The Impact of the Oil Crash and COVID-19 Recession

April 28, 2020

April 20, 2020, the price of an oil futures contract crashed below $0 as producers of oil paid buyers to take product because storage options were running out. This is a stunning decline for a product that cost $75/barrel just 18 months ago and was over $100/barrel less than six years ago.

The reason? Rapidly evaporating demand and suppliers unable to balance production quickly enough to address the reduced needs created by the COVID-19 recession. Self-isolation, distance learning and remote work have drastically decreased commuting and travel, which pummeled demand for gasoline, diesel and aviation fuel, three of the largest oil-derived products.

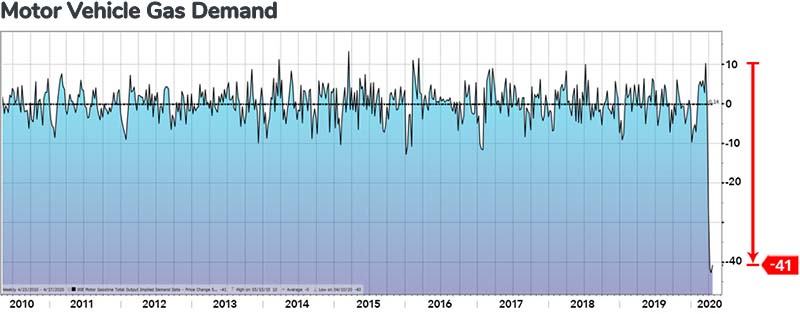

Gas supplied and demand

Gasoline accounts for approximately half of the use of a barrel of oil. Gas supplied, a proxy for gas demand, has plummeted approximately 50% since lockdowns and isolations became widespread.

Diesel volumes have also been hurt by lower transportation and trucking activity. Diesel fuel production for mid-April was 33% lower than mid-February.

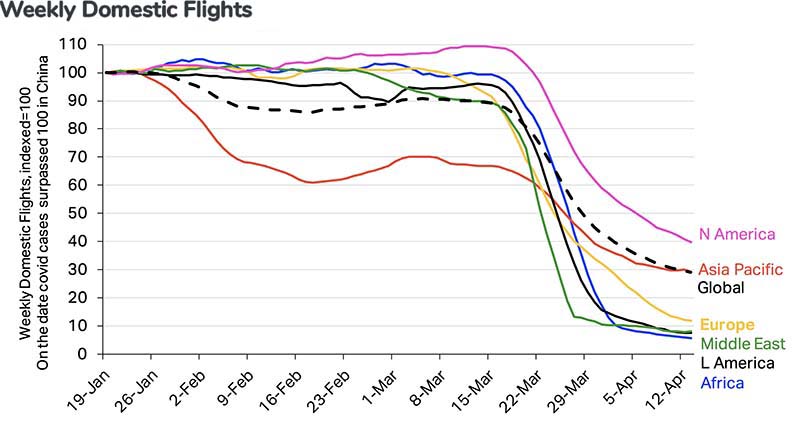

The decline of domestic flights

Further, according to the International Air Traffic Association (IATA), domestic flights across geographies have declined 90%, greatly impacting the demand for aviation gas.

TSA data shows passenger volumes in the US are down 95% more than year over year in April.[1] This is exacerbated by 40% of surveyed airline passengers indicating that they will wait six months or longer before traveling after containment is announced. [2]

While demand for oil in the U.S. has quickly been destroyed, oil supply has not followed.

The recently negotiated truce between Russia and Saudi Arabia to reduce OPEC supply is expected to impact the market in June. Through technological innovations, the U.S. has added supply capacity that has accounted for 2/3 of the growth in oil supply since 2010.[3] With the decline in demand, and with storage capacity tightening, this oil production has nowhere economically feasible to go.

Here are potential impacts and opportunities for companies during this oil crash:

- If you export product, review your sales forecasts – declining commodity prices, especially oil, can hurt countries whose economies are based upon extracting natural resources and selling them on the world markets. When prices decline, budgets are reduced, which ripples through an economy. For US-companies that export to or have operations in natural resource-driven economies, often in emerging markets, there is increased risk that sales forecasts are too high.

- Renegotiate fuel surcharges – suppliers with fleets may have used prior oil spikes to implement fuel surcharges and have not eliminated them subsequently. Have conversations with those suppliers to eliminate them – they shouldn’t have it both ways!

- Renegotiate or re-source oil-derived input costs – Companies with inputs that are oil and oil-derivative products should engage suppliers about cost reductions so that cost savings are passed along. You deserve to share in the savings.

- Optimize fleet fuel expenses – Companies that have car/truck fleets should explore opportunities to purchase fuel now in exchange for early payments and/or lock in lower fuel costs through negotiating with fuel marketers about fleet programs.

The bottom line

Aprio’s Manufacturing & Distribution team and our Investment Advisory team will continue to watch the impacts of COVID-19 on oil demand and provide continued updates and advice on opportunities and concerns for manufacturers across the U.S.

If you are a manufacturer or distributor and would like to discuss how Aprio can help your business, contact Adam Beckerman, Partner-in-Charge, Manufacturing & Distribution.

If you have investment related question or questions about the economy, contact Simeon Wallis, Chief Investment Officer.

[1] https://www.tsa.gov/coronavirus/passenger-throughput

[2] https://www.iata.org/en/pressroom/pr/2020-04-21-01/

[3] Bloomberg LP.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Recent Articles

About the Author

Adam Beckerman

Adam Beckerman is Aprio’s Manufacturing and Distribution Leader and Assurance Partner. Adam's team of 30 professionals focus on the manufacturing industry with 20+ years of experience enabling the success of manufacturing start-ups, growth companies and businesses preparing for equity events.

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Simeon brings two decades of professional investing experience in publicly traded and privately held companies, as well as senior-level operating and strategy consulting experiences.