CFO vs. Controller – What’s the Difference and Why it Matters

September 22, 2023

At a glance

- Main takeaway: CFOs and controllers serve two very different but essential functions. Knowing the difference is key to understanding how to build the best finance teams to drive and enable growth.

- Impact on your business: Understanding the differences between the roles and when to bring each on board can help drive growth, increase efficiency and build stronger, more resilient organizations.

- Next steps: Aprio’s CFO Advisory can help you build an ideal executive financial leadership team to accomplish your strategic goals.

Schedule a consultation with Aprio’s CFO Advisory team today!

The full story:

Some titles are intuitive. An uninformed observer could reasonably assume that accountants have something to do with a company’s accounts, for example, or that a financial analyst’s role would include analyzing financial data. Coders code, drivers drive and copywriters write copy—but not every job title is quite so descriptive.

Take the two roles in the title of this article. If you asked a random person off the street to describe the responsibilities and importance of a controller you’d probably get your answer in the form of a blank stare and a swift departure.

Asking the same questions about a chief financial officer (CFO) might get you some reasonably accurate guesses, but the fact remains that most people have no idea how the roles differ nor why they are so important.

The difference between CFOs and controllers

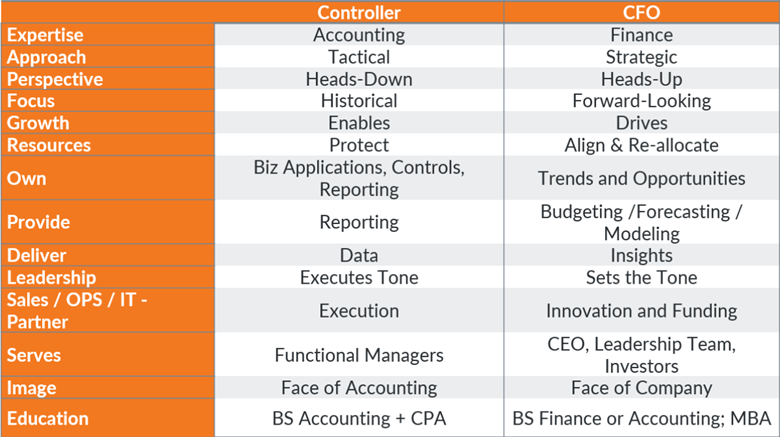

CFOs and controllers are symbiotic, not synonymous. There are a number of differences between the roles that go beyond their position on an org chart, including their responsibilities and how they approach them, their educational and professional backgrounds, their areas of expertise, how they affect a company’s growth and much more.

Before we get too deep into the details, however, let’s explore a few basic definitions.

The CFO

As the title implies, a CFO is the chief financial officer in a business, typically serving as the trusted partner of the CEO and the rest of the leadership team.

CFOs are strategists and advisors. They don’t keep the books, they oversee the people who do.

They don’t usually crunch numbers or run reports, they offer valuable insights that help drive growth and inform the company’s next steps.

What traits does a high-performing CFO possess?

A good CFO should always have their head up, constantly scanning for what’s next, pointing out potential opportunities and threats and watching for changes in the economic trends or conditions that could shift the focus of the business. They run big-picture scenario analyses, create action plans and present them to the CEO and the rest of the leadership team.

Great CFOs take an active role in driving growth in their organizations. They are the visionaries who collaborate with the firm’s leadership team to establish clear destinations and lay out roadmaps for the business to follow. They direct resources and actively reallocate them to their highest and best use.

The strongest CFOs are the face of their companies.

They are forward-focused professionals who do whatever they can to partner with and support their sales, operations, IT and other teams that directly or indirectly drive growth. They don’t get in the way of initiatives, and remove roadblocks holding their internal partners back from achieving their goals.

Instead of simply saying no, the best CFOs ask questions, listen to concerns, solve problems and confidently make decisions that drive innovation and growth.

The Controller

CFOs drive growth. Controllers enable it. They are precise, detail-oriented accounting professionals who make sure the company’s internal operations run smoothly, accurately and on budget.

Where CFOs operate in a strategic, heads-up position with their eyes on the horizon, controllers operate more from a tactical heads-down perspective with their eyes on the nitty gritty details that can make or break a company’s operations.

What traits does a high-performing controller demonstrate?

A good controller has a collaborative relationship with sales, IT, operations and any other personnel who affect or are affected by any accounting systems, company accounts, and internal controls—many of which they develop themselves.

A confident controller will protect their company’s assets, monitoring all the books, reports and filings for errors and potential fraud.

A great controller owns their firm’s financial operations from top to bottom. They have a deep—if not encyclopedic—understanding of bank covenants, tax authorities, internal controls and protocols. They work closely with other teams, simultaneously expecting and enabling the kind of flawless execution that their teammates and customers deserve.

Strong controllers are enablers, not roadblocks. They seek solutions and drive the efficient use of existing resources.

The best controllers go beyond managing their firm’s financial operations to take an active role in designing, building and running the business applications, controls and reporting systems their firms rely on.

They help others in the company understand, respect and comply with internal controls, bank covenants, tax laws and any other commitments the company has to uphold.

When do you need a CFO or controller?

Though CFOs and controllers are both high-level financial professionals who typically work closely with one another, growing businesses don’t necessarily need to bring both on board at the same time. Deciding when to bring on permanent in-house talent in either or both roles isn’t an exact science—every business is different, after all—but there are a few guiding principles to keep in mind.

Bringing on a controller

It may seem counterintuitive, but it is almost always a good idea to bring on a controller first, while getting strategic guidance from a consulting CFO.

A controller enables growth by building, establishing and overseeing a firm’s financial operations—all of which are necessary for the business to scale. Every business needs a strong infrastructure to stand on and a clear, accurate view of the firm’s finances before they accelerate organic growth or contemplate acquisitions.

A company should start thinking about bringing on a part- or full-time controller when they reach $1 to $5 million in annual revenue. It is typically wise to go for a part-time controller at first, though firms should plan to transition to a full-time controller when they approach $10 million in annual revenue.

Bringing on a CFO

Firms should consider bringing on a part-time or fractional CFO when their revenues approach or reach $10 million. A part-time or fractional CFO should likely be sufficient until revenues reach between $50 to $100 million, at which point a full-time CFO should be brought on board.

The bottom line

Controllers and CFOs have two different roles to play. CFOs drive growth. Controllers enable it.

CFOs think strategically and work with their heads up. Controllers are tacticians who work with their heads down.

Neither role is more important than the other, and both are incredibly important to the functioning of a successful, growing business.

For help determining the next best step for your firm to achieve your goals and successfully scale operations, schedule a consultation with Aprio’s CFO Advisory team.

Related Resources/Assets/Aprio.com articles/pages

How to Find the Right CFO for Your Growing Business

How a Fractional CFO Can Help Increase the Value of Your Business

4 Priorities for Business Leaders in the First 100 Days Following an Acquisition

Recent Articles

About the Author

Eric Krucke

Eric, a former Berkshire Hathaway CFO, advises companies walking through transitions and transactions or seeking to accelerate growth. He has more than 25 years of financial leadership experience accelerating growth, navigating acquisitions, finding capital to fund growth, and facilitating successful exits for founders and investors, including a sale to Berkshire Hathaway. He’s seen time and again that the most important responsibility of a CEO or founder is to provide clarity, particularly during the first 100 days of an inflection point.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.