, interest in biometrics and remote patient monitoring technology has increased substantially over the past 7 years.

Key takeaway: With a wave of wearable smartwatches and apps that can track heart rate, net calories and more, people are now becoming increasingly interested in their own biometric data. To stay competitive with online biometric providers, provide similar solutions, such as remote blood glucose monitoring for diabetic patients or regular blood work for those looking to optimize their health.

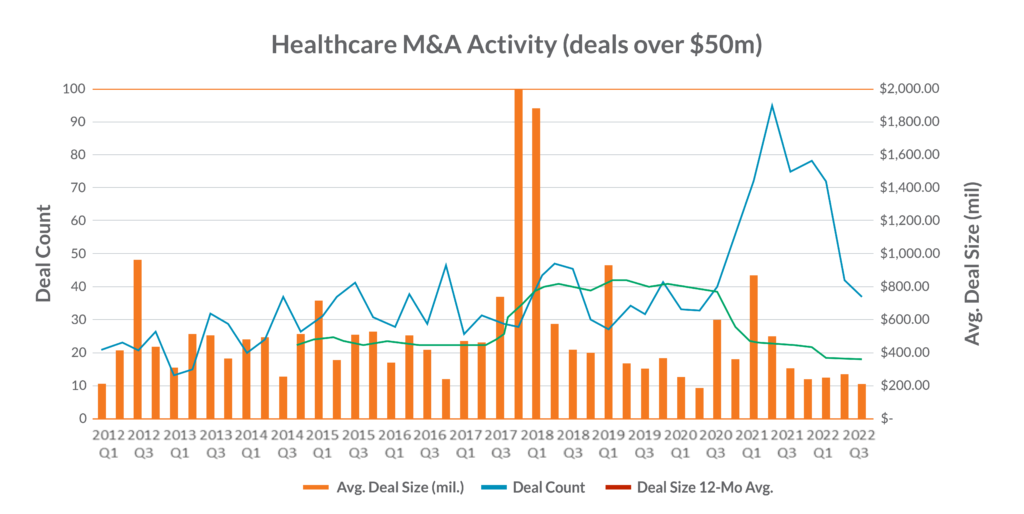

5. M&A activity has reverted to more normal levels in 2022

M&A in the healthcare space surged in 2020 and 2021 but declined to more normal levels in 2022.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (December 14th, 2022) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Angela Dotson

Angela Dotson, CPA, is the Professional Services Team Leader and a Tax Partner at Aprio. She brings more than 26 years of experience delivering tailored tax solutions to corporations, partnerships, and individuals. Angela is passionate about empowering women-owned businesses by educating them on tax planning and business opportunities.

(404) 814-4981

Scott Rittenberg

Scott is a Tax Partner on Aprio’s National Healthcare Practice team, where he advises dental and medical practice owners to help them deliver results and achieve their goals. With more than 30 years of public accounting experience, he specializes in strategic tax planning, cash flow and working capital management, profitability and compensation consulting, and succession planning.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.