Insights |

The Pulse – What’s happening in the Economy and the Capital Markets: 11/2/20 – 11/6/20

November 12, 2020

Executive Summary

It was a strong week for the markets with a positive response to the election and the strongest election-related performance since the 1930s. History suggests that a divided government is positive for both bonds and stocks.[1]

Economic news continues to be mixed – lagging manufacturing data is positive while sectors directly impacted by COVID-19 took a sharp turn for the worse in the high frequency data. Meanwhile, the largest IPO in history was shelved by the Chinese government.

The Markets

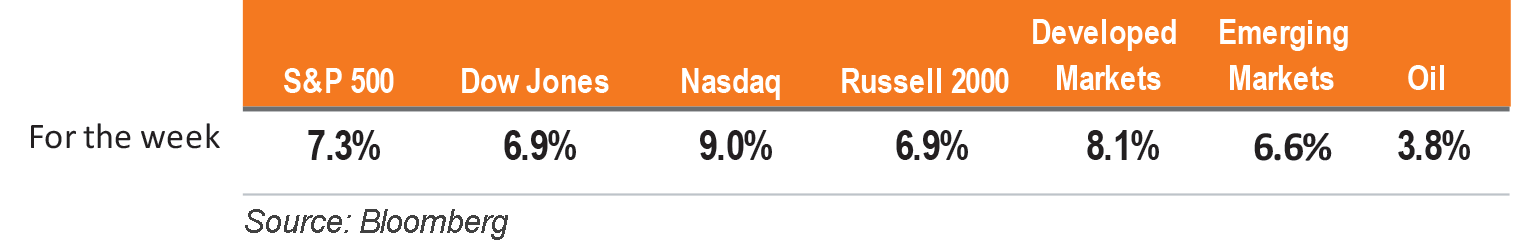

The markets rallied following election results that signaled gridlock will likely prevail, mitigating the likelihood of any tax increases on capital gains and income. The S&P 500 rose 2.2% on Wednesday, its strongest result for the day following an election. It rose another 2% on Thursday and ended the week with its best election week gain since 1932, according to Barron’s.

The market interpreted from the election “lower growth for longer,” which would reduce the probability and magnitude of inflation and result in interest rates remaining low for the foreseeable future. Sectors with secular growth, such as technology and healthcare, fared best. Sectors that are perceived as low- or challenged-growth, such as utilities, real estate and energy, performed the worst.

Global market results were similar with developed and emerging markets’ returns in line with the U.S. markets.

The Economic News

The economic news remains very mixed. Labor and manufacturing reports came in above expectations. However, the high frequency data as it relates to the consumer is showing a significant slowdown, likely due to rising COVID-19 cases.

This week’s Jobs Report exceeded expectations across multiple categories:

- The Oct Unemployment Rate exceeded expectations at 6.9%, down 1 percentage point from September

- The Labor Force Participation Rate reported a positive increase.

- The Underemployment Rate also reported positive news, declining 0.7 percentage point from September.

- Jobs (aka non-farm payrolls) increased 638k versus the expected 580k.

- The Private sector (aka non-government payrolls) excelled increasing 906k versus the expected 680k.

- Job numbers in manufacturing disappointed increasing just 38k from September and below expectations.

ISM Manufacturing performed better than expected with the index beating September at 59.3.

- New Orders really shined – up 8% from September and exceeding expectations.

- Durable Goods and Capital Goods orders met expectations reporting flat against September.

