6 Manufacturing & Distribution Insights from Q2 2024 and What They Mean for You

April 16, 2024

The U.S. manufacturing and distribution sectors are rebounding with improving demand and growing output, although inventories and backlogs are shrinking. After years of contraction, EBITDA margins are on the rise signaling recovery in the sector. Following a surge in M&A activity post-pandemic, deal volume has reached multi-decade lows. While input prices remain mostly lower, price volatility for steel and copper continues. The rising interest in manufacturing and distribution jobs indicates a loosening labor market, while growth rates in wages are declining.

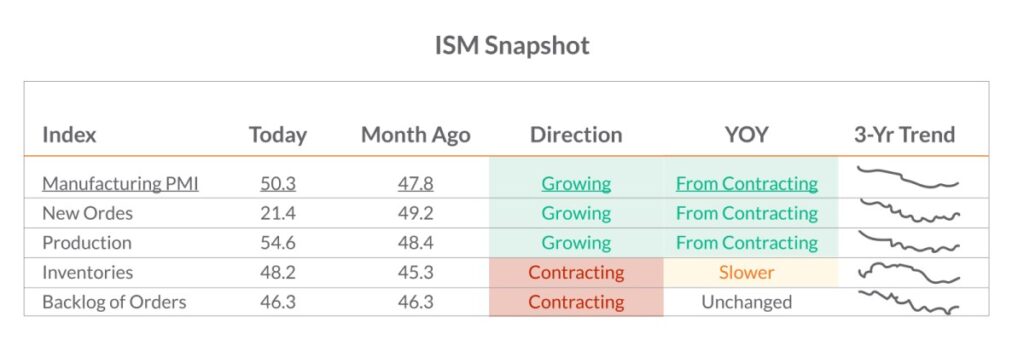

1. U.S. manufacturing sector rebounds into expansion

The U.S. manufacturing sector saw a notable turnaround, entering an expansion mode for the first time since September 2022. Strong demand, improved output, and favorable input conditions contributed to the positive shift. Meanwhile, inventories and backlogs continue to contract, albeit at relatively lower rates.

What this means for you: Look to capitalize on the sector’s expansion by preparing production to meet rising demand. Favorable input conditions help mitigate ongoing challenges, such as backlog and inventory contractions. Managing inventory levels efficiently and investing in production capacity can help sustain growth and profitability in this improving market environment.

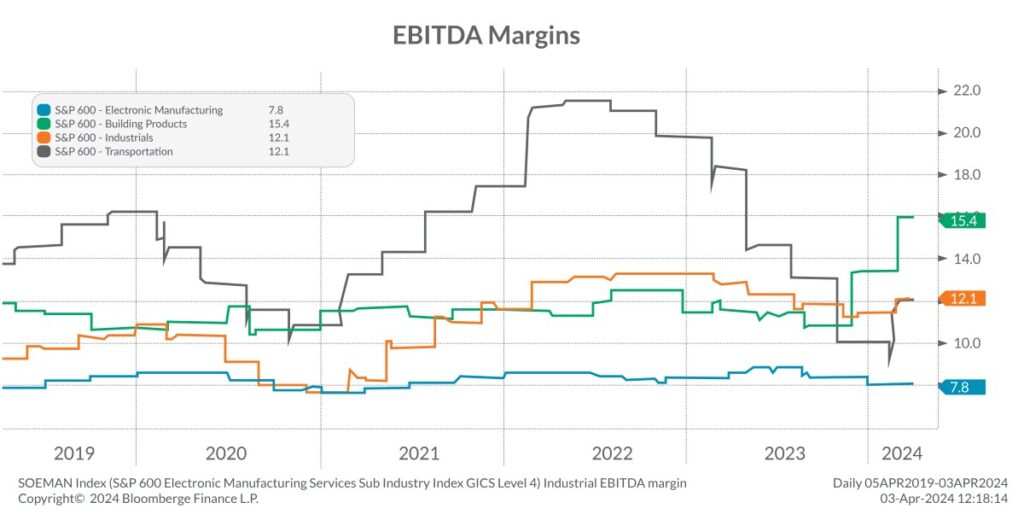

2. Rebounding EBITDA margins signal manufacturing sector recovery

In 2022 and 2023, EBITDA margins mostly contracted for manufacturing-related industries. However, in 2024, margins appear to be expanding as the manufacturing sector recovers.

What this means for you: With EBITDA margins showing signs of improvement, manufacturers can anticipate a stronger financial outlook as the sector recovers. To capitalize on this trend, focus on reducing variable costs, operational efficiency, and strategic investments to sustain and grow profitability.

