How Will the COVID-19 Crisis Affect the Value of Your Business?

March 31, 2020

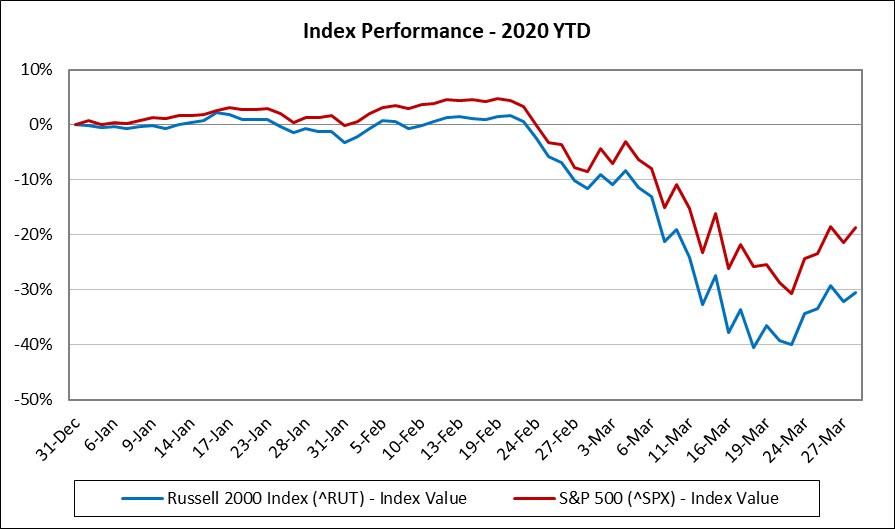

We’ve all witnessed the recent share price volatility in public equities. While there may be some debate about exactly when investors began to price in the impact of the COVID-19 crisis, the downward trend is clear. Year-to-date through March 30, the S&P 500 index had fallen about 19% and the Russell 2000, an index of small-cap stocks, had fallen about 30%.

Source: S&P Capital IQ

But do these indicators translate to a decline in value for small- and medium-sized entities (SMEs)? We have been and are continuing to monitor the COVID-19 crisis and factors relevant to the valuation of SMEs and their assets. Keeping in mind that this an evolving situation, here are some of our preliminary thoughts:

All SME valuations require the use of estimates and judgment. The direct and indirect impacts of the pandemic will likely place heightened emphasis on estimates and judgments for most 2020 valuation dates. For any SME, estimating the COVID-19 impact on value will depend on consideration of all available information as of the applicable valuation date. Facts and circumstances to consider include, but are not limited to, the following:

- Which sector and industry does the entity operate in, and what are its specific lines of business?

- Where geographically are the entity’s operations concentrated?

- How will the business continue to deliver its products and services in the face of operational disruption?

- How long is operational disruption expected to last?

- How concentrated or diversified is the customer base, and which customers may be in distress?

- How concentrated or diversified is the vendor/supplier pool, and which vendors/suppliers may be in distress?

- Will the entity need to manage cash balances differently or modify its policies around working capital?[1]

- Will capital expenditures need to be deferred (to conserve cash) or potentially accelerated?

- What actions must the business take to maintain compliance with debt covenants?

- Has the SME applied for or received government assistance pursuant to the Economic Injury Disaster Loan Program[2] or the Paycheck Protection Program?

- Was the SME highly leveraged prior to the COVID-19 crisis?

For SMEs a key consideration will be assessing the impact of the pandemic on near-term and longer-term prospective financial information. The COVID-19 impact may not yet be known or quantifiable. Even if known and quantifiable, those estimates likely will be subject to change in real-time. Valuation specialists commonly look to the Discounted Cash Flow (DCF) Method when estimating the value of SME ownership interests and assets. The potential impact from COVID-19 can be illustrated in a DCF context. Key inputs to a DCF model include future cash flows (based on an entity’s prospective financial information), the discount rate (or cost of capital), and long-term growth expectations. The table below provides a basic directional summary with respect to those three DCF inputs.

| DCF Input | Change to DCF Input | Impact on Value[3] |

| Future cash flows | Increase (decrease) | Increase (decrease) |

| Discount rate | Increase (decrease) | Decrease (increase) |

| Long-term growth | Increase (decrease) | Increase (decrease) |

At a high level, SMEs may want to step back and think about how these inputs are viewed currently, compared to pre-pandemic inputs. This will be a challenging task indeed and will likely require consideration of multiple scenarios and feedback from a variety of functional areas in order to understand how risk and uncertainty has changed. While any one of these inputs may change in a direction that (in isolation) pushes down on value, for some SMEs all three inputs, when reassessed as of a current date, may push downward pressure on valuations.

Viewing the COVID-19 crisis more narrowly from a financial reporting perspective, potential impairment charges are top of mind for CFOs and controllers. With respect to goodwill for example, ASC 350 requires an entity to consider whether an interim “triggering event” has occurred in between the dates of its annual impairment testing[4]. If a triggering event has occurred, then a quantitative analysis would ensue to determine if in fact the carrying amount of goodwill exceeds its implied fair value. Determining whether a triggering event has occurred pursuant to ASC 350 requires an assessment of the totality of events or circumstances such as the following[5]:

- Macroeconomic conditions such as a deterioration in general economic conditions, limitations on accessing capital, fluctuations in foreign exchange rates, or other developments in equity and credit markets

- Industry and market considerations such as a deterioration in the environment in which an entity operates, an increased competitive environment, a decline in market-dependent multiples or metrics (consider in both absolute terms and relative to peers), a change in the market for an entity’s products or services, or a regulatory or political development

- Cost factors such as increases in raw materials, labor, or other costs that have a negative effect on earnings and cash flows

- Overall financial performance such as negative or declining cashflows or a decline in actual or planned revenue or earnings compared with actual and projected results of relevant prior periods

- Other relevant entity-specific events such as changes in management, key personnel, strategy, or customers; contemplation of bankruptcy; or litigation

- Events affecting a reporting unit such as a change in the composition or carrying amount of its net assets, a more-likely-than-not expectation of selling or disposing of all, or a portion, of a reporting unit, the testing for recoverability of a significant asset group within a reporting unit, or recognition of a goodwill impairment loss in the financial statements of a subsidiary that is a component of a reporting unit

- If applicable, a sustained decrease in share price (consider in both absolute terms and relative to peers)

In summary, the value of many SMEs will be negatively affected by the COVID-19 crisis. But there will be a continuum. At one end of the spectrum, the decline in value could be minor and temporary. At the other end of the spectrum, the decline in value could be major and permanent. Where your business falls along that spectrum will depend on an ongoing assessment of a host of factors, such as those highlighted above.

[1] See also our blog Cash Management in the Time of COVID-19.

[2] Stay tuned for an announcement about an upcoming webinar on this topic.

[3] Impact on value here is considered in general terms and each input in isolation (i.e., assuming all else held constant).

[4] “Triggering event” refers to an event or change in circumstances that would more likely than not reduce the fair value of a reporting unit below its carrying amount.

[5] Source: ASC 350-20-35-3C. The list of examples is not exhaustive. Entities should consider all available information.

Got questions? Connect with an experienced Aprio advisor today.

Schedule a Consultation

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.