High Frequency Data

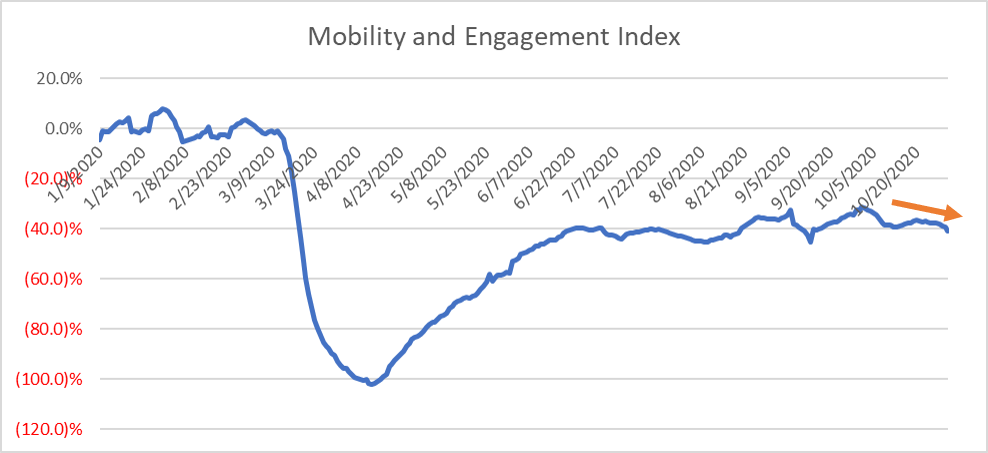

Mobility and engagement, a sign of consumer activity, has started to decline after peaking in October.

Dallas Federal Reserve Mobility & Engagement Index (lags by approximately 1 week)

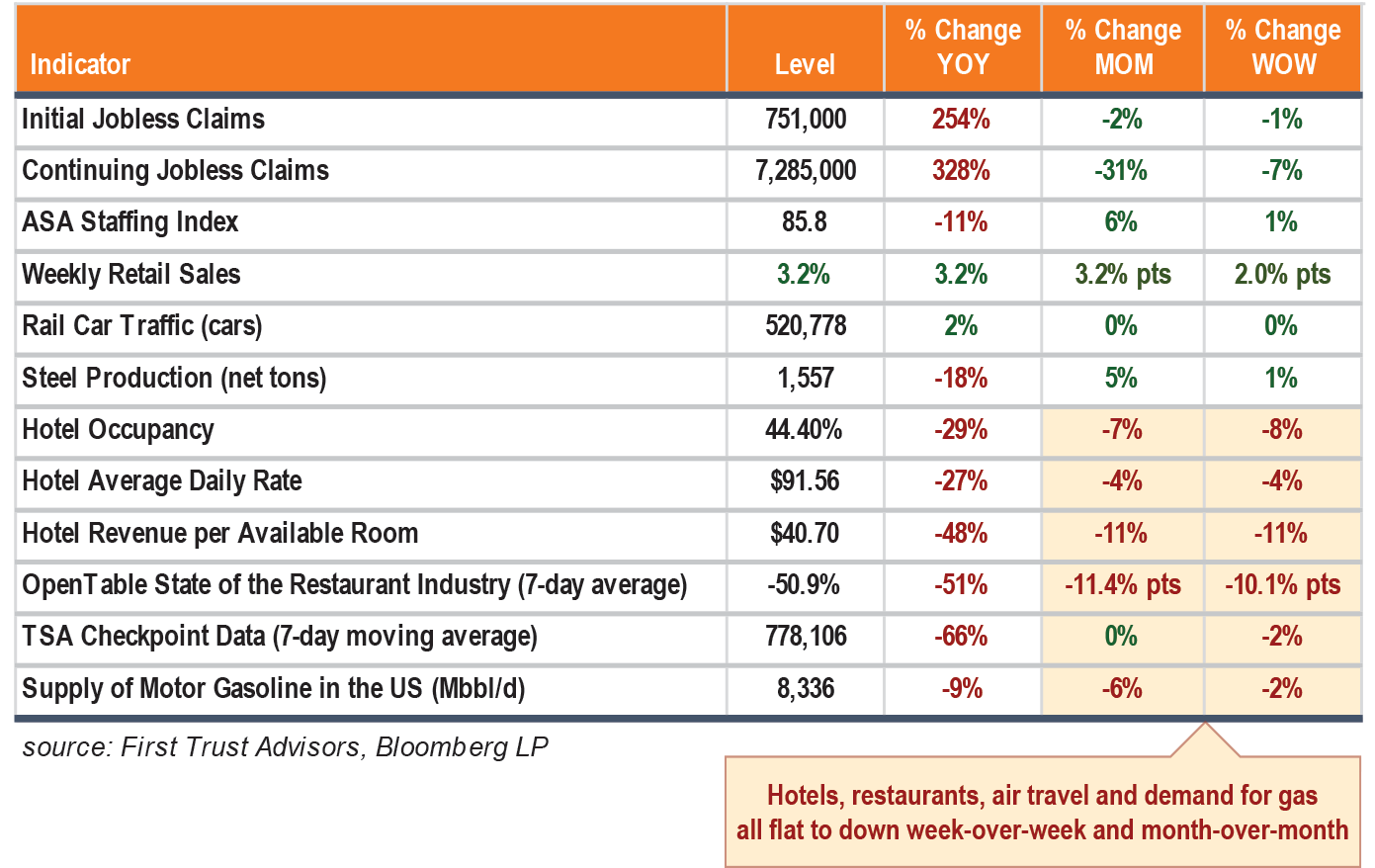

The High Frequency Data shows the sectors of the economy that were most directly impacted by COVID-19 – restaurants, air travel, lodging – regressing.

