6 Real Estate Insights from Q4 2023 and What They Mean for You

January 3, 2024

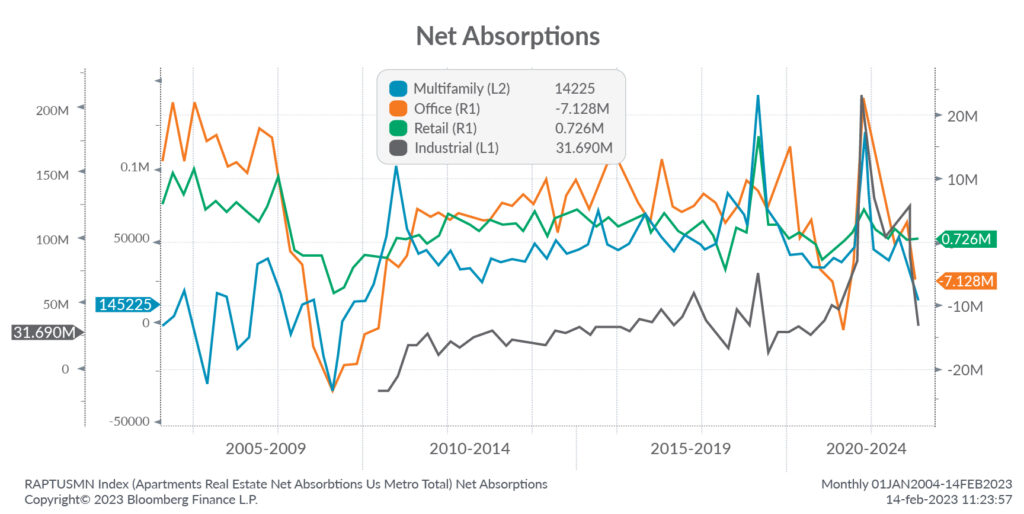

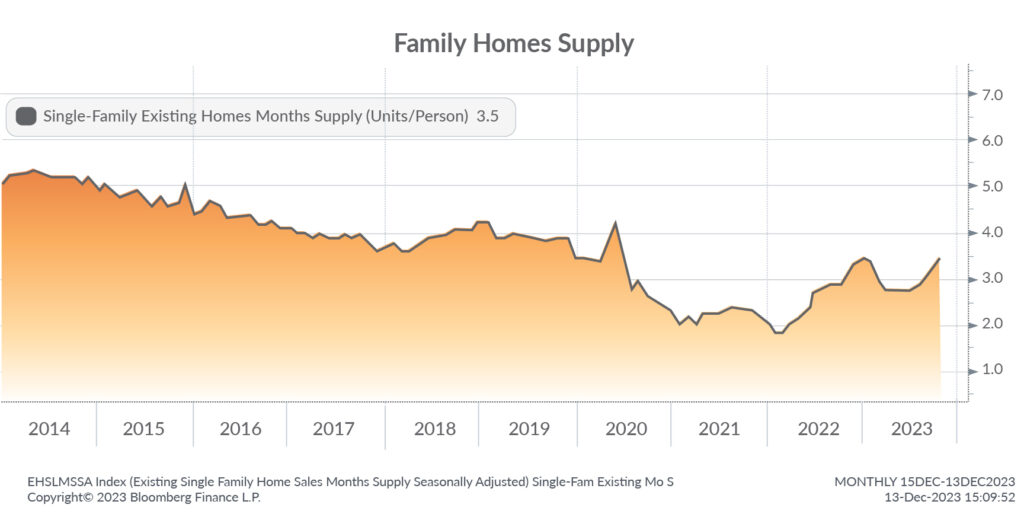

The commercial real estate market is currently experiencing a slowdown after a period of rapid post-pandemic growth. Rising interest rates are impacting the market, with the gap between cap rates and bond yields narrowing. While lending remains cautious, there is no significant increase in lender concerns. Publicly traded REITs have seen declines in market value, potentially indicating undervalued opportunities within the sector. Net absorption rates are falling, particularly in the office sector due to continued work-from-home trends. The supply of single-family homes is rising but still historically low, highlighting the ongoing need to address the housing market’s supply and demand imbalance.

