Will You Be Able to Deduct R&D Expenses in the Future?

September 15, 2021

At a glance

- The main takeaway: The tax legislation passed in 2017 removed the immediate expensing of R&D costs beginning January 1, 2022.

- What this means for you: With the end of 2021 fast approaching, businesses that incur foreign and domestic R&D costs need to understand how this change may affect their tax situation if Congress does not remove the provision.

- Next steps: Call your Congressional representative to ask for the amortization provision to be removed completely and contact Aprio for help with understanding what it means from a tax standpoint.

Schedule a free consultation with Aprio

The full story:

Like many aspects of life, tax code changes are inevitable in the United States — and some of those changes have a greater impact than others. Many of the current proposals in the House and Senate have received a lot of press, but there is one proposal that has not risen to the forefront.

Tax deductibility of R&D expenses

Under current tax law, research and development (R&D) costs are fully deductible in the year incurred; software development costs are included in the definition of R&D.

In the 2017 tax legislation, Congress included a provision stating that R&D expenses for all taxpayers must be amortized over five years for domestic costs and over 15 years for nondomestic costs, starting with the years following December 31, 2021. Since the 2017 legislation did not apply until 2022, many taxpayers and practitioners have not focused on the change, but the end of 2021 is only a few months away.

The 2017 legislation also included the elimination of a special election to amortize R&D over either a five- or 10-year period. These special elections are favorable to certain taxpayers’ situations — for example, some startup companies have large losses in their early years. These losses can often become “trapped” and not useable in the future when there is an ownership change greater than 50% (this is referred to as a “382 limitation”). This issue is prevalent with early-stage companies as they progress through various rounds of funding. By electing to amortize R&D expenses over five years, the expenses are pushed out beyond the 382 limitation and are not trapped. For instance, drug development has often seen a long R&D period, which makes the 10-year amortization favorable to pharmaceutical companies.

How does this change affect your company?

Assume your U.S. company has a 100% foreign subsidiary that performs R&D; for U.S. purposes, those costs will have to be capitalized for income taxes and expensed over 15 years, while the foreign subsidiary will continue to recognize income as earned.

While an income tax expense on a financial statement may not change due to the accounting for deferred income taxes, we expect that companies will have to use cash to pay taxes that otherwise would be used to perform more R&D. The impact of this change might not be visible on a company’s financial statement; rather the footnotes to the financial statement will disclose the impact of the change on cash flow.

Will the public and private markets value companies differently because of this change? In leveraged and unleveraged M&A deals, there has always been an assumption that these costs are fully and immediately deductible to obtain a tax benefit.

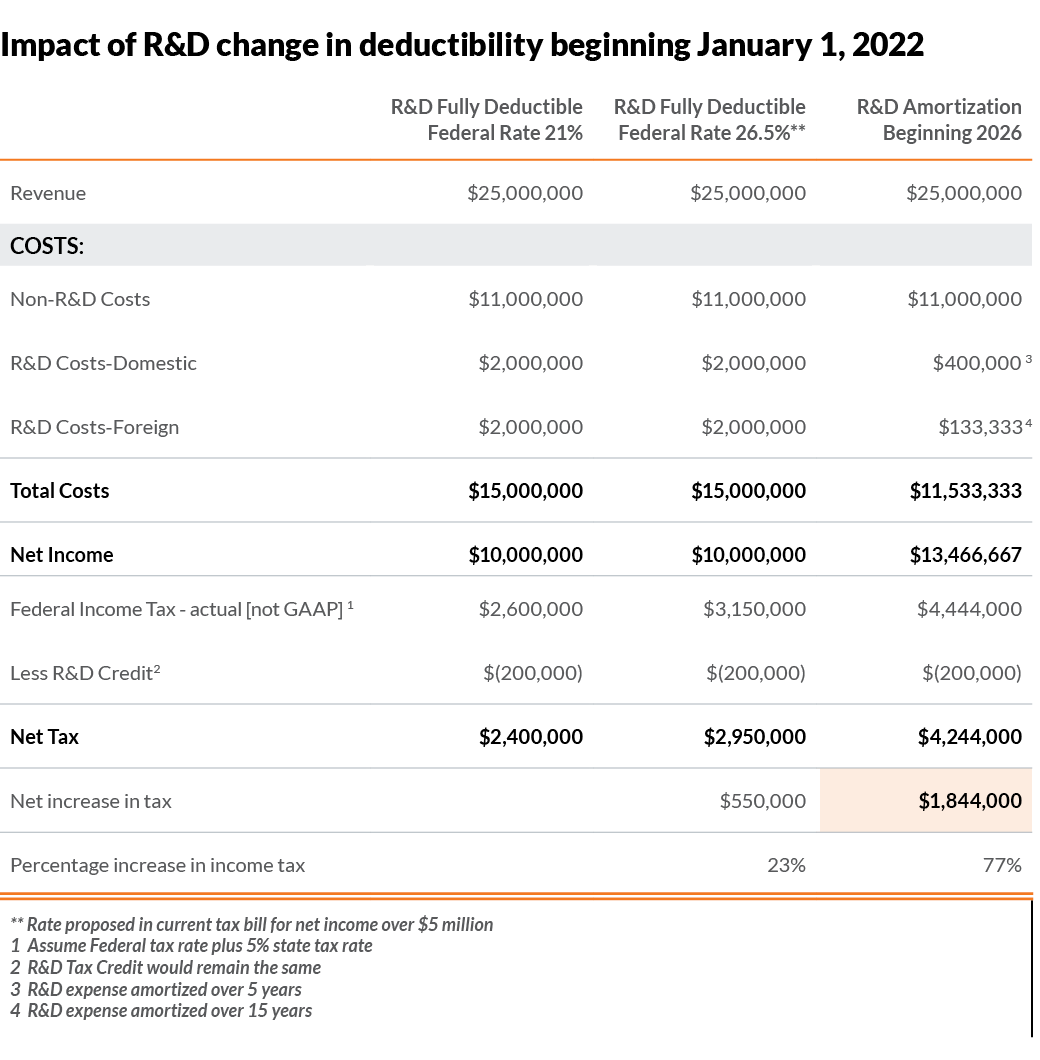

Let’s look at an example and assume the following to see the impact of this change hypothetically:

The bottom line

With bipartisan support, the House originally included a provision to remove the five-year amortization set to begin in 2022, but they did not address foreign R&D costs, which would still have to be expensed by companies over 15 years. In the Democratic version of the provision released on September 13, the R&D amortization requirement was not removed but delayed until tax years beginning after December 31, 2025.

While you should applaud the House for adding this delay, we strongly suggest you contact your Congressional representatives and ask for the amortization provision to be removed completely, especially for small businesses.

If you have any questions about the provision and how it affects your business, schedule a free consultation with our team today.

Related resources

Recent Articles

About the Author

Charles Webb

Partner At Aprio Charles is a partner in Aprio’s Technology & Biosciences and International Services groups. He has more than 25 years of experience providing tax planning, tax compliance and strategic analysis to his clients. Charles is adept at serving the needs of startups and other emerging companies. He has been an entrepreneur himself and understands firsthand the needs and challenges growing companies face.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.