Tech Over Troubled Waters: Six Questions Facing the Tech Industry Right Now

March 20, 2024

At a glance

- The main takeaway: Economic uncertainties and investor pressures have fueled surging tech layoffs affecting employees at all levels and across geographies. Companies genuinely changing the world using Generative Artificial Intelligence (AI) are reshaping businesses in every sector.

- Impact on your business: Venture capital and private equity funding have plenty of dry power; funding slows down, putting pressure on tech companies to do more with less. At startups, experienced executives are leaving big tech and starting new tech companies with their capital.

- Next steps: Cash flow modeling, increasing the velocity to close deals, fractional and interim CFOs, repricing underwater stock options, and fundraising assistance from strategic partners can help.

Aprio’s experienced technology team can help tech companies fuel profitability, manage risk and prepare for regulatory changes.

The full story:

Turbulence surrounds the tech industry. From economic uncertainty to a surge in layoffs and lower valuation, tech companies are navigating stormy waters. However, it is helpful to remember that we have been here before. While the current disruption led by generative AI innovation is distinct from the dot-com boom/bust of the 1990s, lessons from that period that can be applied to the tech industry’s current situation.

By understanding the factors motivating layoffs across the tech space and engaging in strategic partnerships to help successfully navigate funding hurdles, founders and leaders of tech companies can chart a path to a successful future filled with opportunities for growth and resilience.

What’s behind the recent surge of tech layoffs?

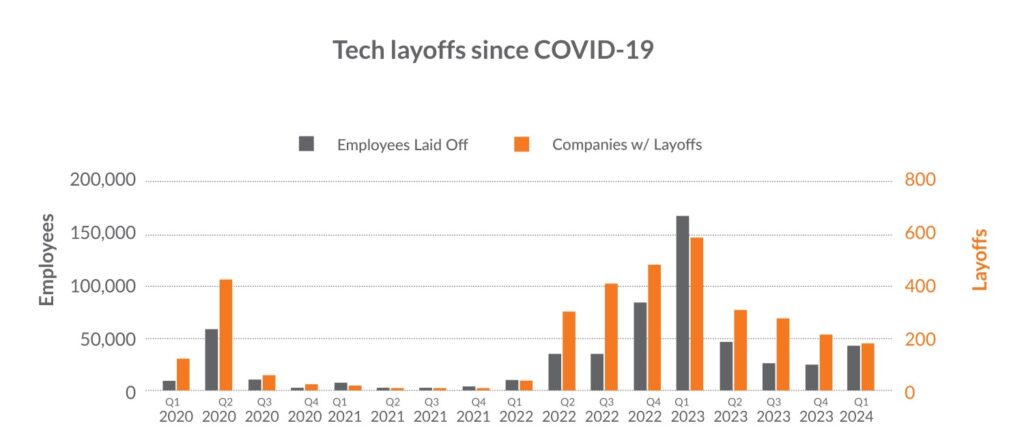

As Simeon Wallis, Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office, highlighted in his Tech Trends Report, layoffs per company in the tech industry have begun to increase as companies focus on cash flow and profitability.

There have been more than 260,000 job losses and counting across the tech sector despite a return to pre-pandemic workforce levels and positive economic indicators. These layoffs are not solely driven by economic necessity or strategic shifts within companies. Instead, they are influenced by market perception, mimicking behavior among competitors, and the desire to demonstrate cost discipline to shareholders.

Smaller tech startups are increasingly facing fundraising struggles. Those funding challenges result in running out of cash, also prompting workforce reductions. While distinct from the factors motivating large tech companies to reduce their workforce, this trend indicates a broader shift in the industry towards prioritizing cash flow and profitability.

Who is experiencing layoffs and company closures?

Tech layoffs have impacted employees, from entry-level positions to senior executives, including founders. The pressure to increase profits and demonstrate cost efficiency, driven by investors’ expectations, has heightened job insecurity among experienced professionals. Even amidst a booming job market in other sectors, tech workers feel despondent and disillusioned, leading some to reconsider their career paths.

Tech companies wanting to remain competitive can view those layoffs as opportunities to hire talented professionals that may become available as competitors reduce headcount to protect their margins.

What’s causing venture capital and private equity firm funding to slow down?

Smaller to mid-sized companies, particularly those struggling to secure funding, have borne the brunt of layoffs and closures. Venture capital deals have declined to pre-pandemic levels, making fundraising challenging for many startups. The expectations of investors have shifted, with a focus on maximizing operational efficiency and minimizing cash burn.

