Posts by Sandi Buttram

If You Received Carried Interests, Profits Interest or a Promote – You Are Subject to a 3-Year Holding Rule

At a glance Schedule a consultation with Aprio’s Tax Team today. The full story: In January of 2021, the Internal Revenue Service (IRS) issued final guidance on the taxation of carried interests under the Internal Revenue Code (IRC) Section 1061 and was enacted in the 2017 Tax Cuts and Jobs Act (TCJA). The regulation imposes a…

Read More1031 Exchanges –Navigating Related Party Exchanges

At a glance: The main takeaway: With careful tax planning, 1031 exchanges offer taxpayers an opportunity for big savings on income taxes. Know the risks: Few good things ever come easy, and 1031 exchanges are no different. One of the biggest risks is structuring a transaction with a related party. Next Steps: Taxpayers can often mitigate the risks…

Read MoreAlternative Tax Strategies for the Qualified Improvement Property “Glitch”

The road to tax reform was paved with good intentions. The Tax Cuts and Jobs Act (TCJA) produced the most sweeping tax law changes in more than 30 years, and yet it was passed just 51 days after it was introduced. However, rushed tax reform is bound to be messy. Such is the case with…

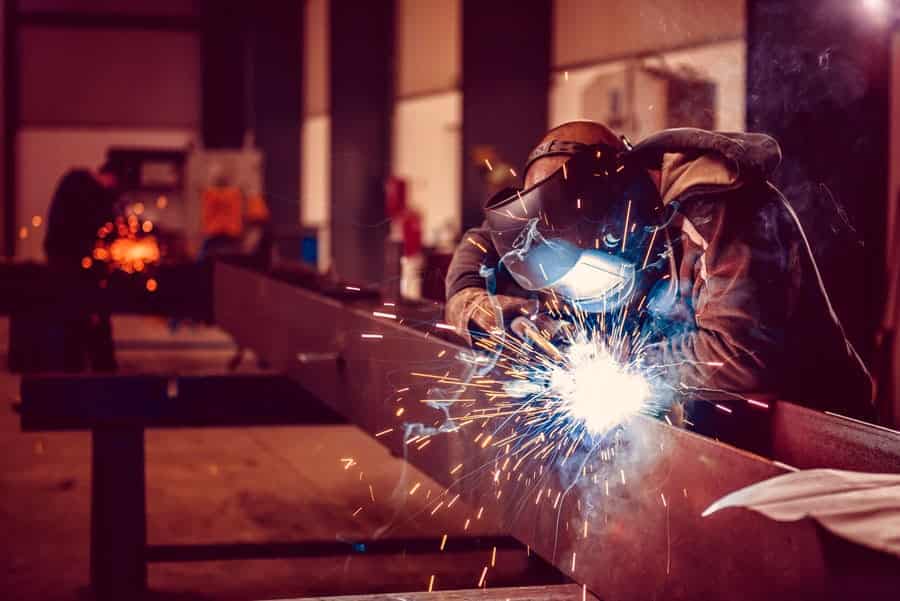

Read MoreIndustrial Real Estate Braces for Effects of Steel Tariffs

The industrial real estate sector is bracing for the impact of recent steel tariffs on two fronts. Industrial manufacturers could see their bottom line shifting as the cost of production increases. And industrial/distribution facility construction costs could rise with the price of raw materials. “Pricing has gone up significantly just with the threat of tariffs,”…

Read More