Focus of the Week: COVID-10-impacted industries

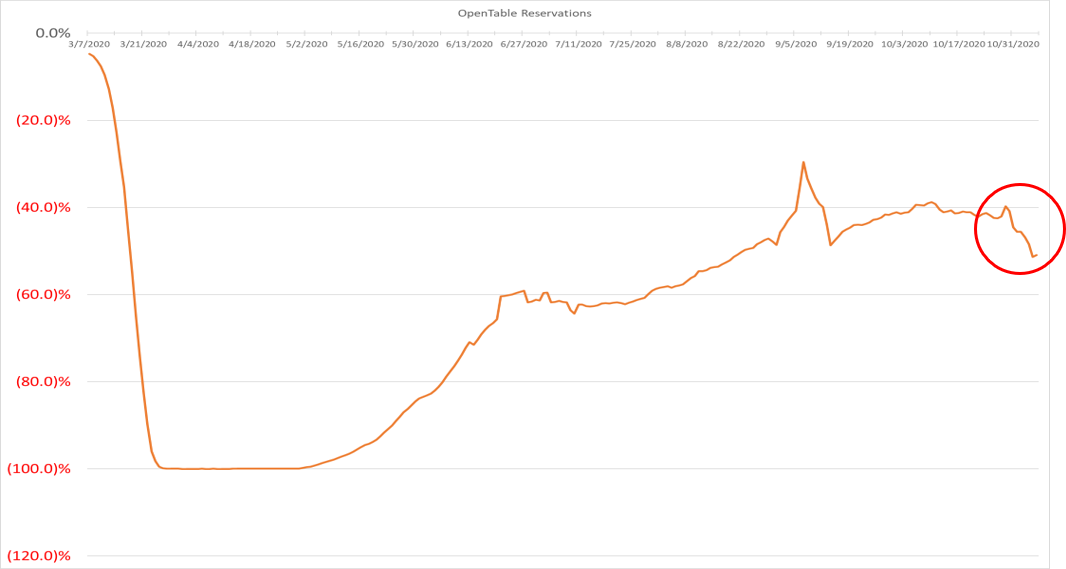

Restaurant dining is dropping precipitously. (source: OpenTable)

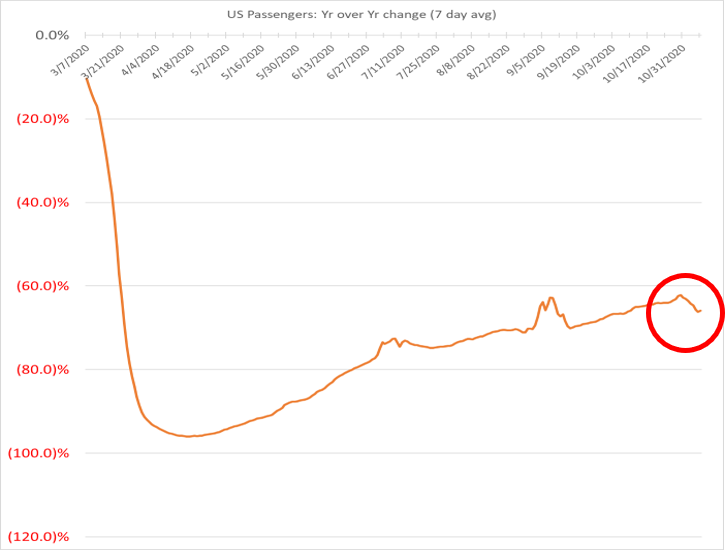

Similarly, air passenger volume has also declined, diverting from its rebound trend. (source: TSA)

A Few Stories that Caught My Eye

- Chinese government shelves the largest IPO in history

- Bitcoin hits highest price in 30+ months

- Marijuana Legalization – The Real Election Night Winner

- Why Chinese Companies are so Tough to Analyze

- One of the best investors you’ve never heard of

[1] Oxford Economics, Macro Musings, 11/6/20.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (October 12, 2020) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.