Venture capital and private equity firms increasingly seek more efficiency and longer runways for their investments, prodding tech companies to achieve more with less. Previously, companies were expected to double sales within a specific timeframe with substantial capital injections; the current landscape demands similar results with reduced resources.

This shift in expectations has resulted in challenging decisions for companies, leading to layoffs and workforce restructuring. The decision to lay off employees or not backfill positions can be emotionally difficult, and therefore, unattractive to founders who may have longstanding personal relationships with employees they have decided to let go. That difficulty is lessened with management-led companies, but the pressure, particularly from VC and PE firms, remains.

For underperforming companies, stock options, considered attractive incentives, could now be underwater, posing challenges in retaining talent. Even founders can lose significant value in down rounds. Companies may consider repricing options to motivate and retain their teams.

How can strategic partnerships help tech companies navigate these staffing and funding challenges?

Strategic partnerships can be instrumental in successfully navigating layoffs and financial uncertainties. By leveraging the expertise of seasoned partners, companies can better understand their financial position and explore viable options for sustainable growth.

Since the early dot-com days, Aprio has helped tech companies weather the storms of uncertainty that accompany rapid growth and volatility. Tech companies leverage our tailored solutions, which include cash flow modeling, fractional and interim CFOs, fundraising assistance, use of debt and equity, and business coaching, to manage their finances and chart a clear path forward.

What role can AI play in building a bridge to brighter futures for troubled tech companies?

The emergence of generative AI, particularly in training language learning models (LLM), presents tech companies with opportunities and challenges. While AI-driven innovations promise to revolutionize industries and drive growth, they also necessitate significant investments in infrastructure and talent.

In the short term, a shift toward generative AI-powered solutions is creating a surge in demand for servers and storage units at data centers, signaling a fundamental realignment of priorities within the tech ecosystem. Companies offering reliable, safe and effective AI solutions are awash in funding and have the potential to solve staffing needs for a fraction of their current cost.

However, this growth is accompanied by challenges, including increased cybersecurity threats. As AI-driven cyberattacks become more sophisticated, the investment in cloud security is forecasted to increase, presenting challenges and opportunities for tech companies. A shift away from human programming and other functions taken over by AI will be incremental but should pick up dramatically over the next five years.

Companies that embrace generative AI early could reap significant savings in labor costs and time to market.

How can your company remain resilient and grow amidst the challenges facing the tech industry?

As the tech industry grapples with layoffs and economic uncertainties, it is essential to remain adaptable and innovative. Despite the challenges, opportunities abound, especially in emerging technologies like AI. While AI may reshape job roles and workforce dynamics, it also presents avenues for growth and efficiency.

By staying agile and proactive, tech companies can weather the storm and emerge stronger. As the industry evolves, those willing to adapt and innovate will continue to thrive despite uncertainty.

The bottom line

Billions of dollars are sitting on the sidelines, waiting to be invested in promising tech companies. Aprio connects venture capital funds and private equity portfolio companies with growing tech companies. We provide cash flow modeling and fractional CFO solutions for some clients looking to scale.

For entrepreneurs and founders facing underwater stock options and staffing reductions, we offer tax and accounting guidance on repricing options to help keep their teams motivated and in place.

Whatever challenge you’re facing, Aprio is here to help fuel profitability, manage risk and simplify regulatory compliance. Let’s talk.

Related Resources/Assets/Aprio.com articles/pages

6 Key Tech Industry Insights and What They Mean For Your Business

Recent Articles

About the Author

Mitchell Kopelman

National Leader in Aprio’s Technology Practice, and Tax Partner, Mitchell works with SaaS companies in FinTech, HealthTech, Transaction Processing, Blockchain and Gaming. Whether a company is pre-revenue, starting up, growing, or preparing for a liquidity event, Mitchell works with them to maximize their potential at each stage. He is known for promoting research, innovation and entrepreneurship by enabling companies to be successful, regardless of where they are in their business lifecycle.

(404) 898-8231

Robert Casey

Rob is known for combining deep, technical audit experience with common sense, resulting in not only time savings for his clients but also cost savings. His approach also reduces the complexity of quarterly filings and annual closings. He specializes in revenue recognition, working with high-tech companies, especially SaaS and software businesses. Over the past 20 years, Rob has reviewed thousands of contracts in the manufacturing, distribution, technology and service company industries to discover potential revenue recognition issues. Rob’s experience has led him to be the ideal business coach and consultant for many of his clients, positioning them for smart growth.

(404) 898-7432

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.