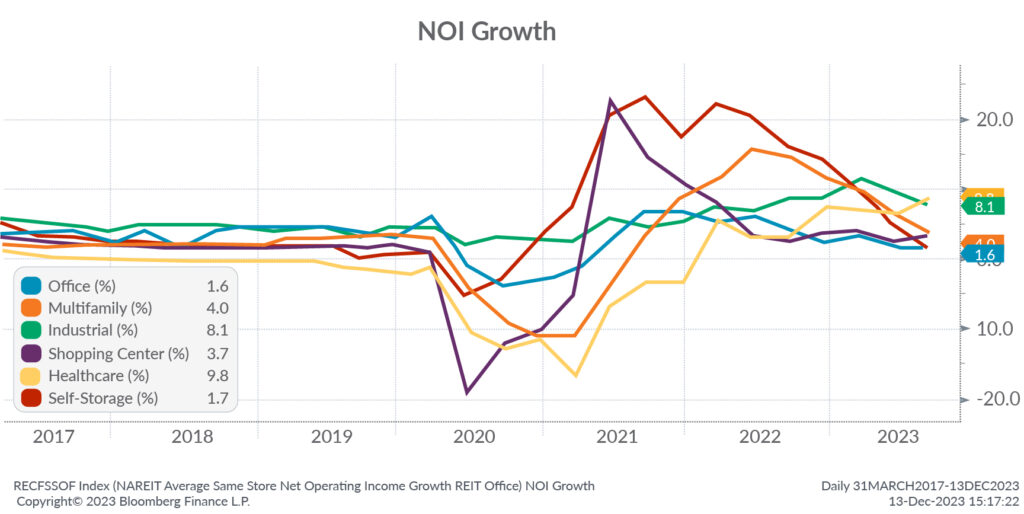

1. Growth in Net Operating Income (NOI) is reverting toward historical levels

Apart from healthcare and industrial, NOI growth for commercial real estate has reverted closer to normal levels after experiencing substantial growth coming out of the pandemic.

What this means for you: Do not plan for the same level of NOI growth as the sector experienced in 2021 and 2022. Should the Federal Reserve (the Fed) accomplish a soft-landing with interest rate policy, there could be NOI growth sustained at historical levels; however, if the economy dips into a recession, anticipate below average NOI growth and tenant challenges.

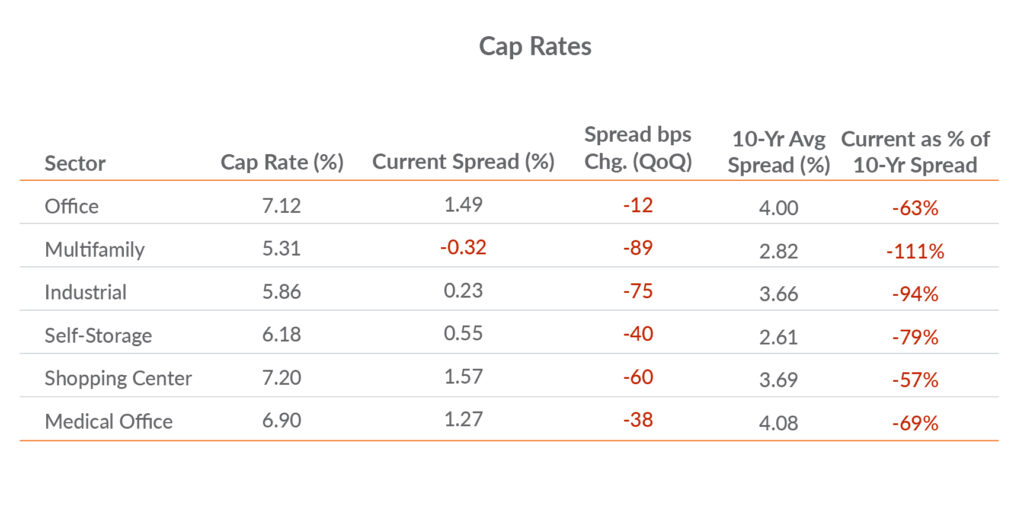

2. Spreads between cap rates and investment grade bond yields continue to narrow as bond yields rise

Cap rate spreads over investment grade bonds continue to narrow, and remain, historically low. While cap rates have risen, the quicker and more substantial rise in bond yields has narrowed spreads. Office and shopping centers appear the most attractive with the highest cap rates and largest spreads, however, both have faced challenges in the digital age of remote work and e-commerce.

