The Pulse on the Economy and Capital Markets: March 29 – April 2, 2021

April 5, 2021

Executive Summary

- Economic Excitement Takes Center Stage: The U.S. market had a stellar showing last week, while the riskiest part of the bond market turned in an impressive first quarter.

- Bad News for London Tech and Archegos: One of London’s most buzzed-about IPOs fell short of expectations, while the blow-up of family office Archegos Capital Management swept headlines.

- Jobs Report Joy: March’s employment report was one of the brightest spots of last week’s economic news, surpassing expectations.

In the Markets

The First Quarter Brought Good Times for Risk

The market’s excitement over the U.S. economy is evident in stocks and bonds. Last week, the S&P 500 closed above 4,000 for the first time and was up 7% year to date.

The lowest-quality segment (i.e., bonds rated CCC and below) of the riskiest part of the bond market — i.e., high-yield (a.k.a. “junk”) — rose 3.6% in the first quarter, as credit risks are perceived to be lower while the economy rebounds. In contrast, investment-grade bonds — where there is believed to be much less concern about default risk — declined 4.7% in the first quarter. This eight-percentage-point gap in performance in the quarter is huge. With an improving economy, default risk is less of an issue.

London Tech’s Very Bad Week

In the last edition of The Pulse, we wrote about the vibrancy of the initial public offering (IPO) market — and we timed it well. Last week, we had the “Worst IPO in London’s History,” according to the Financial Times. Deliveroo, a U.K.-based food delivery app whose investors include Amazon and leading venture capitalists, declined 26% on its first day of trading. For London’s tech scene, this IPO had the anticipation that Facebook and Uber had in the U.S.

Playing with Fire, or How to Lose $10 Billion in a Few Days

A week ago, we started to hear about the blow-up of the family office, Archegos Capital Management. Using derivatives to hide his exposure, Archegos founder Bill Hwang was able to amass “exposure” worth tens of billions of dollars on well-known U.S. and Chinese large capitalization companies, such as ViacomCBS, Discovery, Inc. and Tencent, at levels that usually require regulatory disclosure.

Derivatives are a form of leverage, and when the stocks that underlie them started to decline, Archegos couldn’t post collateral to the investment banks that were their counterparties. Global investment banks such as Credit Suisse and Nomura are losing billions, and Hwang’s family office is reportedly insolvent. Expect investigations and potentially more regulations for investment firms that employ derivatives.

In the Economy

Biden’s Infrastructure Plan: “I Like Ike”

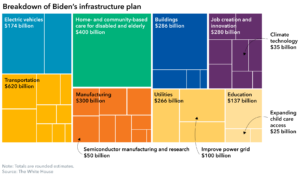

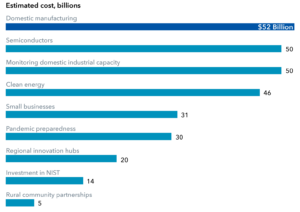

With a size and scope resembling the two decades following World War II, President Biden unveiled a $2.3 trillion infrastructure plan — roughly 10% of the U.S. economy. The planned investments will occur over eight years and include:

- $180 billion for research and development

- $115 billion for roads and bridges

- $111 billion for water infrastructure

- $100 billion for broadband

- $100 billion for modernizing the electrical grid

- $85 billion for public transit

- $80 billion for railroads/Amtrak

- $42 billion for ports and airports

According to The New York Times, the plan would:

- Spend $300 billion to promote advanced manufacturing, including restocking the Strategic National Stockpile of pharmaceuticals and vaccines.

- Repair the U.S.’s 10 most economically significant bridges as well as 10,000 smaller bridges.

- Electrify 20% of yellow school buses.

To fund this, Biden is proposing increasing corporate tax rates to 28% from the 21% initiated during the Trump administration and closing loopholes that multinationals use on profits earned overseas.

Biden’s Sustainability Plan: Electric Vehicles

The infrastructure plan includes heavy emphasis on electric vehicles (EVs):

- $174 billion would be used for tax credits and other incentives for manufacturing and purchasing EVs.

- $46 billion for federal procurement programs to buy fleets of EVs.

- One EV investment goal, which is to develop a domestic battery-making capability to rival China’s early lead.

- The investment would lead to 500,000 EV charging stations (for comparison, that’s four times the number of gas stations in the U.S.)

Concurrently, oil companies and auto manufacturers are saying demand for gasoline may have peaked in 2019:

“…We see the profiles for North America and Europe, probably for gasoline, ultimately, flattening to declining, just given improved auto efficiencies, given bios, given EVs in that space.” — Greg Garland, CEO of Phillips 66 (PSX)

“…The international energy agency yesterday predicted that the demand for petrol engines will never reach the level of 2019 again.” — Dirk Arnold, Head of Communications at Audi (AUDVF)

A Stellar Employment Report

The jobs report for March blew away expectations, with payrolls increasing 916,000 (versus a 660,000 estimate) on a widespread scale across the economy and various industries. Here are some more important points from the report:

- Leisure and hospitality jobs increased 280,000.

- Construction jumped 110,000.

- Manufacturing increased 53,000 the biggest advance since September.

- The unemployment rate fell to 6% from 6.3%.

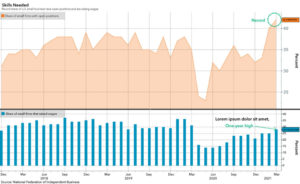

Small businesses are hiring — hiring is at a four-plus decade high! — and increasing wages.

A Few Stories That Caught My Eye

- Coinbase, The large cryptocurrency exchange and broker, is expected to become publicly traded on April 14. This article takes a deep dive into the platform: (link).

- Google, Amazon and Goldman Sachs prepare to return to the office. (link)

- The COVID-19 Bankruptcy Gap: With one of the harshest recessions in a century, why didn’t we have nearly as many bankruptcies as models predicted? (link)

- Get Car and Driver’s take on the Biden plan. (link)

- The bank was open on Saturday night – behind Gonzaga’s shot for the ages and the quest for an undefeated season. (link)

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (April 5, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Simeon brings two decades of professional investing experience in publicly traded and privately held companies, as well as senior-level operating and strategy consulting experiences.