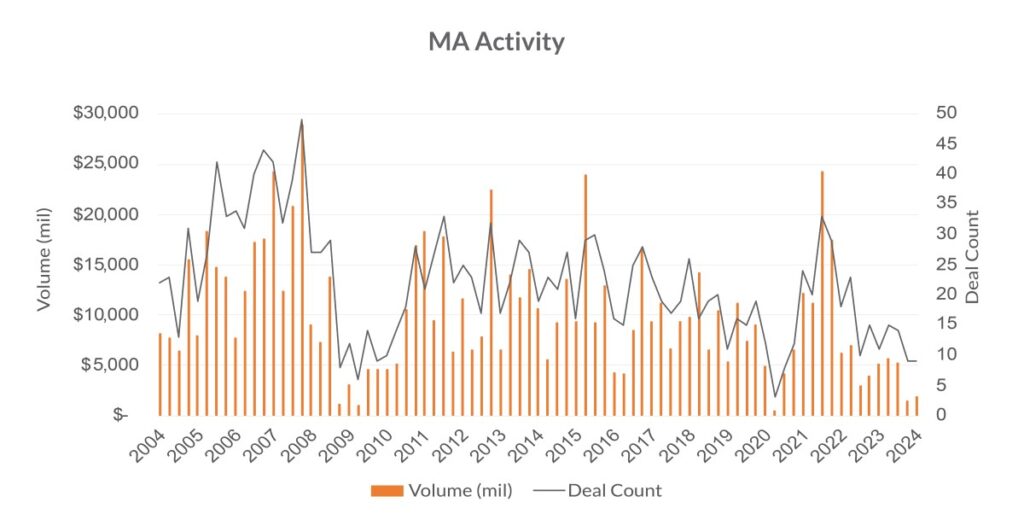

3. Manufacturing M&A activity plummets amid economic contraction

Source: Bloomberg

Following the surge in M&A activity post-pandemic, higher interest rates and a slowing economy led to a quick contraction in deals for manufacturers. In the first quarter of 2024, deal count and volume reached multi-decade low levels.

What this means for you: With deal activity near low levels, focus on organic growth, operational efficiency, and strategic partnerships to drive value for owners. If you are considering acquisitions, prioritize smaller tuck-in opportunities that can be quickly integrated.

4. Input prices remain low, but volatile

Input prices remain largely below their three-year highs and have been trending lower over the past year; the exceptions being steel and copper. Despite commodity prices being mostly lower, price volatility in some areas remains.

What this means for you: Most commodity prices remain below their three-year highs, yet volatility persists, particularly in steel and copper. To mitigate input cost risks, consider diversifying suppliers, implementing hedging strategies, and maintaining a flexible cost structure to adapt to fluctuating input costs and sustain profitability.

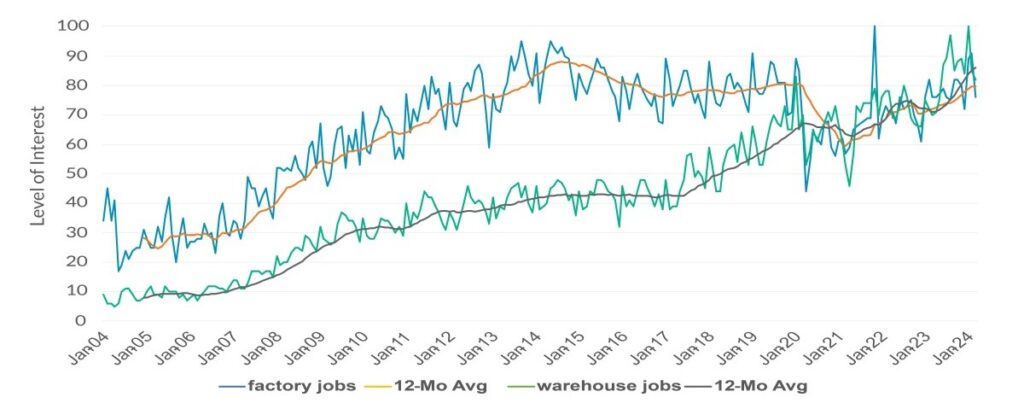

5. Rising interest in manufacturing jobs

Google Trends for “warehouse jobs” & “factory jobs”

Google Trends data reveals that a surging interest in “warehouse jobs” and “factory jobs” has reached peak levels. The increasing interest in manufacturing and distribution-related roles suggests a more favorable labor market for employers.

What this means for you: The spike in interest for “warehouse jobs” and “factory jobs” indicates a growing labor pool for manufacturers and distributors. For manufacturers to capitalize on this raised interest, focus on recruiting strategies, offer competitive wages, and enhance employee retention programs to attract and retain top talent in this evolving labor market.

6. Growth in sticky wages is trending lower, yet remains historically high

Year-over-year wage growth continues to decelerate as higher-for-longer interest rate policies pressure inflation. With the Federal Reserve expected to start reducing rates this year, wages may continue to decline, but at relatively slower rates.

What this means for you: For budget planning, consider reducing expected inflation rates and wage increases. With potential rate cuts ahead, wage increases may slow, however it’s important to maintain focus on cost management and the flexibility to adapt to evolving economic conditions.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Aprio Wealth Management, LLC are not affiliated companies.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Adam Beckerman

Adam Beckerman is Aprio’s Manufacturing and Distribution Leader and Assurance Partner. Adam's team of 30 professionals focus on the manufacturing industry with 20+ years of experience enabling the success of manufacturing start-ups, growth companies and businesses preparing for equity events.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.