What this means for you: As seen in the prior chart, NOI continues to grow at a healthy rate, and with the Fed’s anticipated reversal in interest rates, we may see cap rate spreads widen. If the Fed lowers interest rates, bond yields would likely follow, resulting in commercial real estate spreads becoming more attractive. For those considering lending to or investing in properties, this could be the early stages of an inflexion point.

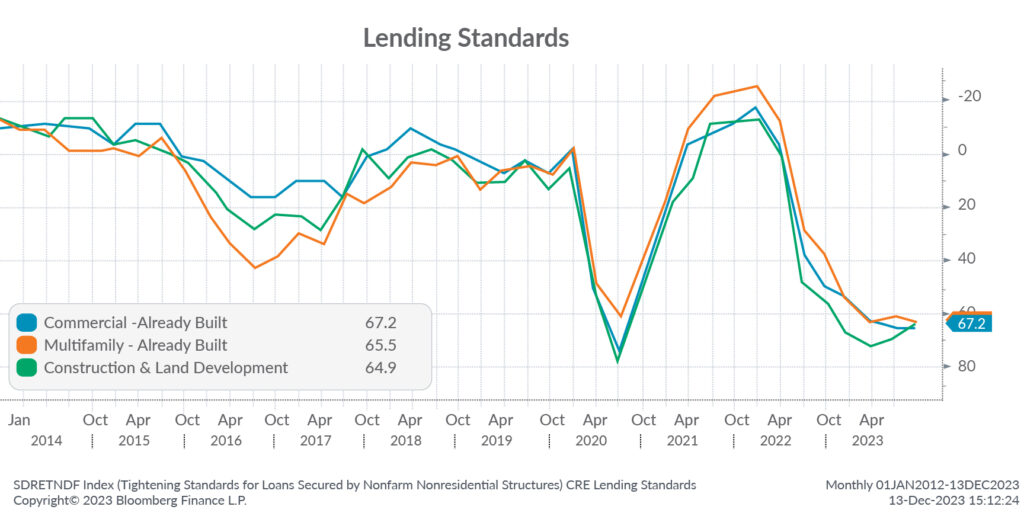

3. Commercial real estate lending standards show signs of relief

Commercial real estate lending standards are tight, but lenders’ concerns do not appear to be worsening, as the economy remains resilient, and the Fed starts to signal at rate cuts in 2024.

What this means for you: Tight lending standards and high interest rates can make capital for commercial real estate costly and more difficult to obtain. If planning to finance any near-term commercial real estate deals, look to alternative sources, such as the private credit market. Additionally, tighter lending conditions today will constrain future supply, helping to support valuations 18-to-24 months from now.

