The Pulse on the Economy and Capital Markets: April 12–16, 2021

April 21, 2021

Executive Summary

-

- Crypto Dominates Headlines: Markets initially reacted positively to the Coinbase listing, while bank earnings were optimistic on the economy.

- Positive News for Private Equity: First-quarter data on private equity shows tech and healthcare are the sectors that continue to attract deals and capital.

- Small Business Cautiously Prepares for a Comeback: Small business owners are becoming more optimistic yet remain concerned about attracting qualified candidates to fill vacancies. And with two critical sectors — restaurants and residential construction — showing strong future demand, this will only become a bigger challenge.

In the Markets

The success of the Coinbase direct listing to become a publicly traded company coincided with Bitcoin hitting $62,000. This was before the “Saturday night massacre” that saw Bitcoin fall 15% and Ethereum 18%. Coinbase’s valuation is roughly equal to Intercontinental Exchange, the company that owns the New York Stock Exchange, global exchanges for emissions, agriculture, commodities, options and the mortgage software platform, Ellie Mae.

Overall, we saw another positive week for the markets as earnings season began. While the indices we follow were positive, we’re seeing the Nasdaq lead the pack, compared to the more cyclical Dow Jones and Russell 2000 — a reversal from the first quarter.

Large banks led off earnings reports with stellar results from releasing reserves. Essentially, the banks were too conservative relative to the expected devastation to their client base; thanks to the Federal Reserve and Washington, that devastation did not occur to expected levels.

Now, banks are expecting the opposite, with Jamie Dimon of JPMorgan Chase stating, “We believe that the economy has the potential for extremely robust multiyear growth.” Here are a few other key datapoints to note:

- Wells Fargo noted that travel-related spending on debit cards increased 422% for the first week of April compared to the same period last year.

- JPMorgan Chase stated that travel-related spending increased 50% in March (versus February 2021).

- JPMorgan Chase also noted that overall credit and debit card spending increased 9% in the first quarter of 2021 (versus the first quarter of 2020).

Private equity news

PitchBook released its Q1 2021 review of private equity activity. Here are a few telling charts:

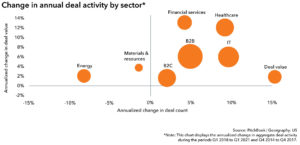

Healthcare and tech have experienced the greatest increases in deal volume, while financial services (which includes real estate) has seen the largest increase in dollar value of deals:

Private equity deal size is growing the most in the lower ($25–$100 million) and middle ($100–$500 million) markets as a percentage of overall deal activity:

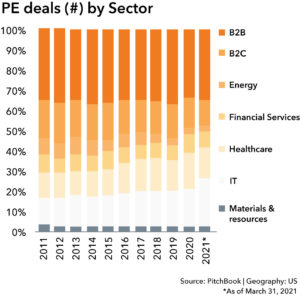

The first quarter of 2021 continued the trend that has persisted over the past decade: the shift away from energy, materials and consumer-oriented deals toward tech and, to a lesser extent, healthcare.

In the Economy

While many big companies have spoken about the economic strength they see looking forward, smaller businesses have been more reserved in their perspectives. The National Federation of Independent Business (NFIB)’s recent survey of small businesses shows optimism has rebounded over the last few months — but overall, perspectives are more tempered:

Small Business Optimism – Rebounding but Mixed

- Sales expectations over the next three months improved eight points to a net 0% of owners, a historically low level.

- Earnings trends over the past three months declined four points to a net negative 15%.

The ability to hire qualified candidates is a huge concern; it is at a near-50-year high (since the survey started):

Small Business Job Openings – Hard to Fill Index

Small business owners’ challenge to find the right candidates is impacting two sectors of the economy; these sectors can have a disproportionate economic impact:

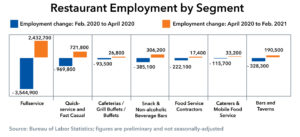

1. Restaurants

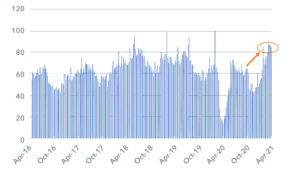

As vaccine deployment increases, Google searches for reservations are increasing sharply, which is a sign of future demand growth.

Google Searches for Reservations – Last 5 Years

However, labor supply is well below prior levels across every segment of restaurants:

2. Residential Housing Construction

Housing starts are another critical area of the economy. Labor market tightness could lead to higher prices and/or a moderation of the pace of the rebound. The housing market’s tight supply is resulting in additional supply housing starts for single and multifamily units, which continue to be strong.

Housing starts (total and single-family) are now at 15-year highs and at levels that were consistent with the 1990s, when the U.S. population was smaller. Yet, this Wall Street Journal article notes that the U.S. is short on home builders.

Housing Starts – Total & Single Family

Multifamily starts are also strong and at the top-end of their range since 2014:

Housing Starts – Multifamily

A leading indicator for housing starts is building permits; this is a sign of future construction. The indicator has rebounded sharply from the downturn and the trend is clear and strong; it is also near its highest level in 15 years.

Building Permits

A Few Stories That Caught My Eye

- Roaring Twenties, Part Duex? Champagne sales say yes! (link)

- The fraud cycle tends to follow market rallies — and an electric vehicle (EV) technology darling is being called into question (link).

- “A Failure of Texas-Sized Proportions” — how Texas is looking to overhaul one of the most deregulated electricity systems in the U.S. after the severe weather disaster in February (link).

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (April 21, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.