Aprio Wealth Management | Election 2024

October 28, 2024

Research shows that those who stay invested through a presidential election year come out on top. When TIAA-CREF analyzed market data from Morningstar, it found that all but four election years since 1928 ended with positive stock returns and all-but-one election year ended with positive bond returns. Overall, election year returns average 10.2% for stocks (versus 10.1% in non-election years) and 5.5% for bonds (versus 4.9% in non-election years).1

U.S. Bank investment strategists studied market data from the past 75 years and identified patterns that repeated themselves during election cycles. The analysis points to minimal impact on financial marketperformanceinthemediumtolongtermbasedonpotentialelectionoutcomes.2 Sowhilethere may be noise to each election, the big picture is clear – stay invested!

Further, markets have performed well under both Democrat and Republican administrations – neither is inherently better for the markets nor the economy. More important factors are the growth in corporate profits (or GDP) and inflation (its direction and magnitude of change). For example, inflation increased during the Nixon administrations (the S&P 500’s total return was -8% during his five years) while the GDP growth rate declined every year of George W. Bush’s second term.3

Source: Dimensional Fund Advisors

Around elections, financial market returns can be greatly impacted by the level of uncertainty; more uncertainty can create weaker markets, as historically, markets tend to favor stability. Stability enables investors and companies to have more confidence in the probability of different outcomes, and thus can make financial decisions. For elections, this means a better ability to handicap policy changes, taxes, and regulation, often resulting in higher short-term confidence.

Divided governments, where one party controls the White House and the other controls at least one part of Congress, have historically been preferrable because there is less likelihood of polarizing policies, as more sweeping legislation typically must be negotiated, and thus, bipartisan, to be enacted into law. As we consider the upcoming election, the Presidency, Senate and House of Representatives are all considered very close contests that will likely come down to just a few states. According to KKR, today we have the smallest majorities in the House and Senate in modern times.

One short-term concern that may present volatility to the markets is what we foresee as a lower likelihood of the election being determined on election night or shortly thereafter.

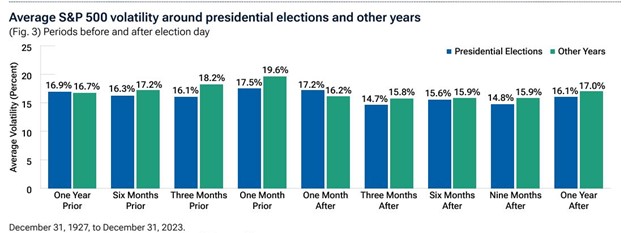

Source: T. Rowe Price & Associates

Historically, volatility in presidential election years peaks one month prior to the election (at 17.5%), and then proceeds to decline over the following one month (17.2%) and three months (14.7%) as clarity on policies and cabinet appointees become clear. With the move toward extended voting periods and mail-in ballots, and with several swing states not starting to count until election day,4 we believe that it could be several days or longer until the winners are declared, and composition of the executive and legislative branches are known.

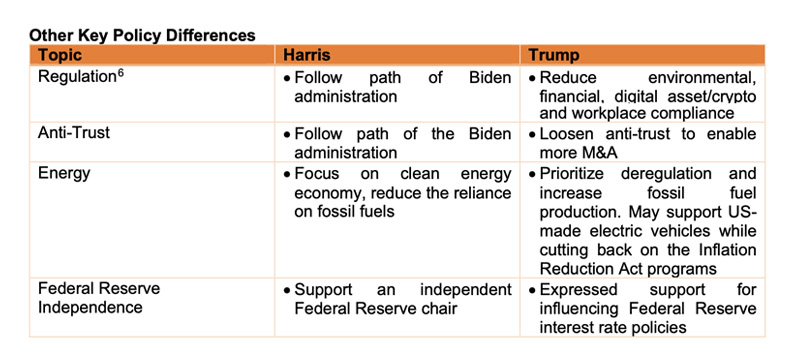

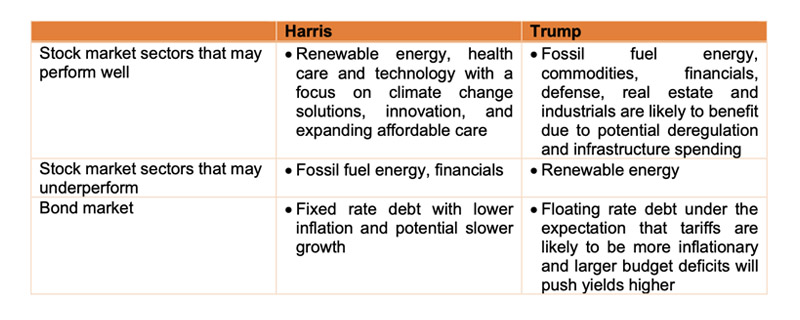

For the presidential election, we see five key areas that could have the greatest impact on the economy and markets, where there is differentiation between Vice President Harris and President Trump. These are taxes, trade policies, regulation, anti-trust and Federal Reserve independence.

Different administrations may shift sector performance based on presidential initiatives. However, history shows greater complexity: potential outcomes are quickly priced into securities, even pre- election, while frictions like divided government and lobbyists can impede policy implementation.

An additional factor reducing predictability is that Donald Trump has shifted the Republican party’s platform away from its traditional base toward more populist (e.g., his relative appeal to union members). This could impact which sectors perform well relative to history.

As we approach Election Day 2024, we are reminded that staying invested during presidential election years generally yields positive returns for both stocks and bonds. Market stability is imperative, as higher uncertainty around elections can weaken markets, while stability boosts investor and corporate confidence. Historically divided governments are preferred due to the reduced likelihood of polarizing policies and greater predictability. Lastly, candidates Harris and Trump have significant policy differences, the fact that one is essentially an incumbent while the other has held the office before helps markets in projecting likely outcomes for sectors.

Sincerely,

Simeon Wallis, CFA Chief Investment Officer

1 https://www.wsj.com/buyside/personal-finance/investing/how-u-s-presidential-election-years-affect-the-stock- market

2 https://www.forbes.com/sites/us-bank-wealth-management/2024/09/18/how-presidential-elections-affect-the- stock-market/

3 Sources: Dimensional Fund Advisors, Bloomberg Finance, LP.

4 https://ballotpedia.org/When_states_can_begin_processing_and_counting_absentee/mail-in_ballots,_2024

5 Sources: Kiplinger’s, Urban Institute

6 Sources: Kleinman Center for Energy Policy at the University of Pennsylvania, Reason.com

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Aprio Wealth Management, LLC are not affiliated companies.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.