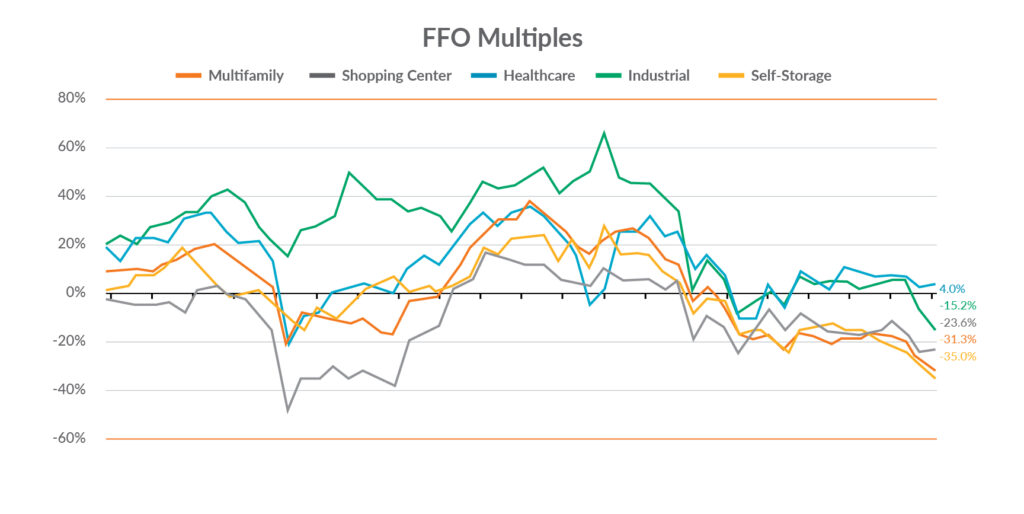

4. Deep discounts for public REITs indicate attractive valuations for real estate

Publicly traded REITs continue their near two-year contraction with FFO multiples now trading at deep discounts (except for healthcare) to historical averages. Self-storage and multifamily are pandemic-era valuations. Similarly, shopping centers are trading at a greater than 20% discount.

What this means for you: Public markets tend to lead private markets, so with large reductions in public valuations, expect private real estate valuations to compress. With the Fed expected to pivot on their interest rate policy in 2024, we believe deal makers may capitalize on the lower valuations before the anticipated real estate market pivots too.

5. Net absorptions are trending lower off their highs in 2021

Net absorptions for commercial real estate are trending modestly lower. The office sector’s decline is mostly pronounced because work-from-home policies persist. Industrial real estate is reverting to more normal levels after seeing net absorptions experience a substantial rise. Multifamily net absorptions were slightly negative earlier in the year but have since recovered to a more moderate level.

What this means for you: With net absorptions not showing much strength, expect demand for commercial real estate to be more modest. To combat weaker trends in net absorptions, look to competitively price rents and lock-in longer-term leases to mitigate vacancies.

6. Historically low supply of single-family homes is now on the rise

The supply of single-family homes is starting to rise driven by an economy that remains strong and inflation subsiding, thus making it more economical for developers to increase construction. While supply is rising, it continues to be historically low and would need further improvement to bridge the supply and demand gap.

What this means for you: Increasing supply of single-family homes may create more affordability for home buyers, thus supporting local economies. However, supply of single-family homes is still historically low and expensive, which supports valuations for multifamily housing.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (June 23, 2023) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He brings to his role two decades of professional investing experience in publicly traded and privately held companies as well as senior-level operating and strategy consulting experience.

(470) 236-0403

Alan Vaughn

Alan has more than 40 years of experience serving in the real estate and construction industry. He works with all types of real estate clients and focuses his efforts on advising clients with tax advantaged transactions, while helping make connections with others.

(404) 898-8233

Darrin Friedrich

As a Tax Partner at Aprio, Darrin works closely with C-level executives and owners of real estate, construction, development, management, and lending companies, specializing in tax consulting, tax preparation, and business consulting services. For over three decades, Darrin has advised clients on how to structure their businesses in ways that mitigate tax liabilities and help them obtain state and federal tax credits like the Low-Income Housing Tax Credit (LIHTC).

(404) 898-8241

Kevin Collins

Kevin is the co-leader of Aprio’s Northeast Real Estate practice and a tax partner, where he focuses on serving high-net-worth individuals, real estate professionals and operators, real estate fund sponsors, closely held business owners, CEOs, CFOs, attorneys, mid-market companies, and real estate lenders.

(201) 543-0754

Jim King

As a partner and co-leader of Aprio’s Northeast Real Estate division, Jim provides a wide range of consulting and tax planning services, helping real estate clients solve complex real estate-related issues such as taxation, formation, restructuring, acquisitions, 1031 like kind exchanges, and Delaware Statutory Trusts (DST). His clients include real estate developers, investors, owners, and managers.

(201) 543-0756

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.