Critical Decision: State Pass-Through Entity Tax Elections

November 7, 2022

At a glance

- The main takeaway: Pass-through entity (PTE) taxes have been enacted in 30+ states and the eligibility rules and deadlines vary significantly depending on where you are located.

- Impact on your business: 2023 election deadlines will be here before you know it, so it’s important to take action, assess your eligibility, and decide whether or not taking the election makes sense for you.

- Next steps: Aprio is here to help you navigate the complex rules surrounding the PTE tax election to make the best-possible tax decision for your business.

Schedule a consultation with Aprio

The full story:

Over the past year, we have been following the pass-through entity (PTE) taxes that have been enacted in a little over 30 states and how they could affect businesses across the country. As a follow-up to our webinar on the topic, which took place October 19 (click here for the recording if you missed it), we wanted to provide a cursory overview of what the PTE tax election is, the challenges and opportunities it poses to your hospitality business, and the key decisions you should make before tax time rolls around.

What is the PTE tax election, anyway?

The PTE tax elections allow you to pay tax at the entity level for the respective states rather than pay tax at the individual level. The PTE tax imposes income tax directly on the PTE (it’s not a composite or withholding tax on behalf of individual owners), and the PTE owners receive a personal income tax credit for their share of the PTE tax liability. As acknowledged in the IRS Notice 2020-75, the PTE is entitled to deduct the PTE tax paid in full on its federal partnership return, which lowers the federal taxable income reported by and the federal income tax liability paid by each of the owners.

The challenge

Let’s take a quick step back. Prior to the 2018─2019 tax year, taxpayers received an itemized deduction for the amount of taxes they paid (whether it was property tax, income tax, etc.). However, the Tax Cuts and Jobs Act (TCJA) put a $10,000 limit on that deduction, so many higher-earning taxpayers do get to deduct a large portion of their state taxes. States have started to enact PTE tax regimes as a workaround to this deduction cap.

There are two main ways in which taxpayers apply taxes paid to other states against their home state taxes (these also apply to taxes paid under PTE tax regimes):

- The owner receives a credit against personal tax for their share of PTE tax paid (generally refundable)

- The owner receives an exclusion on their respective state return for the income subjected to PTE tax

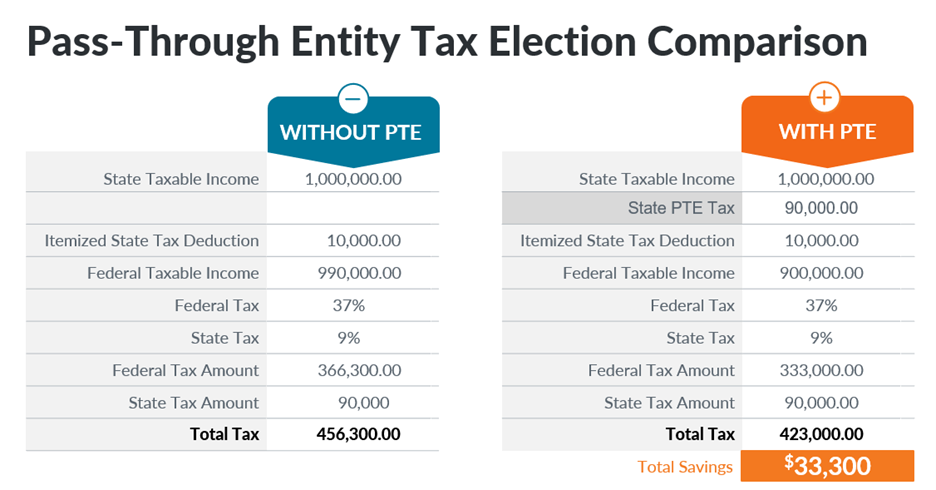

Here is a high-level example illustrating the benefits of electing into a state PTE tax regime:

PTE tax considerations for your hospitality business

PTE tax rules can be complex in terms of how, when and if businesses should apply them. You need to keep the following considerations in mind:

- Which states have established PTE tax rules: We have created a handy interactive map to help you easily identify whether or not your state has these rules in place, and if so, what they mean for you. Click here to take a look.

- How to collect into PTE and qualifying factors: Generally speaking, partnerships and S corporations are among the types of entities allowed to make PTE tax elections. However, each state has its own exceptions, which could significantly impact your eligibility. It’s important to enlist the help of a qualified, industry-specific tax team like Aprio to fully understand whether or not you qualify and how to approach next steps.

- PTE tax computation and estimate requirements: In order to pinpoint your PTE tax election benefit, you must evaluate a wide range of factors, including entity performance. This process will also illuminate whether or not the election is actually going to be beneficial to you, which is important to underscore and reiterate — not every business, and not every partner, will benefit from making a PTE tax election. This is another area in which the expertise of a qualified team is essential.

- How to apply the PTE tax election credit or exclusion: Once you have decided to take the PTE tax election, then you must act quickly to make sure you don’t miss your deadline. Just like the rules governing the election itself, essential due dates vary significantly state-by-state.

- Multistate considerations: If you own an entity with income taxed in multiple states, then you have a host of other factors to parse through. For instance, as a nonresident, will you be allowed to take an “other state tax credit” on your resident state income tax return for elective PTE taxes paid in a different state? This is one of the most critical state and local tax issues to solve for and, once again, it varies depending on where you are located.

- Partner/shareholder residency considerations: Entity owners may include partners and shareholders, and these individuals either might be allowed to take a state tax credit for their portion of the PTE tax, or they might exclude their share of the entity’s income in calculating their state income taxes. As mentioned above, residency considerations vary by state and will be determined on a case-by-case basis.

What you need to do

Deadlines for 2023 elections will be here before you know it, so it’s important to make a decision soon regarding whether or not you want to take advantage of the PTE tax election. But first, you need to determine your eligibility. Aprio’s Restaurant, Franchise & Hospitality group has deep expertise in the tax issues affecting restaurants and hospitality businesses across the country. We can provide you with the knowledge, guidance and support you need to make the right decision for your business.

First, be sure to listen to our webinar on the PTE tax election and get a better understanding of your eligibility status and next steps. Then, take the next step and schedule a consultation with our team to start the process. We look forward to helping you navigate the complexities of the PTE tax rules and ensuring you’re in the best-possible tax position going forward.

Related resources

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Recent Articles

About the Author

Tommy Lee

Tommy is the partner-in-charge of Aprio's Restaurant, Franchise & Hospitality group. His practice focuses on small and mid-sized retail, franchise and hospitality companies and real estate firms. Tommy has expertise in corporate structuring arrangements, multi-state and international tax planning, and corporate and individual tax mitigation.